Investing in high-risk, high-reward strategies can be the best way to make gains over the long term, but can also lead to disaster. Equally, backing a trusted name also comes with pitfalls, as evidenced in 2019 by the collapse of Neil Woodford’s investment management firm. However, when combining a high-risk fund with a proven manager, the results can also be spectacular.

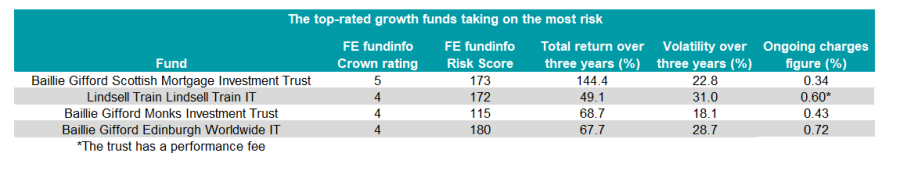

In the first of a new series, Trustnet looks at global investment trusts run by FE fundinfo Alpha Managers that had made top-quartile returns over the past three years and had a FE fundinfo Crown rating of four or five. We included all three global sectors – IT Global, IT Global Equity Income and IT Global Smaller Companies – however no global income trusts made the list.

We then filtered out those that had taken on the most risk by using the FE fundinfo Risk Score. This is a measure of volatility relative to the FTSE 100 index over three years – with a score of more than 100 showing a fund has taken on a higher level of risk than the UK market.

The FTSE 100 has been more volatile – and therefore more risky – than the MSCI World over the past three years, making it a higher hurdle rate for global funds.

In a difficult year for markets in 2020, technology and high-growth funds, which tend to be more high-risk, did well as people were forced to work from home, increasing the need for technology. Conversely, with shops shuttered, manufacturing ceased and planes grounded, traditional ‘value’ stocks were hit the hardest.

This year, the trend has reversed, with value stocks on top and tech names taking a hit, but over the past three years the high-growth companies have been the best way to invest, even despite the recent wobbles.

Scottish Mortgage Investment Trust has been the poster-child for this shift. Britain’s largest investment company has struggled in 2021 compared with its peers, yet is still up 9% year-to-date, placing it 12th out of the 17 global funds in its sector.

However, the trust had a barnstorming 2020, more than doubling investors’ money, as the below chart shows. It was the best performer in the IT Global sector during this time.

Total return of Scottish Mortgage Investment Trust vs the IT Global sector and MSCI World index in 2020

Source: FE Analytics

As such, the fund has been one of the best performers over the past three years, returning 144.4%, around 100 percentage points more than the MSCI World index and 110 percentage points more than its average peer.

The £18.6bn trust, run by James Anderson and FE fundinfo Alpha Manager Tom Slater, has achieved this by taking on significant risk however. It has a large weighting to private companies, with 51 of the 100 portfolio holdings unlisted, accounting for 21.2% of the overall fund.

This, alongside its high weighting to technology stocks such as Tesla and Alibaba, gives the trust a high risk score of 173, making it one of the most high-risk, high-reward options available to investors.

Source: FE Analytics

Monks is another Baillie Gifford trust to crack the list. The fund also buys fast-growing technology companies, which account for a quarter of the portfolio, but has less invested in private equity.

Run by FE fundinfo Alpha Manager Spencer Adair, the £3.3bn trust has followed a similar pattern therefore to Scottish Mortgage, with strong returns in 2020 petering out somewhat this year. The trust has slipped to the bottom quartile of its sector for 2021, with a 3.2% gain.

It has the lowest risk score of the four trusts mentioned, at 115, but its returns of 68.7% over the past three years are good enough for second among its IT Global peers.

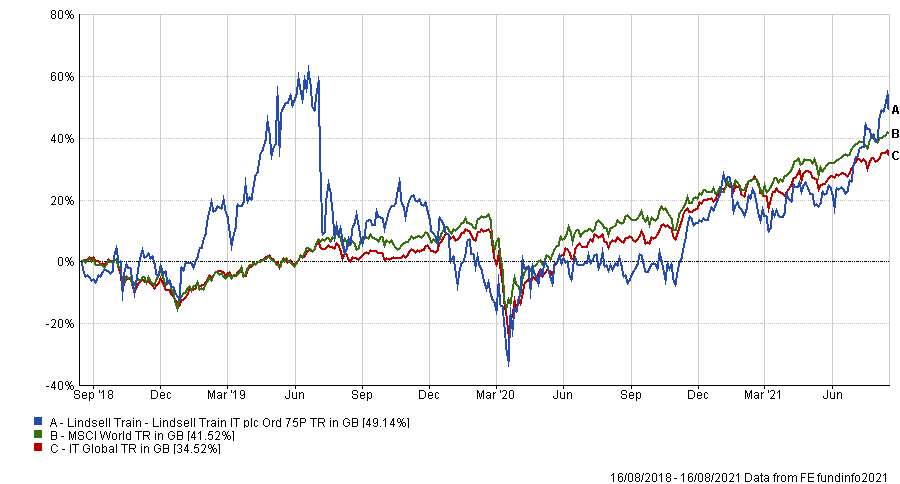

Next up is the £337m Lindsell Train IT, which has the lowest returns of the four funds. The only trust not managed by Baillie Gifford to make the list, it managed top-quartile returns last year and has done so again so far in 2021, but suffered a poor 2019.

The trust is more than 45% weighted to the Lindsell Train asset management business, which means returns can fluctuate heavily based on the performance of the fund house.

However, the main reason for the trust’s wild swings has been the share price premium to its net asset value, which peaked at around double the value of its holdings. This unsustainable level has come down to around 35% today, impacting returns. It has a risk score of 172.

Total return of Lindsell Train vs the IT Global sector and MSCI World index over 3yrs

Source: FE Analytics

Despite this, it has made 49.1% over three years, a top-quartile performance. FE fundinfo Alpha Manager Nick Train typically invests in high-quality businesses, using a buy-and-hold approach that has served his funds well over the past decade and more recently over the past three years.

The final trust mentioned, Edinburgh Worldwide IT, is the only smaller companies specialist included. Run by FE fundinfo Alpha Manager Douglas Brodie, the £1.2bn portfolio has been described as the sister fund to Scottish Mortgage and has been used by the managers of the larger trust for new ideas.

Like its two stable mates above, the fund is technology heavy and can invest in private companies, with up to 15% of its assets allowed in unlisted firms. However, unlike the other Baillie gifford funds above, it generally invests in companies with a market cap of below $5bn, (£3.6bn) and has a long-term mindset of investing for a minimum of five years.

This can lead to periods of underperformance, as has happened this year. The trust is down 15.1% in 2021 after making 87.7% in 2020 – the highest in the IT Global Smaller Companies sector. These large swings have contributed to an FE Risk Score of 180 – the largest on the list. It has made 67.7% over the past three years, the second-best returns in the four-trust strong sector.