Investor confidence has started to wane slightly over the past month, with flows into stock market funds halving, according to data from Calastone.

In July, net inflows to equity funds fell to £1.1bn, around half the average monthly inflow over the past six months (£2bn).

Peter Sleep of Seven Investment Management said some of this was seasonal, with the March ISA season still a big factor in the second quarter, while the summer months tend to be more muted.

“There are other things to spend your time and money on than thinking about boring investments. Things like the Euro finals, holidays or buying a new car, for example,” he said.

However, there are also real risks that have started to concern investors.

Stuart Clark, portfolio manager at Quilter Investors, said the market had significantly rebounded since its lows last year but had started to slow in recent months.

“Investors have understandably been buoyant given the success of vaccine trials, rollouts and the mass of stimulus unleashed by central banks to keep the global economy afloat. However, prior to the Covid pandemic we were discussing how expensive markets already were, so this issue is now looking even starker as markets continue to touch new highs,” he said.

Clark added that “we should not be surprised to see a pullback at some point and thus it may be prudent to begin to ease of the gas”.

The main risk is inflation and what this will ultimately force the Federal Reserve and Bank of England to do with its ultra-loose monetary policy. The expectation is that inflation is fleeting, but not everyone agrees.

“Some in the industry seem to believe that inflation will just simply return to where it used to be or around the Fed’s long-term average but this could end up being wishful thinking as it appears supply chain issues are not going away,” Clark said.

Central Banks will be watching how inflation progresses in line with economic growth, and investors should do the same thing, he added.

“Any policy misstep or lack of communication from the central banks, or even a bout of stagflation, could end up having unintended consequences and spook markets into a fresh bout of volatility,” said Clark.

“While time in the market is ultimately the best strategy, investors do need to make sure they are aware to the opportunities any volatility will bring and as such it is wise to hold some firepower back until a risk on environment looks more realistic.”

Chris Metcalfe, investment director at Iboss Asset Management, disagreed. “As longer-term investors, we feel there is a danger in reacting to short-term macro news,” he said.

He argued that the main driver behind the supernormal equity and bond returns –central bank policy – remains and that although this may change at some point, it hasn’t yet.

“The backdrop for risk assets remains just as positive as previously so we will not be reducing our equity allocation until evidence of central bank support changes,” he said.

In the second quarter, the biggest losers were index funds, with inflows down to £39m – the second-lowest in more than five-and-a-half years.

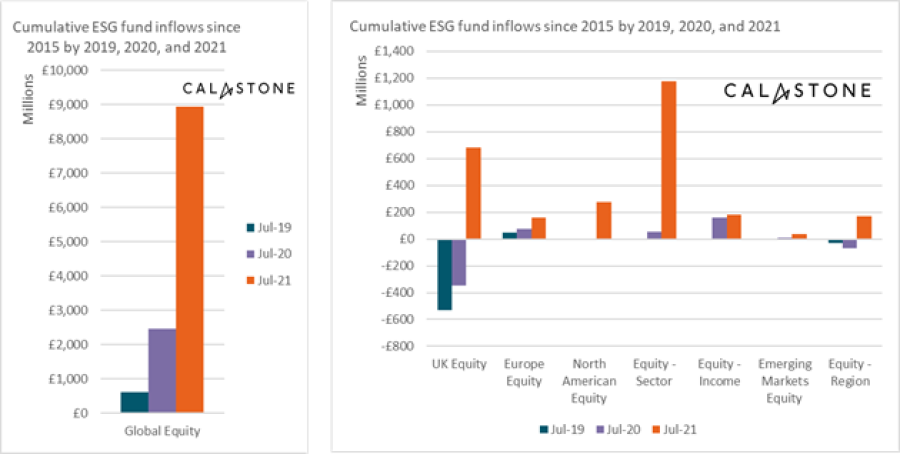

There were strong inflows into active funds, primarily due to continued demand for environmental social and governance (ESG) equity funds which were major winners amongst investors.

Source: Calastone

A net £995m was added in July to ESG funds, around 90% of the total, according to the report. More than £11.5bn has been added to ethical strategies since 2015, with 99% of this added since August 2019.

Edward Glyn, head of global markets at Calastone said: “ESG funds are proving a real game-changer. Investors seem to view them as a class apart – even after two years of dramatic growth, the trend of inflows is still firmly on an upward path, with only relatively minor wobbles when the wider stock market is down.”

Elsewhere, net inflows into fixed income funds rose to £696m as falling bond yields, pushed lower by global-growth concerns, attracted buyers, while real estate funds continued to suffer outflows for the 34th consecutive month with a further £94m taken from the sector.