Global trusts Lindsell Train and F&C Investment Trust have both made investors exceptional returns over the years, but it is the former that has been rewarded by investors.

The £262.7m Lindsell Train trust is currently running on the highest share price premium to its net asset value (NAV) in the IT Global sector at 26.2% as investors have been bought into its stellar performance over the past decade.

Conversely, the £5.5bn F&C Investment Trust – the UK’s oldest investment company – is operating on an 8.3% discount after a decade in which it beat its rivals and the FTSE All World index, but trailed some of the high-growth strategies in its sector.

Below Trustnet asks which fund is more appealing to new investors and whether the stark difference in share price discount and premium is worth it.

Darius McDermott, FundCalibre managing director, said: “Normally we would side with the trust on a discount, but this is an exceptional case.”

Although the two trusts run in the same sector they are very different, according to McDermott. Most especially in the portfolios’ construction.

Lindsell Train’s current premium reflects the performance of the Lindsell Train Limited business itself, which the trust has 48.6% of its portfolio allocated to.

For investors considering the Lindsell Train portfolio, they must be comfortable with the high exposure to the Lindsell Train business in what is already a high conviction portfolio where the top 10 holdings account for more than 80% of the trust. In F&C the top 10 account for just 15% of the total allocation.

Lindsell Train’s buy-and-hold approach, picking quality companies that can weather different market conditions, has benefitted from the low-growth world that investors have suffered through over the past decade.

As low-risk investors have been pushed away from bonds and into bond-like, lower-risk stocks, these firms have soared.

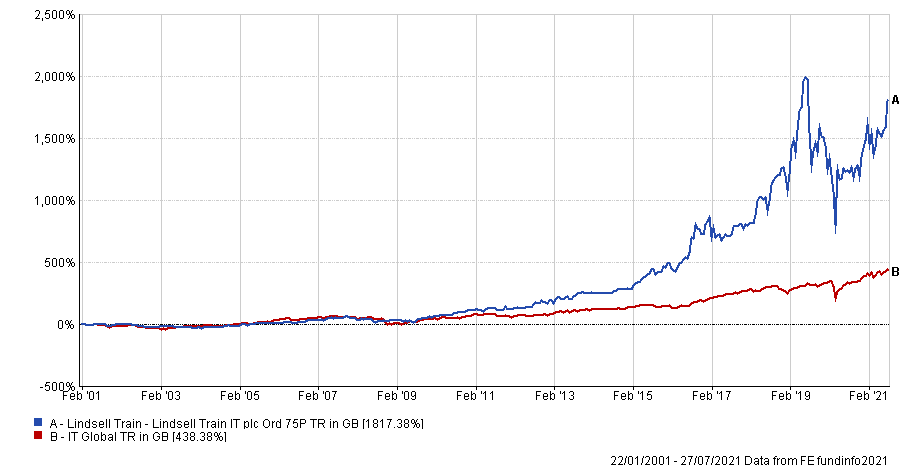

This has helped Lindsell Train, which has generated a total return of 1,817.4% since its launch in 2001, besting the IT Global’s 438.4%.

Performance of Lindsell Train vs IT Global sector since launch

Source: FE Analytics

The success of the Lindsell Train Limited business itself has also contributed to the high returns. As the company has grown its assets under management (AUM), the amount the firm generates in fees has also spiked, increasing its valuation and boosting the trust.

Simon Elliott, head of research at Winterflood Securities, also backed the Lindsell Train portfolio out of the two.

Calling it a “special situation,” due to its high allocation in Lindsell Train Limited, Elliott also felt that the share price reflected this “strategic holding.”

Outside of this allocation the trust is made up of FE fundinfo Alpha Manager Nick Train’s ‘best ideas’, including payment processor PayPal, games firm Nintendo, consumer staple Unilever and drinks companies Diageo and Heineken.

Elliott noted that unlike other trusts, which have traded on a premium, Lindsell Train has not issued new shares. He explained this was because of the Board’s “desire to not dilute down the stake in Lindsell Train Limited, which is a private company.”

Holding an FE fundinfo Crown rating of five, Lindsell Train currently has a 3% dividend yield and no gearing.

But this outperformance isn’t enough of a reason to invest in the portfolio for Andy Merricks, manager of the EF 8AM Focussed fund and market commentator.

For him, the high weighting to Lindsell Train Limited is too off-putting to justify investing in a trust with such a high premium.

“You would need a really good reason to buy an investment trust on a big premium, Merricks said.

“The fact that Lindsell Train’s biggest component is Lindsell Train itself has been well documented I’m sure, but it doesn’t sit comfortably with me to own an investment with that kind of profile.”

The £4.5bn F&C Investment Trust is Merrick’s choice.

The trust is the oldest in existence, launched in 1868. FE Analytics data only goes back to 1995 and since then the trust has underperformed the IT Global sector, but is in-line with the FTSE All World benchmark index.

Performance of F&C Investment Trust vs IT Global sector since 1995

Source: FE Analytics

Merricks commented on how F&C behaves like an All World tracker, which he said can be viewed in two ways.

“You’re either buying a tracker on an 8% discount, or you’re buying an ‘active’ tracker with higher fees than most passives."

Another positive in the case for F&C is that it is much less volatile than Lindsell Train, Merricks pointed out. Comparing the 10-year cumulative volatility F&C is top quartile, 13.5%. Lindsell Train by contrast has the second worst, 24.8%.

“They’re both very different things despite being in the same sector (Princes William and Harry come to mind!),” Merricks said.

FE fundinfo Alpha Manager, Paul Niven, has managed the trust since 2014, aiming to generate consistent outperformance of the FTSE All World Index and build on its strong track record of raising dividends, which it has done consecutively for the past 50 years. Currently its dividend yield is 1.4%.

Although he largely backed Train’s trust, Elliott said that F&C would still be attractive for long-term investors seeking a well-diversified global strategy.

He noted that the 8.3% discount was “at the wider end of its range over recent years,” something manager Niven also recognised in the latest half yearly results.

In his most recent outlook, Niven said that growth rates in the global economy and corporate earnings were likely to exceed initial forecasts due to a stronger than expected recovery.

One thing he expected to see during the recovery was a rebalance in markets following a very narrow focus on certain geographic, sectoral and stock leadership.