UK consumers currently have a mindset reminiscent of the strapline from a L'Oréal advert, telling themselves “you’re worth it” when it comes to spending their lockdown savings on indulgences.

This is according to Georgina Brittain, who is aiming to take advantage of this trend through exposure to consumer stocks in her JPMorgan UK Smaller Companies investment trust.

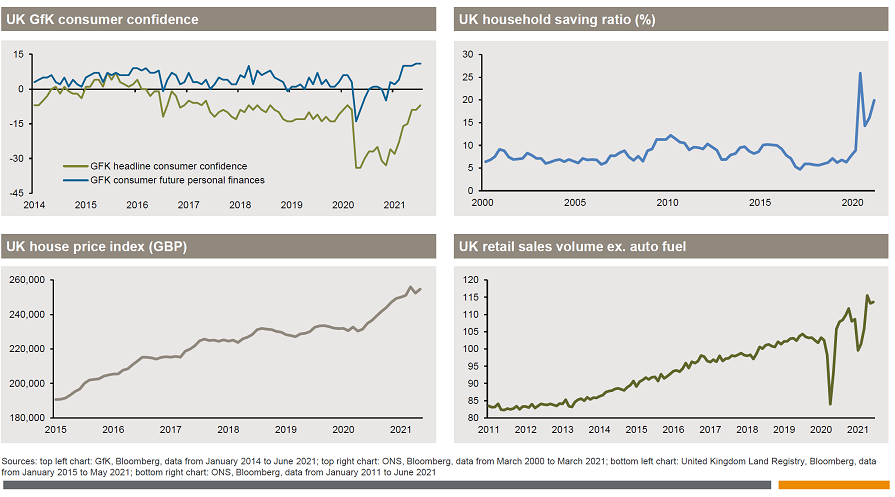

The manager pointed to numerous charts highlighting the strength of the recovery in the UK, such as a return of consumer confidence to pre-Covid levels, upgrades to GDP expectations, record house prices and one million job vacancies.

Combined with excess household savings which are more than double the long-term average, she said this painted a rosy picture for UK consumer-facing industries in the coming years.

“It's not just retail, we're looking at the overall leisure spend,” Brittain said. “An update from Barclaycard last week showed the share of non-essential spending in August was up for the fourth month in a row, and more importantly was up on the same period in 2019.

“There is no doubt that people are spending some of that excess: we are all desperate to embrace normality and get out there and enjoy ourselves.

“Each of us feels like we deserve it. We sound like a L'Oreal advert, but it really is true. ‘Do it now, don’t wait anymore. Book the holiday, book the restaurant, book the theatre, etcetera.’ And it's coming through in the stats.”

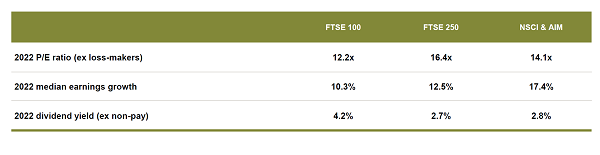

Yet despite this powerful tailwind, the UK market remains cheap, particularly small caps. Brittain pointed out the Numis Smaller Companies plus AIM index is currently trading on a forward P/E ratio of 14.1x, even though median earnings growth for 2022 is expected to be 17.4%.

Valuations of UK indices

Source: FE Analytics

Brittain’s co-manager Katen Patel added: “The UK was severely hit last year. Analysts really took a knife to numbers across the entire market, particularly in the more domestically focused small- and mid-cap space.

“That sets expectations at very low levels. But as we've gone through the summer and companies in our portfolio have reported their first-half numbers, there has been a raft of upgrades, often by double digits.”

The managers’ optimism is reflected in the gearing of the trust, which stands at 9.5% out of a maximum of 10%.

They are not the only ones who see value in this market. Private equity bids for UK stocks have reached a record level, and the trust is benefiting from the spike in merger & acquisition activity.

“We've had three bids this year and we've got two bids still in the portfolio,” Brittain continued. “Sumo, the video games company, and Augean, which is going to go to auction tonight [an offer for the waste management firm has since been accepted].

“We’ve got those in quite small sizes in the portfolio, but that is effectively cash because if one company drops off a cliff, we want to have firepower.

“There's also a heap of IPOs, we've seen three already this week in the small-cap space. We're getting quite close to what I call ‘sell to buy’.”

Despite their focus on the consumer, Brittain and Patel have tried to keep a balanced portfolio, with exposure to companies that are benefiting from the re-opening trade and those that sailed through last year’s crisis relatively unscathed.

They have also maintained some exposure to value stocks as well as the growth and momentum names favoured by most UK small-cap managers.

One example is Serica Energy, a North Sea gas company. The managers bought this partly because of the strength of the underlying commodity, and partly because it was too cheap to ignore.

“That’s one we’ve been watching for some time,” said Patel. “It takes late-life assets, typically buying them off the majors and running them for further than expected.

“But if you look at where the gas price is now, it could be generating more than its market cap in cash next year, so it is well placed to benefit from what's going on in that market.”

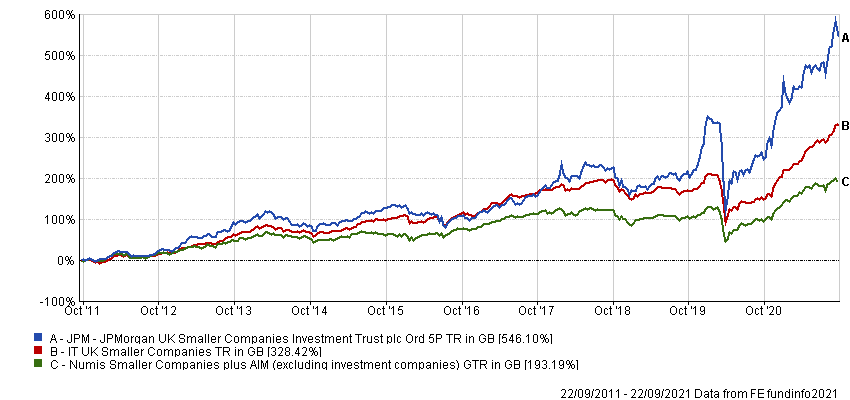

Data from FE Analytics shows JP Morgan UK Smaller Companies has made 546.1% over the past decade, compared with gains of 328.4% from its IT UK Smaller Companies sector and 193.2% from its Numis Smaller Companies Plus AIM (ex ITs) benchmark.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

It is on a discount of 2.8% compared with 4.8% and 10.2% from its one- and three-year averages.

The £362m trust has ongoing charges of 1.01%.