Investors shouldn’t ditch quality growth stocks even if inflation fears prove justified, as they can continue to outperform in an environment characterised by rising prices, according to Trium’s Raphael Pitoun.

However, Ninety One’s Alessandro Dicorrado warned that while the underlying business models of quality growth stocks may offer some protection against inflation, their current high valuations complicate the picture.

Pitoun, manager of the Trium Sustainable Innovators fund, buys what he refers to as “innovation compounders” – businesses with a strong track record of innovating to deliver the best products and services to clients over the long term.

“We are looking at companies more or less like a private equity firm,” he explained. “We spend between six months and one year looking at every individual business before being in a position to invest.”

He avoids sectors such as banks and energy, where performance is more dependent on supply and demand, and innovation is less important. He also steers away from many tech stocks, holding just one of the FAANGs (Alphabet) in his top 10, saying they are either too expensive or do not have a long enough track record of sustainable innovation.

A short-hand way to describe such a strategy is quality growth, or growth at a reasonable price, which has served its proponents well since the financial crisis.

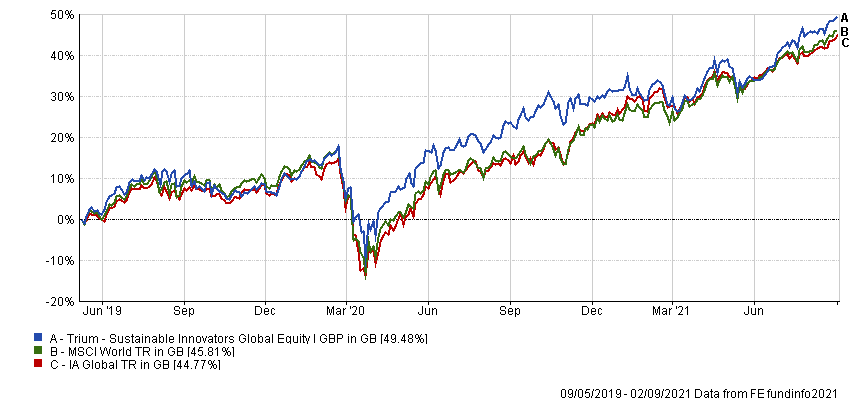

Yet Trium Sustainable Innovators was only launched just over two years ago. Although it has done reasonably well over this time – it is up 49.5% since launch, compared with 45.8% from the MSCI World index and 44.8% from its IA Global sector – it could be argued that, after such a lengthy run, the time to invest using this strategy has been and gone – especially with a ramp up in inflation, which has historically favoured value stocks.

Performance of fund vs sector and index since launch

Source: FE Analytics

However, Pitoun is confident he can continue to outperform.

“We invest in companies that have a sufficient amount of pricing power across the board, so they can increase prices year after year because of the quality of the product and the fact the products they deliver are essential to their clients,” he said.

“There is kind of a win-win relationship between the customer on one side and the corporate on the other.”

He also pointed out that many of his holdings have low input costs – many sell what he calls “digital capital” rather than physical goods, so a rise in the price of commodities will have little impact on their bottom line. Instead, he said they rely on intangible assets to deliver the right products and services to their clients.

“We think many of them will actually benefit from a bit more of inflation,” the manager added.

Dicorrado of the Ninety One Global Special Situations fund agreed with Pitoun that one of the best ways to protect against inflation is to buy companies with pricing power.

He noted that, given two similar valuations, a quality growth company with pricing power will generally fare better than a lower-quality business.

However, the strong performance of quality growth companies over their lower-quality counterparts in the past decade has created a huge divergence in valuations. And while value managers such as himself have underperformed in this environment, the high starting valuations of quality growth stocks and a change in the macro background mean the next 10 years could be very different.

“One of the consequences of rising inflation is rising interest rates, and therefore rising discount rates in discounted cash flow (DCF) valuations,” Dicorrado explained.

“After a decade-long bull market, the discount rates that are being used to value many quality growth stocks have been reduced to justify ever-rising prices. By way of example, the equity discount rate used by sell-side analysts to value Microsoft currently ranges between 6.5% and 8.3%. The key question to ask with inflation is, what happens to valuations if equity discount rates increase?”

The manager said the way around this is to buy good companies cheaply. He said his investments don’t need to see a spike in inflation to “come good”, and he never reduces discount rates to justify higher valuations.

On the other hand, he said the stocks that will suffer the most from a spike in prices are those that are pricing in permanently low inflation and low interest rates.

“Conversely, some sectors are currently not pricing in higher inflation: some of the money-centre banks both in the US and the UK, as well as some energy stocks, come to mind.”

More generally, Dicorrado said value does not necessarily have to just correlate to cyclical businesses and industries.

“There will be instances where the more staple-like businesses, healthcare or consumer staples themselves, should rightfully fall onto a value investor’s radar,” he added.

“We believe it is important to have the foresight and the willingness to move nimbly between different value styles as the opportunity set in the market changes.”

Performance of fund vs sector and index under manager

Source: FE Analytics

Data from FE Analytics shows Ninety One Global Special Situations has made 72.7% since Dicorrado joined in January 2016, compared with 121.6% from its MSCI ACWI benchmark and 114.2% from the IA Global sector.

However, Dicorrado pointed out the fund has been a top-quartile performer in the past year, when conditions have been more favourable for value investors.