Bank of England governor Andrew Bailey has signalled an interest rate hike earlier than planned as rising energy prices and supply chain problems have caused inflation to last for longer than forecast.

As reported by the Financial Times, Bailey told a group of G30 central bankers that he “will have to act” to stop the inflationary pressure if it continues.

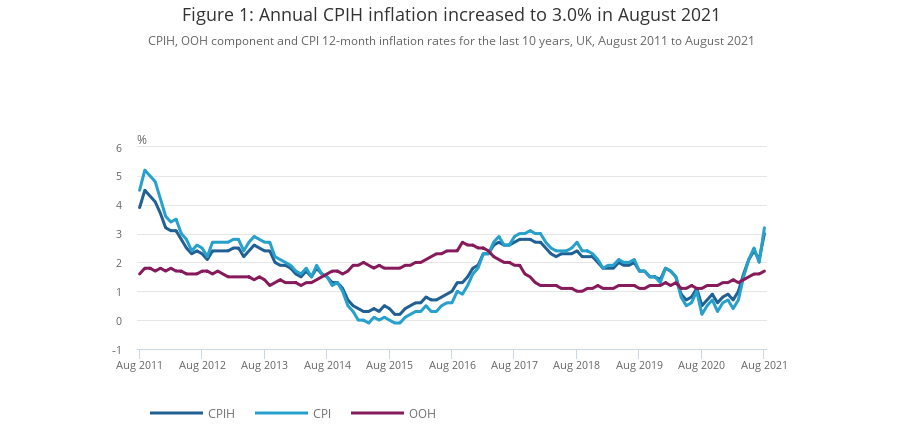

UK inflation has risen over the past few months after it collapsed during the Covid-19 pandemic a year ago. In August, inflation rose to 3.2% year-over-year and is expected to rise to 4% by the end of the year.

The latest UK inflation figures from September are expected to be published on Wednesday.

“That’s why we, at the Bank of England, have signalled, and this is another such signal, that we will have to act,” Bailey said. “But of course that action comes in our monetary policy meetings”

Source: Office for National Statistics

The next Bank of England Monetary Policy Committee meeting is scheduled for November 4.

Tom Stevenson, investment director for personal investing at Fidelity said: “Investors are worried that this is ‘bad inflation’ - a consequence of rising energy costs and higher wages and not a response to rising demand and activity.”

He said that the comments from Bailey “have triggered a major change” in market expectations.

“Only a few weeks ago, markets were pricing in a first rate-hike next summer, now it could be before the end of the year,” he said.

Laith Khalaf, head of investment analysis at AJ Bell, said that interest rate markets indicate an 85% chance of a rate rise this year, and a 60% chance of a hike at the next Monetary Policy Committee meeting in November.

The US Federal Reserve is set to announce its stance on monetary policy a day earlier on November 3rd.

Khalaf said: “Guessing how nine people in a room are going to vote on interest rate policy isn’t based on any science, but a rate hike in November would give the impression of a pretty panicked knee-jerk reaction to events unfolding in the energy market.

“A December hike therefore looks more likely, but there’s still a lot of data to enter on the Bank’s spreadsheet before then.”

He warned that the Bank of England may want to wait to see how the economy copes after the “sticking plaster of furlough” has been properly removed and how much further the energy price crunch can go, before it raises interest rates.

He said: “The Bank may well be wary that rising energy costs will act as a brake on economic growth, which will do a similar job to an interest rate hike, thereby alleviating the need for tighter policy just yet.”