Ethical investing has surged in popularity over the past 18 months, with investors keen to not only make money from their funds, but also do good. Funds have raked in savers’ cash, but Ninety One Global Environment and Liontrust Sustainable Future Global Growth stand out.

They have benefited from the trend, which, rather than dissipating, has ramped up in recent months. In July, almost all of the net new inflows into stock market funds was in portfolios with an ethical, social and governance (ESG) tilt, according to fund flow data from Calastone. In total ESG funds accounted for 90% of inflows (£995m).

The theme gained momentum in 2020 when the pandemic increased the spotlight on social and environment problems and investing in the solutions. Combined with the general outperformance of ESG strategies during the pandemic it became a well-liked area. The IA reported that the number of responsible investment funds launched in 2020 grew 66%.

Responsible investment funds now make up 5.1% of the overall share of industry funds under management, according to Investment Association (IA) data. Three years ago it made up just 1.3%.

Ninety One Global Environment and Liontrust Sustainable Future Global Growth are two that have captured investors’ attention. Over three months the former has added £305.8m to its assets under management from inflows, while the latter has gained £164.6m, according to FE Analytics.

Both offer two different ways of accessing ethical stocks. One is a niche, pure decarbonisation strategy, while the other is a broader and more general thematic approach. Below Trustnet looks at the merits of both.

Ninety One Global Environment is the newer of the two funds, launched in 2019, but its managers, Deirdre Cooper and Graeme Baker, are veterans in the sustainability space.

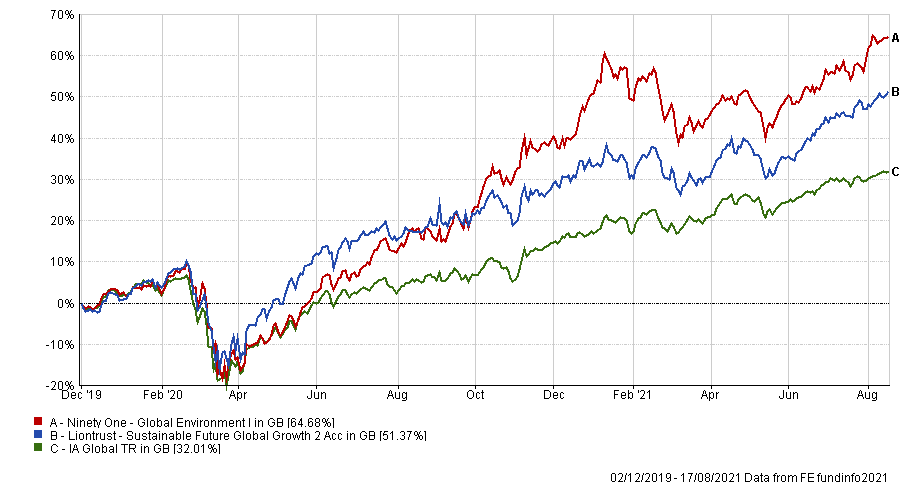

Comparing the performance of both funds since Ninety One Global Environment launched, it has outperformed both Liontrust Sustainable Future Global Growth and the IA Global sector during that time.

Performance of funds vs sector since launch of Ninety One Global Environment

Source: FE Analytics

The £1.6bn Ninety One Global Environment is an impact fund investing in companies specifically tackling decarbonisation.

Managers Cooper and Baker buy companies exposed to at least one of the three themes they identify with decarbonisation; renewable energy generation, electrification of transportation, and improved energy efficiency.

They have created a concentrated portfolio of 40 lesser-known names compared to Liontrust Sustainable Future Global Growth, such as Nextera, Waster Management, Croda, Iberdrola, Aptiv.

Conversely, Liontrust Sustainable Future Global Growth invests in growth companies and applies a much broader ESG lens, with its top-10 holdings including names such as Alphabet, Visa, Autodesk, PayPal.

Patrick Thomas, investment director and head of ESG investing at Canaccord Genuity Wealth Management said this has led to a fund of more “traditional companies that are least likely to be disrupted”.

“Think of Liontrust as a bet on resilience and Ninety One a bet on innovation,” he said.

For Thomas the choice came down to whether or not investors think climate transition is going to be the most important macro theme over the next decade, but he said both were strong options for ethical investors.

However, Charles Stanley Direct pension and investment analyst, Rob Morgan said there was a clear winner – Ninety One Global Environment.

“The two funds are different and both good quality in their own right,” Morgan said, but noted that Ninety One Global Environment’s concentrated portfolio and ability to outperform without a high allocation to US growth and tech tipped the scale.

“This shows some early signs of strong stock picking,” Morgan said, adding that the team had demonstrated an ability to identify “interesting companies” outside of the “usual suspects” within the decarbonisation theme, something that Morgan said would be “very powerful” in the coming years.

AJ Bell analyst Laith Khalaf meanwhile said the £1.8bn Liontrust Sustainable Future Global Growth was the preferrable sustainable option.

“Manager Peter Michaelis, head of the sustainable funds team at Liontrust, has been running sustainable funds since before Greta Thunberg was born,” Khalaf said.

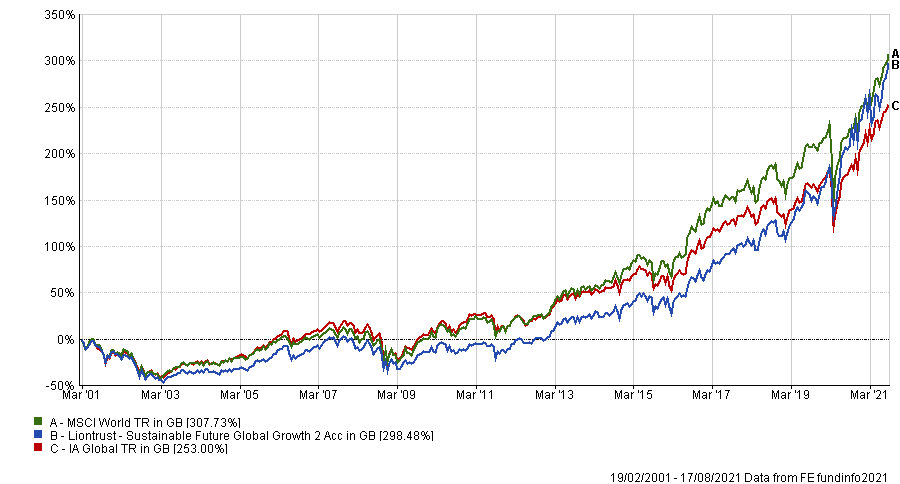

Michaelis has run the fund since launch in 2001 and under his tenure it’s been the 18th best performing fund in the entire IA Global sector, an “impressive track record to boot,” Khalaf said.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Michaelis runs the fund along with Simon Clements and Chris Foster. The team does not use “negative screens to weed out ethically dubious stocks”, Khalaf said.

Instead, it applies Liontrust’s proprietary Sustainable Future process looking for companies within three themes: improving people’s quality of life either through medicine, technology or education, secondly, driving the improvements into the efficiency which scarce resources are being used, and finally, helping to rebuild a more stable, resilient and prosperous economy.

This is a “well defined and robust process,” according to Khalaf.

GDIM investment manager, Tom Sparke, agreed. He said that Liontrust Sustainable Future Global Growth would be an “excellent core holding”.

One of the fund’s attributes is that it doesn’t sit in isolation in the Liontrust Asset Management range, as the fund house offers a wide range of ESG mandates and has been invested in the theme for over a decade.

Its portfolios have been “very successful” Sparke said, following the house’s “progressive and pragmatic approach” which the global fund can also benefit from.

“Overall, for a core offering of high-quality global exposure I would lean towards Liontrust but for a more specialist exposure to environmental themes, Ninety One would be the pick,” Sparke concluded.