There are several ‘deep waves’ that will affect every element of portfolios for decades and need to be considered by investors today, according to the Franklin Templeton Investment Institute.

In the oceanographic field, deep water waves originate in depths of around 200 metres1 or more, accelerate rapidly and often intertwine with others to form even bigger waves. They are difficult to spot from the surface and their potential impacts are often overlooked.

Kim Catechis, an investment strategist with the Franklin Templeton Investment Institute, said there are “striking parallels” between these deep water waves and the long-term drivers that are expected to influence markets and economies.

“Powerful ‘waves’ are sweeping away established assumptions before them, fundamentally altering the economic, political and public policy foundations for asset prices,” he said. “Accelerated by Covid-19 and intensified by socioeconomic pressures, climate change and geopolitics, these forces will exert themselves on every facet of investment portfolios for years to come.”

The Demographic Wave

Population structure is seen as an important driver of economic development, with the United Nations Population Fund arguing that there is a ‘demographic dividend’ – or a period of accelerated economic growth that occurs when a country has a growing population of workers.

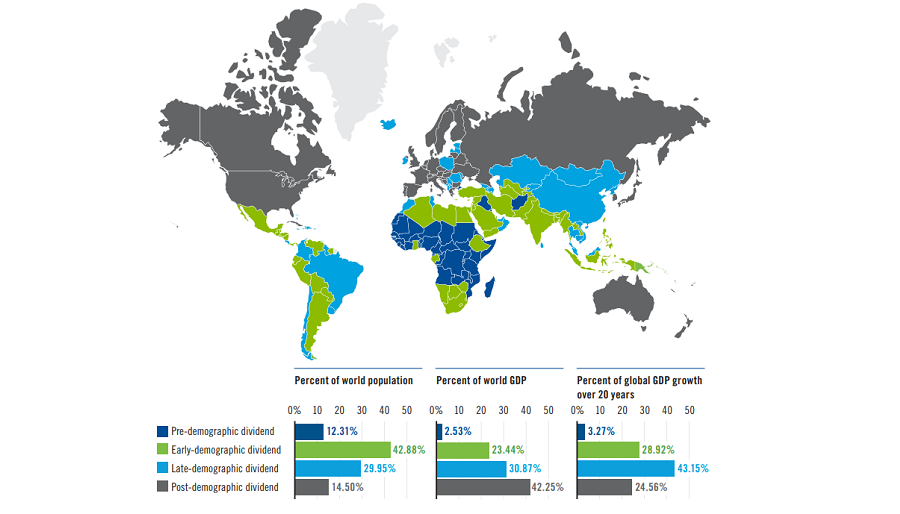

However, as the map below shows, many developed countries have already benefitted from their demographic dividend while several important emerging markets are in the latter stages of theirs.

Geographical distribution of demographic dividend

Source: Franklin Templeton, World Bank

Franklin Templeton’s research pointed out that countries with shrinking working age populations will experience reduced output as well as a growing ratio of dependents to working age citizens, suggesting increased requirements for healthcare investment and higher taxation to cover higher costs.

Catechis said: “For investors, the main point is the countries that represent the largest contributions to global economic growth are those with the ageing populations, which likely will result in slower economic growth in the future.”

In the past, governments in developed countries would have looked to migration to “take up the slack” from those retiring from the workforce and contribute taxes to the public coffers. But many countries now appear opposed to more immigration, with the pandemic hardening this attitude.

When it comes to the investment implications of this, Catechis argued that the economic implications of the demographic wave are “clearly visible” but “not unavoidable”.

“Given the low probability of increased migration, private sector companies will likely react by investing in innovation and potentially in the continuing education of their workforces,” he added.

“Best-in-class management teams in any sector or country will drive policies that support their stakeholders beyond simply earnings growth; the related entities represent a significant and growing investment opportunity set. Allowing for cultural and wealth disparities between countries, consumption patterns generally will change.”

He also argued that consumption patterns could change as populations age – such as a boom in labour-saving innovations in healthcare services and convenience or cruise liners growing faster than areas tilted more towards youthful consumption like ski resorts – which could create opportunities.

The Technology Wave

The second ‘deep wave’ revolves around the impact of greater technological advances and adoption. The Franklin Templeton Investment Institute said developed nations are “urgently” investing in technological innovation, whether than be looking towards robotics to replace retiring workers or using artificial intelligence (AI) to enhance business models in every industry.

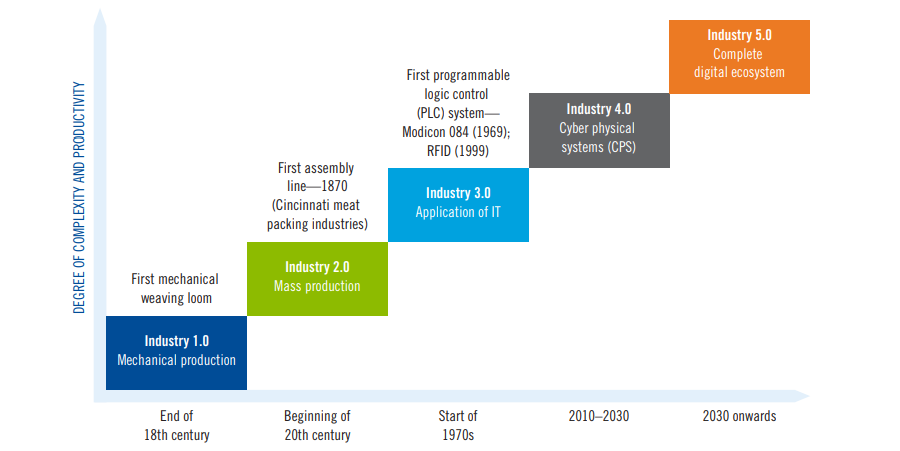

“The much heralded fourth industrial revolution may finally be here, promising unparalleled access to knowledge and increased processing power, supported by technological breakthroughs in fields such as AI, robotics, the Internet of Things (IoT), 3D printing, nanotechnology, augmented and virtual reality (AR/VR), and quantum computing,” Catechis said.

Industrial revolution timeline

Source: Franklin Templeton, Statista, Deloitte, PwC

He added that “there is almost too much choice” in the sectors where investment opportunities will be seen on the back of this.

Healthcare (remote and bespoke) and healthcare security; asset management, insurance and fintech; data management, e-commerce and cybersecurity; energy transition, alternative energy and European Union Green Deal; robotics, semiconductors, IoT, cloud and AI; logistics and electric vehicles; and food production are some of the sectors that could be the principal beneficiaries of increased automation.

The Debt Wave

The past 40 years has seen the use of debt become ever more pronounced as both a tool of policymakers and as a more efficient means of managing the cost of capital for companies and individuals.

While central banks had been trying to scale back the amount of liquidity they were providing the market since 2018, the Covid crisis upended this. The monetary and fiscal response to the pandemic was 3.5 times larger than the e immediate response to the global financial crisis of 2008–2009.

Debt levels are likely to remain high for the foreseeable future and countries with ageing populations face the added challenge of how to handle their rising pension liabilities. Franklin Templeton noted that this scenario leaves investors in an uncertain position.

“Investors understand very well the potential fallout of the world’s build-up of debt, but seem unlikely to be pricing it in, especially as interest rates are broadly expected to remain low for the foreseeable future and there is no expectation of the debt being called in,” Catechis said.

“Large stocks of debt are sustainable only if inflation remains subdued or if ‘financial repression’ is deployed. It would be prudent to expect this to happen. Banks, insurance companies and potentially even pension plans may be mandated to hold larger fractions in government debt. There will doubtless be attempts by governments to introduce unorthodox policy.

“Unfortunately, this question remains unresolved for now. If inflation accelerates beyond the central bankers’ assumptions, we do not know at what point they would press the button marked ‘achieve price stability at any cost.’”

The Geopolitical Wave

Another conclusion of Franklin Templeton’s research is that geopolitics is set to become more influential in the shaping of investment returns as the tension between the US and China grows and starts to cover more economic touchpoints.

“Unless the two can find some accommodation that supports the normal functioning of the international system, they will each line up their respective teams,” Catechis explained.

“Many countries will not be able to resist the call, because of their geographical proximity and economic linkages, like Mexico to the US, or Pakistan to China. Meanwhile the rest of the world is in limbo, pressured by both sides and trying to remain neutral. For third-party countries, the pressure to choose sides will become intolerable, resulting in significant economic pain in many cases.”

The US game plan appears to be levying tariffs on many Chinese goods, reducing economic links between the two countries to ‘plain vanilla’ commodities such as soybeans, while blocking many technological or industrial exports for being sensitive for national security reasons. It is also encouraging its allies help isolate China.

China, meanwhile, is aiming to grow wealthier and assume the role of the ‘Middle Kingdom’ it has held before. Part of its strategy is to recruit allies through initiatives such as Belt and Road, which also cements access to those markets, integrates Chinese companies into those economies and establishes secure long-term supplies of raw materials, resources and agricultural products, while encouraging adoption of Chinese technical and technological standards.

On the implications for investors, Catechis said: “Companies will find themselves disadvantaged in certain markets, depending on where their headquarters is located. In others, categorised as ‘friendly’ markets, these same companies will find their competition evaporating and margins widening.”

The Climate Change Wave

The fifth ‘deep wave’ concerns climate change, which Franklin Templeton described as a risk unlike most others, as there is no way to hedge against it.

Climate-related risks for investors can appear in three principal ways: physical risks, or damage and disruption caused by climate and weather-related events; transition risks, or those associated with the pivot towards a carbon-neutral economy, which will require significant structural changes to the economy; and geopolitical implications, or how all this affect different countries in different ways.

“Climate change is finally being accorded the attention it requires. There is clarity on direction but not on the mechanism, the pace and the efficiency of progress by countries and companies. This is understandable, as the key information missing for investment decision makers is the policy detail from governments and regulators as well as the innovation outcomes that would come predominantly from the private sector,” Catechis said.

“The greatest excitement (and uncertainty) is generated by the innovative solutions that have not yet been established. There are myriad ideas and investors broadly have the experience, the general knowledge, and the patience to deliver investment returns and improve lives at the same time.”