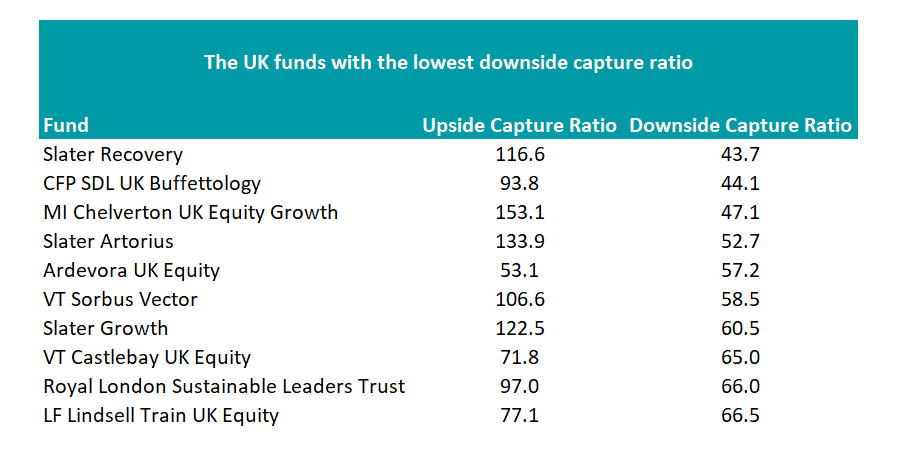

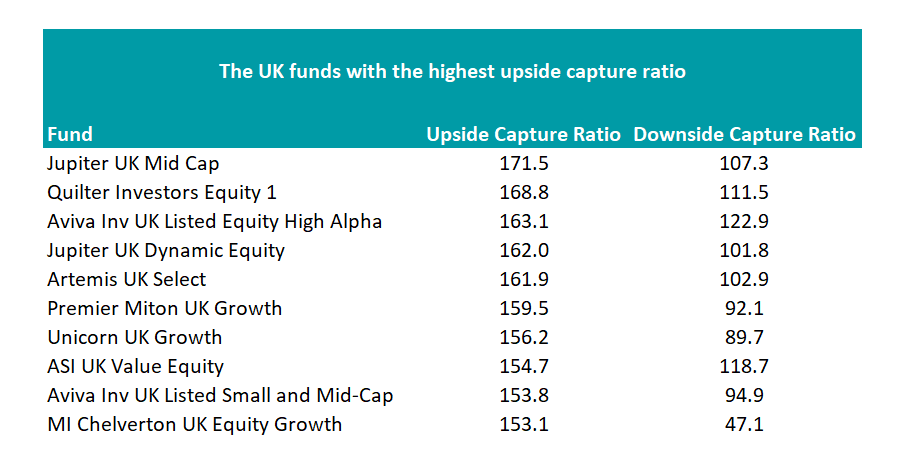

Only one fund in the IA UK All Companies sector has made the top-10 list for protecting investors on the downside while also capturing the gains in the good times, according to the latest Trustnet study.

In this latest series, we looked at the upside and downside capture ratios, which measure how much a fund has risen or fallen relative to the FTSE All Share over the past five years.

If a fund had a downside capture ratio score of 100, it showed it had lost the same amount as the market. A ratio of 50 showed that if the market were down 10%, the fund would be down 5%. Similarly, 150 implied a 15% drop if the market were down 10%. The opposite is true for upside – a score of 150 would imply a 15% rise if the market were up 10%.

The only fund on both lists was MI Chelverton UK Equity Growth, the top performer in the sector over the past five years.

The £1.7bn fund, managed by James Baker and Edward Booth, predominantly buys smaller- and medium-sized firms, including those quoted on AIM.

It has made investors 184.7% over the past five years, more than four times the gains of its average IA UK All Companies peer and almost 40 percentage points more than its next-closest rival.

Slater Recovery leads the UK funds that have been the best at protecting investors’ cash. The £339m multi-cap fund, run by FE fundinfo Alpha Manager Mark Slater, was the third-best performer in the IA UK All Companies sector over the past five years, returning 140.2%.

The fund has managed this while also falling less than the market in bad times. Its downside capture ratio of 43.7 was the best among its peers. It also had a decent upside capture ratio, of 116.6, showing it performed well in both rising and falling markets.

Source: FE Analytics

Other well-known names in the table included LF Lindsell Train UK Equity, managed by Alpha Manager Nick Train, and CFP SDL UK Buffettology, headed by Alpha Manager Keith Ashworth-Lord.

At the other end of the spectrum, Jupiter UK Mid Cap was the best fund for aggressive investors. The £3.7bn portfolio, managed by Alpha Manager Richard Watts, has made investors 78.9% over the past five years, placing it in 21st position out of its 227 peers.

The fund, which invests in mid-sized companies on the FTSE 250 as well as larger firms quoted on AIM, had an upside capture ratio of 171.5.

However, it had a higher downside capture ratio of 107.3, suggesting it is built for rallies rather than pullbacks.

Source: FE Analytics

Multi-cap strategies performed well in terms of upside capture, with both Premier Miton UK Growth and Unicorn UK Growth cracking the top-10.

Jason Hollands, managing director of Tilney, said: “Multi-cap funds give managers the greatest range of stock opportunities from across the UK market.”

The FTSE 100 accounts for around 80% of the UK market cap but numerically there are far more stock opportunities outside of it, especially in the small-cap space – both across the main market and AIM (the latter has more than 830 stocks).

“The further you go down the market cap spectrum, the thinner the brokerage research becomes,” Hollands said.

“That creates greater opportunities for active managers to add value if they do their homework correctly.

“In more recent years, funds underweight large caps have benefited from lower exposure to sectors like oil & gas and banking, which were hammered during the coronavirus crash, and often greater exposure to growth sectors like tech, which is a notable theme in the Chelverton fund.”