The Alternative Investment Market (AIM) is grappling with significant headwinds – and so are the managers investing in it. Some are beginning to reconsider their exposure, while others are worried about the future of the market itself and calling for action to help reignite the space.

AIM has historically accounted for more than two-thirds of the Liontrust UK Smaller Companies fund’s portfolio, but the Economic Advantage team behind the strategy partly blamed the market for its recent underperformance and has begun to voice concern.

“The exposure to AIM is a product of the requirement within our investment process for companies to have a high degree of management ownership, which encourages long-term decision making and aligns interest with minority shareholders,” a spokesperson for the team said.

“It’s important to note that the process is not wedded to AIM as a market and should the composition of the investable universe change, as dictated by the management ownership requirement, then the index profile of the fund may also change.”

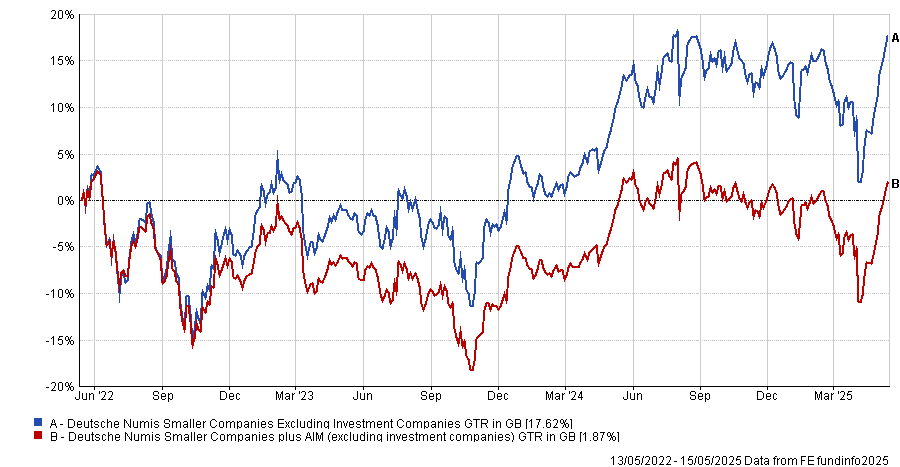

AIM has materially underperformed the IA UK Smaller Companies sector in recent years (a sector that has barely delivered returns of its own). This was partly due to its growth bias in a value-driven market, but also a reaction to changes in tax incentives.

Performance of indices over 1yr

Source: FE Analytics

It has been just over six months since Rachel Reeves cut inheritance tax (IHT) relief on AIM investments from 100% to 50%. But the uncertainty that preceded it has been perhaps even more damaging, according to Eustace Santa Barbara, co-manager of the IFSL Marlborough Special Situations, UK Micro-Cap Growth and Nano-Cap Growth funds.

“The huge uncertainty in the run-up to the chancellor’s Autumn Statement was particularly unhelpful,” he said.

“It was during this period that AIM experienced its biggest dip. The fear was that the chancellor would eliminate the entirety of IHT relief for AIM stocks. There was then something of a relief rally when this didn’t happen.”

Santa Barbara’s exposure to AIM has fallen slightly in the past two years – largely as a result of bids for holdings, such as those of self-storage operator Lok’nStore, tech company IQ Geo and AI player Windward, and partially due to residual uncertainties, including questions around companies preferring a move to the main market and potential further changes to the tax regime.

He added: “It’s also likely that AIM has long since peaked in terms of sheer numbers. It will very probably never again boast 1,700 listings, as it did back in 2007.”

There are now just 679 companies left on AIM – the lowest level since 2001. Alongside a growing exodus of companies, the number of new entrants has also plunged, hitting a low not seen since the 2008/9 financial crisis, with only 10 new listings last year.

Since the changes in IHT legislation, a spate of new companies have announced that they are leaving AIM and moving to the main market, as Paul Jourdan, chief executive officer at Amati Global Investors, noted. Among them was wealth manager Brooks Macdonald, which jumped over to the main market in March 2025.

“The careless changes to the inheritance tax legislation severely damaged AIM shares, which sold off to somewhat ludicrous levels in the first quarter of this year,” he said.

The problem was not just that the level of IHT relief was cut – the imbalance with private companies, which retained the IHT relief at 100%, was “much worse”, as it created a strong incentive for investors to shift their money from AIM into ‘private IHT services’ – bespoke investment products built around low-risk private companies designed specifically to qualify for IHT relief.

“This, combined with slow economic growth and the ongoing move of UK savings out of the country towards the US (certainly until Trump’s ‘Liberation Day’ speech), created a dearth of buyers to offset the selling from AIM IHT portfolios.”

For all the issues in the short term, Jourdan doesn’t believe that companies moving to the main market makes all that much difference – “investors will buy great companies on either market”, he said.

The WS Amati UK Listed Smaller Companies fund is agnostic as to whether a company is listed on the full list or on AIM, preferring instead to invest based on the quality of the companies and the attractiveness of the valuations.

So does this spell the end of AIM? Not for Jourdan, who said that the absence of buyers has created a market full of opportunities for those brave enough to go against the flow. In late April and early May sentiment seems to have started to change and become more positive as well.

Santa Barbara agreed. “Despite recent headwinds, potential is still there today. Many AIM-listed companies still hold real appeal in an era when positive disruption repeatedly comes from smaller, agile, innovative businesses,” he said.

“Looking ahead, we believe the macroeconomic and political environment is creating heightened opportunity for attractive returns over the longer term.”

Simon Moon, co-manager of the Unicorn UK Smaller Companies fund, was even more positive.

“We remain strong advocates for AIM. It plays a critical role in the UK equity landscape and is home to many innovative, resilient businesses,” he said.

“Valuations remain compelling, and there is significant scope for reform to improve demand, liquidity and market access. Much of this could be achieved with limited or no cost to government, and we are optimistic that targeted, practical reforms will emerge.”

However, action is needed. The London Stock Exchange has neglected AIM for a number of years, said Jourdan, and “seems fixated” on launching a Private Intermittent Securities and Capital Exchange System (PISCES) to replace it.

For fund managers who have been investing on AIM for a long time, this is “hard to comprehend”, and Jourdan called for “vigorous and well-judged” deregulation and some “real focus on providing much better value for money for companies seeking a listing”.

“It may well now be appropriate for AIM to be put in the hands of a different body, perhaps a not-for-profit company, so that it can really innovate and reform itself for the benefit of all market participants, providing genuine competition to the main market.

“The history of successes on AIM really matters here. There is an excellent foundation on which to build and it would be a great pity to miss the opportunity to do that. With some reforms, AIM could once again become the most dynamic junior stock market in Europe, and possibly beyond,” he concluded.