BlackRock Throgmorton Trust is one of the latest entrants to the FTSE 250, following the most recent quarterly shake-up. Previously a member of the FTSE Small Cap, it was promoted to the mid-cap index with six other companies: Baltic Classifieds, Bridgepoint, DarkTrace, Draper Esprit, Endeavour Mining and Weir. It was the only investment trust to be added in this allocation.

This follows a positive year for the trust, in which it has made the fourth-highest returns in the sector so far in 2021, even though manager Dan Whitestone’s growth bias has faced headwinds during the value rally.

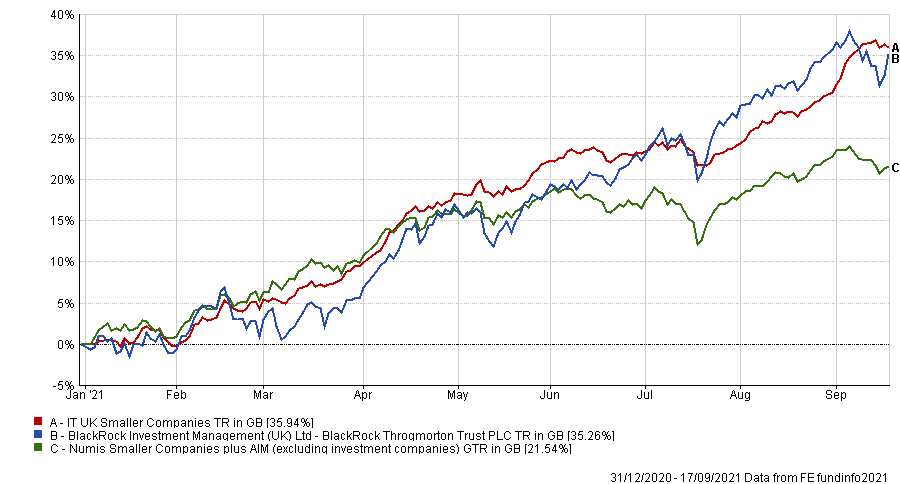

Performance of trust vs sector and benchmark YTD

Source: FE Analytics

James Carthew, head of investment companies at QuotedData, said that a large part of this performance was down to Whitestone’s stock picking abilities.

He said that Whitestone “is genuinely excited about the prospects for the companies in the portfolio” and the UK market in general. In the latest half-yearly report, the Throgmorton manager said that the trust’s ability to outperform in a market which is “less favourable to differentiated growth” is an indicator of the opportunities in the UK.

Carthew added that as international investors become more positive on the UK again, the trust is set to benefit from a pickup in M&A activity.

The trust has also benefited from its ability to take long and short positions, with the latter focused on companies with disrupted business models. Simon Elliott, head of research at Winterflood Securities, said this helps to differentiate it from its peer group.

In the trust’s half-yearly report, Whitestone said his long positions have generally performed “very strongly”, beating the manager’s estimates, due to a continuation of trends from last year.

He later said: “The investment opportunity set remains very compelling in my view, and I believe the portfolio is well positioned to benefit from the enduring secular growth trends we’re witnessing (for example cloud computing, digital transformation, digital payments) as well as our focus on differentiated and advantaged growth companies opening up new markets or taking share from legacy incumbents.”

The strength of the long positions meant that the trust was operating on a lower-than-usual short exposure, with just eight positions compared to 131 long ones.

“This demonstrates our optimism in stock markets, the outlook for UK plc more broadly and the structural and industrial trends to which the company is exposed,” Whitestone said in the report.

Carthew noted the trust has also outperformed over 10 years, making the second highest returns in its sector over this time, at 614.4%. He was overwhelmingly positive on the future prospects for the trust as well.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Kamal Warraich, investment analyst at Canaccord Genuity Wealth Management, was equally bullish.

He said that “adding to the position on a long-term view would be worth consideration”, despite the trust’s current premium of 2.63%. This is the third highest premium in sector and “certainly more expensive than a few years ago,” Warraich added.

“We believe investors are paying for a tried and tested process which has consistently produced impressive results,” the analyst added.

However, Elliott said there were some factors to bear in mind.

He warned that the trust’s premium relative to its peers meant there was a risk of re-rating downwards given that it does not have an explicit discount target.

Elliott also flagged the trust’s style bias, saying that it is “one of the most growth-oriented in the peer group”. This style predisposition meant it was “more exposed to changes in interest rate expectations as central banks begin to taper and debate continues over the persistence of inflation”.

Overall, however, Elliott was positive on the trust, saying that it has “much to commend it”, including its £1.2bn size and healthy liquidity.

The trust holds an FE fundinfo Crown rating of four.

It is worth noting it carries a performance fee. Ongoing charges are 0.6% (excluding performane fee) and charges including performance fee is 1.6%.