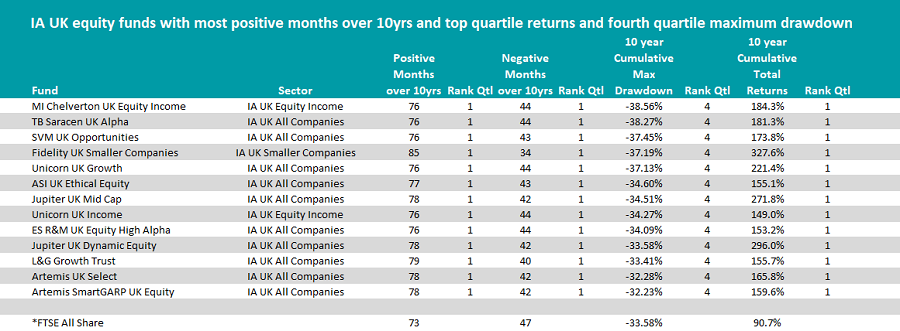

Just 13 funds from the three main UK equity sectors have managed to deliver consistently positive returns while undergoing the steepest losses in their peer groups, FE fundinfo data shows.

In a previous series, Trustnet looked at the funds that had generated both top-quartile returns and were in the top 25% for number of positive months and maximum drawdown. But here, we’ve identified the funds hit with fourth-quartile maximum drawdowns but had still delivering top outperformance over the past decade.

The study looked at the IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors.

Source: FE Analytics

*The FTSE All Share index was used as a comparison for all funds

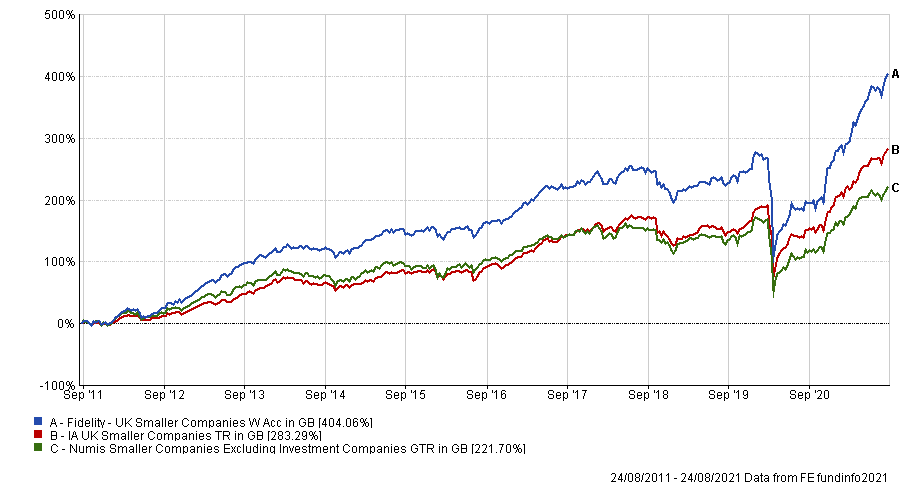

Only one fund from the IA UK Smaller Companies sector made the list: Fidelity UK Smaller Companies.

Run by Jonathan Winton and deputy manager Jac Jones, the fund had the highest number of positive months in the study, 85 out of 120. Over 10 years it made the seventh highest returns in the sector at 327.58% and its maximum drawdown was 37.19%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

To achieve this high performance in spite of the deep losses, the managers pay a lot of attention to downside risk.

Their investment process is centered on the idea that the stock market is poor at pricing companies that have gone through down periods and find themselves unloved.

It’s these “unrecognized growth opportunities” – where companies are trading below what the managers regard as their true value – that Winton and Jones focus on. These companies have to have an “asymmetric risk-return profile”, meaning the potential for future returns and rising share price is greater than the potential losses.

Some of the stocks this process has led to are government contractors Serco Group, energy services company Mitie Group and car dealership Inchcape.

The IA UK Equity Income sector did one better with two funds making the list: MI Chelverton UK Equity Income and Unicorn UK Income. Both funds had 76 positive months and are roughly £525m in size.

MI Chelverton UK Equity Income has delivered the best 10-year returns in the IA Equity Income sector, gaining 184.3%. It did this despite a maximum loss of 38.56%, the biggest in the study.

Performance of fund vs sector over 10yrs

Source: FE Analytics

Breaking down the fund’s performance during the past decade, it has consistently been in the top five performers for the sector, apart from 2020 when it fell to fourth quartile. This is reflective of the massive impact the Covid-19 pandemic had on the UK equity income market especially as many companies couldn’t payout dividend.

The fund has been run by David Horner, David Taylor and Oliver Knott since launch in 2007. It has a quality bias and seeks to provide a growing income stream and long-term capital growth by investing primarily in a portfolio of 130-150 mid-and small-cap UK equities. According to the Rayner Spencer Mills, the “excellent stock picking ability” of the managers has contributed to the outperformance.

Unicorn UK Income fund follows Unicorn Asset Management’s overall philosophy of investing in growth but at a reasonable price, making it a more balanced style portfolio. The fund tends to stay out of large-caps, focusing on names which are less well known and understood by the wider market.

Its long-term performance is strong, generating 149% over 10 years - the fourth best out of 65 in the sector. But over shorter time frames its performance has wobbled, largely due to the aforementioned reasons and generally volatile market caused by the pandemic. Consequently its maximum drawdown was 34.27%.

The fund is run by Simon Moon and FE fundinfo Alpha Manager Fraser Mackersie. Mackersie also runs the Unicorn UK Growth fund from the IA UK All Companies sector, which appeared in the study. He runs that fund with Alex Game.

Unicorn UK Growth is invested across the cap-spectrum, including AIM listed stocks. This creates a portfolio of holdings, including data company Restore, software company Aveva and construction materials firm Breedon Group.

Other IA UK All Companies fund in the study was £3.6bn Jupiter UK Mid Cap which is run by FE fundinfo Alpha Manager Richard Watts. Jupiter UK Mid Cap had 78 positive periods out of 120, returned271.8% over 10 years and had a maximum drawdown of 35.51%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

The Square Mile Research team said that they held a “high regard” for Jupiter’s UK small and mid-cap team, headed by Watts.

Since the fund launched in 2008, the investment process put in place has remained the same, though in reaction to the past year there’s been some “subtle refinements to the process to ensure it remains relevant”, which Square Mile said would benefit the fund.

It added that Watt’s high conviction approach, while it has provided an “impressive track record against the FTSE 250”, can lead to the manager taking sizeable positions in both stocks and sectors. This in turn can result in periods of short-term underperformance.

The other Jupiter fund on the list, Jupiter UK Dynamic Equity, also has a mid-cap focus following the same process but managed by FE fundinfo Alpha Manager Luke Kerr.

It had 78 positive periods with a maximum drawdown of 33.58%, making a total return of 296% over 10 years, the second best in the IA UK All Companies sector during that time.

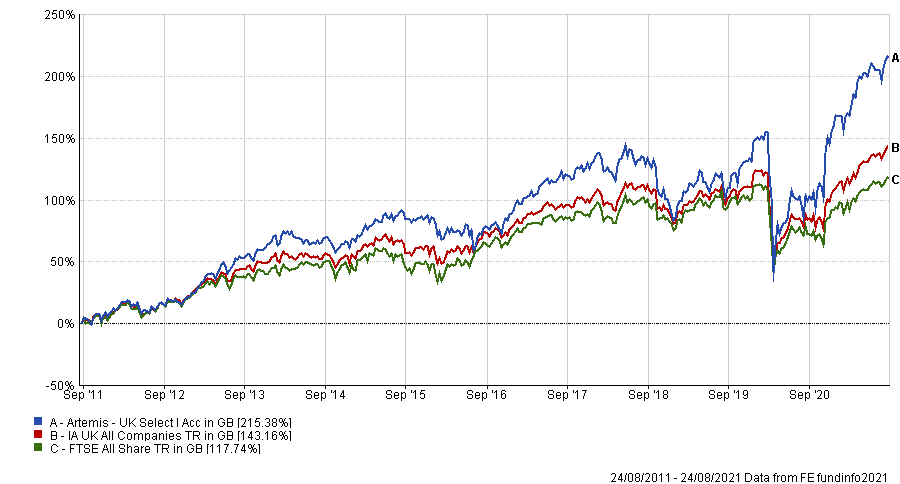

Another pair of funds in the list were Artemis UK Select and Artemis SmartGARP UK Equity.

Both funds had 78 positive periods with similar maximum drawdowns: 32.28% and 32.23% respectively. The 10-year returns were also close, at 165.8% and 159.6%.

Artemis SmartGARP UK Equity uses the fund house’s SmartGARP software tool, which tries to tackle ‘information overload’ by focusing manager Philip Wolstencroft’s attention on just the companies with the most attractive financial characteristics.

For the £1.3bn Artemis UK Select fund, managers Ambrose Faulks and Ed Legget run a more value approach, with high allocations to financial services, leisure and consumer products sectors.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

The fund can take short exposures on stocks the managers think are an over-valued business.