Few managers have the ability to time markets, but Simon Edelsten’s call to sell out of all things China and buy into America has been a master stroke so far this year.

The manager of the Mid Wynd International Investment Trust sold all of his China allocation – 6% at the start of the year – to make room for American stocks.

China has been one of the worst places investors could have put their cash this year, with the MSCI China index down 18% compared with a 16.4% gain for the MSCI World. Conversely, the US has remained a prosperous region for investors, with the S&P 500 up 19.6% in 2021.

Performance of the MSCI China vs MSCI World and S&P 500 indices year-to-date

Source: FE Analytics

“This year we have sold down all our Chinese holdings after the cancellation of the Ant Financial listing last November and the disappearance of founder Jack Ma made us uneasy,” he said.

“This was followed by regulatory action against other Chinese internet success stories, the objection to the flotation in the US of ride hailing app Didi Global and the decision that all quoted education companies should be not-for-profit in future.”

Edelsten sold Alibaba – China’s equivalent to Amazon – at the end of last year, before selling online retailer JD.com and tech giant Tencent, avoiding the worst of the between 24% and 33% falls so far this year.

However, he went further, selling a third of his holdings in Japan (“a proxy for China”) and more recently ditching European luxury good manufacturer Richemont “because of its exposure to China”.

FTSE 100 miner Anglo American was also on the chopping block as it is a significant miner of iron ore, necessary for Chinese steel construction, which has gone down.

Instead the manager has pumped money into the US stock market, which - despite a strong post-Covid economic recovery supposedly impacting the large technology stocks that dominate the index - has done well.

This has helped his £492m trust make an above average return of 14.5% so far this year against its IT Global peers, following on from three consecutive years of top-quartile performance.

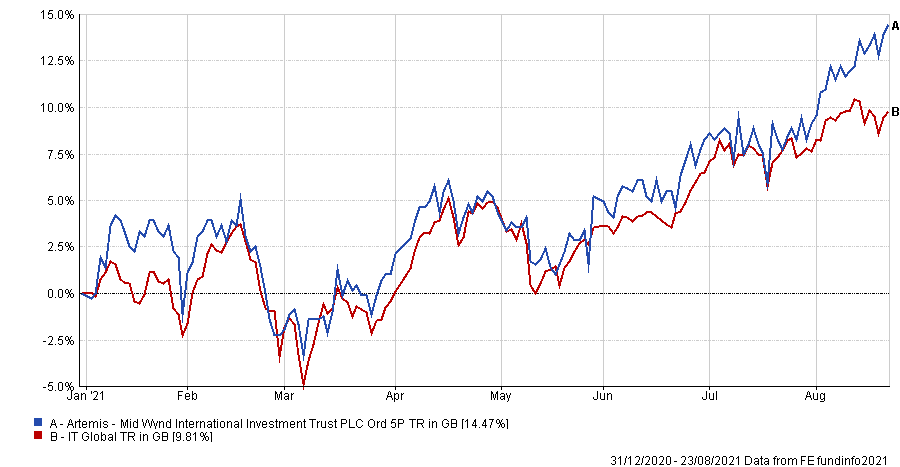

Performance of the Mid Wynd International IT vs the IT Global sector year-to-date

Source: FE Analytics

“I don’t remember ever having such a large exposure to the US and this is in part down to our view on Covid,” said Edelsten.

“Although vaccines used in the West are not 100% effective against Covid – and particularly the delta variant – they have shown themselves to be very effective in mitigating against severe symptoms, while the vaccines most used in Asia seem less successful against delta.”

In contrast, the high levels of vaccination in the West are allowing lockdowns to be avoided. After a slow start, vaccination levels in Europe now exceed the US's 60%, standing at 74% in Spain and 70% in the UK.

“Such levels may require booster shots to maintain a low level of hospitalisations, but any further social measures seem unnecessary, which is particularly good news for mainland Europe, alongside stimulus packages there,” he added.

However, economies such as Germany may be affected by the economic slowdown in China, as companies on the continent tend to rely on exporting goods.

Additionally, the stimulus spending package in the US is significantly bigger than those in Europe and should bolster demand over the next year, he said.

“It should also be noted that the US package specifies that state-funded orders should be directed towards US companies in preference to others – almost like the ‘Buy British’ slogan Harold Wilson launched in the mid-1970s,” Edelsten added.

Although ratings are high, not all sectors are as expensive as the technology stocks, which he has avoided, focusing on the US economy instead.

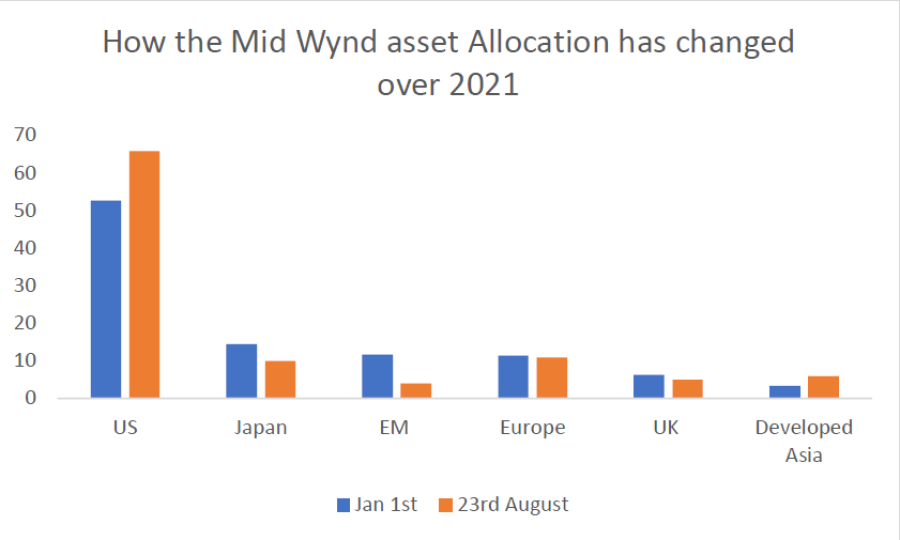

Mid Wynd IT’s regional asset allocation breakdown between January 1st and August 23rd

Source: Mid Wynd International

Recent additions to the portfolio include banking group Wells Fargo and Omnicom, America's largest advertising agency.

“Wells is now recovering from some regulatory issues and has a large book of mortgages which may benefit from the reviving US housing market,” he said.

Omnicom meanwhile has benefited from the major transition from principally handling poster and television campaigns to managing a “matrix of digital formats”, which it has the scale to take advantage of, he added.

“In a US equity market often believed to be expensively valued, Omnicom trades on a PE of around 11x earnings with a yield of 4%,” said Edelsten.