Baillie Gifford’s approach of focusing on the long-term picture appears to have also worked for its £1.3bn Baillie Gifford Strategic Bond fund, which is ranked top quartile in the Investment Association’s Sterling Strategic Bond sector over a five-year period.

Manager Torcail Stewart explained that much of this performance can achieved by simply lending to growing businesses with improving balance sheets and avoiding those in structural decline.

“We look at markets in a different manner,” he said. “Rather than being just fixated on the next set of numbers, we’re looking for what is the long-term trajectory and that offers you quite a lot of benefits.”

He believes that it pays off to lend to companies that are producing goods and services for the future, not the past - regardless of how attractive the yield may be.

“If you're lending to a business that you know is going to collapse or in structural decline, you don't know when that's going happen,” he explained. “It could happen tomorrow, or it could happen in three years. But it is not going in the right direction.”

Stewart said this leaves bond investors who lend to those companies at risk of being left with a business that “defaults out of almost nowhere”.

Whereby lending to businesses where the future direction is clear, it can result in the upward re-rating of bonds to the benefit of the bond investor.

Stewart highlighted Baillie Gifford Strategic Bond’s position in global streaming giant Netflix, as an example.

“It's been great business we’ve lent to,” he recalled. “It’s gone up over 20 points because we can see unit costs are falling, it's growing, and it's creating much better original content.

“So identifying companies where we see that balance sheet improving, that generally means that you find that the risk premium also compresses.

“That spread - the extra cushion above government bonds – compresses, and that can be quite fortuitous for the ultimate pricing of those bonds. That often results in rating upgrades, which of course is good for the risk premium.”

Stewart does this by focusing on long-term processes that are playing through within businesses, such as diversifying or growing in scale. In the case of Netflix, it has grown massively in scale.

On the other hand, in the same way that bond prices can re-rate upwards to the benefit of bond holders, they can also re-rate down.

This is where avoiding declining industries really can pay off in terms of preventing capital loss.

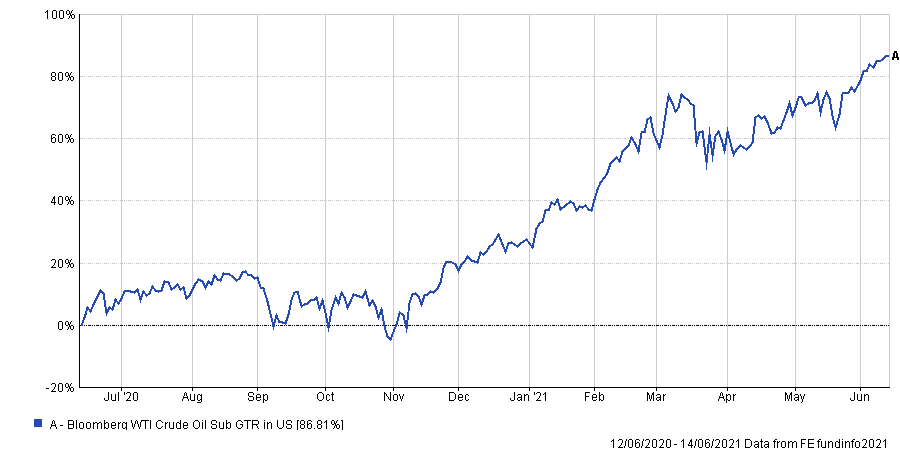

In the last year as oil prices continue to rally, it has direct impacts on the profit margins of many energy companies producing oil at relatively fixed costs. In the space of a year, crude oil prices have almost doubled.

Performance of Bloomberg WTI Crude Oil Sub index over 1yr

Source: FE Analytics

This has also caused a major improvement of the short-term credit profiles of many oil & gas producers, benefitting funds holding these bonds which may have re-rated upwards as a result.

However, despite this short-term rally, Stewart believes that it still does not eliminate the structural decline of many businesses in the industry.

“I think that [oil & gas] is an area where you're going to see increased pressures because of the decarbonisation strategy that is becoming more and more predominant throughout the industry,” he said.

So, whilst the bonds of many of the industry have rallied in recent months, Stewart believes the willingness of capital providers to lend to them at low interest rates will not be what it used to be in the past.

He said: “There's a really strong trajectory towards reducing carbon within funds, and so I do ponder if some of the more risky entities out there might be in a bit more of a difficult situation in terms of actually receiving capital and the level that they'll have to pay in the future to actually able borrow.

“If I were an oil & gas finance director, I’d be looking run with less leverage than I have done in the past, because the cost of capital could be much higher.”

In the same way that many equity funds at Baillie Gifford will avoid declining industries, Stewart will also back his winners for the long run.

Baillie Gifford Strategic Bond’s biggest position is a 2.8 per cent weighting to Netflix bonds due in 2029, a position which the fund has held for several years. The next two biggest positions are a 2.6 per cent position in National Grid bonds and a 2 per cent position in Rabobank bonds.

“It’s in keeping with overall Baillie Gifford philosophy of backing your winners - but just within the bond context,” he said.

“Obviously, our max position is 3 per cent, so we’re not going to the very sizable positions of Scottish Mortgage.

“We don't have unlimited upside, we’re more constrained, but it's still a different approach to bond markets which has worked.”

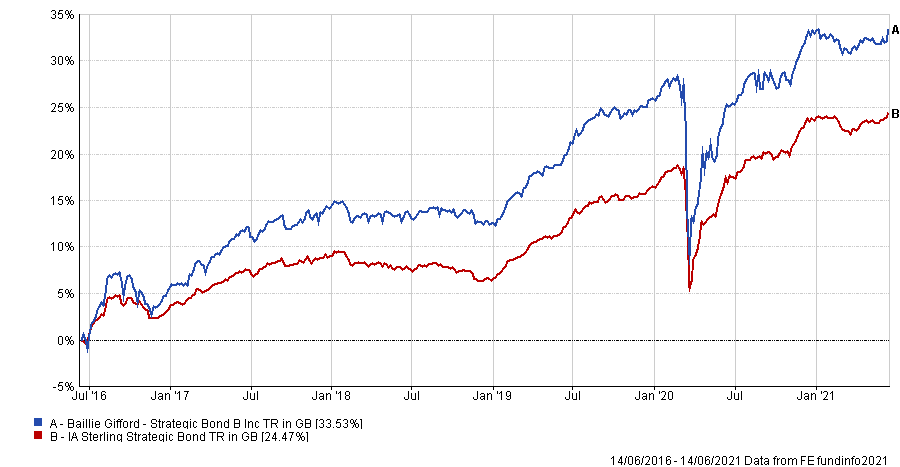

Performance of the fund over 5yrs

Source: FE Analytics

Baillie Gifford Strategic Bond has delivered a total return of 33.53 per cent over the last five years, compared to 24.47 per cent from the IA Sterling Strategic sector average.

It currently yields 3.3 per cent and has an ongoing charges figure (OCF) of 0.52 per cent.