Fundsmith, Invesco and GAM are among the fund groups that have delivered top-ranked performance with charges above the peer group average, according to data from FE Analytics.

Fees are a contentious topic among investors. Some will argue that cheap tracker funds are the best way to invest and theoretically they have a case as the more investors are charged to own a fund, the more that portfolio must return each year to break even.

Others believe active management works and is worth paying up for if they are in the right fund. Indeed some global funds have managed sector-beating returns despite charging higher fees each year.

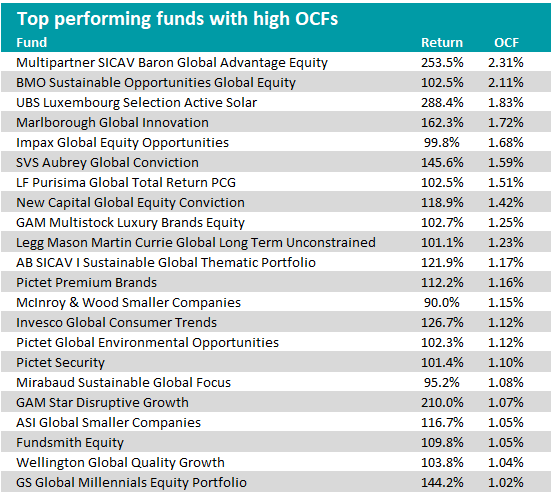

Having looked at the best low-cost funds in the Investment Association’s Global sector, below Trustnet singled out the funds with top-quartile performance over the past five years, and bottom-quartile (high) ongoing charges figures (OCF).

Of the 95 funds with bottom-quartile ongoing charges in the sector, more than half of them (55) had returns below 70%, putting them in the third and fourth quartile for performance.

However, there were 22 funds that delivered the best performance in the sector and charged investors accordingly. Below is the list of funds sorted by their OCF.

Source: FE Analytics

The Multipartner SICAV Baron Global Advantage Equity fund had the highest charges of any of the funds featured on the list, with an OCF of 2.31%.

This fund invests in small, medium and large cap companies globally, and places a focus on companies with “open-ended” growth opportunities and sustainable competitive advantages. Its largest holdings include the US tech giants Alphabet, Amazon and Facebook.

Run by Alex Umansky, a former manager of the Morgan Stanley Opportunity fund, Baron Global Advantage delivered the second highest returns of all the funds that featured with a total return of 253.5%. This performance was second only to the 288.4% return from the UBS Luxembourg Selection Active Solar fund.

Elsewhere in the list, the BMO Sustainable Opportunities Global Equity fund exhibited the second highest charges in the group with an OCF of 2.11%. It managed to deliver a return of 102.5% over the past five years.

Run by Nick Henderson and Jamie Jenkins, the fund invests in global equities based on positive, sustainable investment themes in line with ESG (environmental, social and governance) principles.

Its largest two holdings are in scientific instrument firm Thermo Fisher Scientific (3.4%) and Linde (3.4%), a multinational chemical company that specialises in selling atmospheric gases.

Another notable fund with returns on the higher end of the scale was the SVS Aubrey Global Conviction fund, which delivered a total return of 145.6% over the past five years.

Managed by Andrew Dalrymple alongside John Ewart, the fund takes a concentrated approach with only 33 holdings. They focus on mid-caps that can grow their earnings at least 15% per year.

Although it has a large exposure to US technology firms such as Nvidia (4.7%) and Alphabet (3.9%), the index-agnostic managers have weighted Singaporean tech firm Sea Ltd as the portfolio’s top position (6.8%).

Elsewhere, Terry Smith’s Fundsmith Equity fund was a notable fund that featured – with returns of 109.8% over the past five years and an OCF of 1.05%.

Despite charging high management fees when compared to the overall sector, Smith is known for his buy-and-hold investing style, and regularly endorses his own low portfolio turnover and low trading cost approach.

The fund’s largest holdings include Microsoft, PayPal and Stryker - which have also been the fund’s biggest contributors to performance over the past few years.

Another notable fund was the GAM Star Disruptive Growth fund, one of only three strategies in the list that delivered returns of more than 200% for the period.

Managed by Mark Hawtin, the fund focuses on investing in companies involved in what he deems are the most disruptive themes taking place in the global equity market.

Despite being a growth fund, Hawtin takes an active approach to valuation and regularly trims holdings when they run up to unsustainable levels. He will sometimes wait for prices to come down before buying into a new position.

Some of the fund’s largest holdings include the US tech giants like Microsoft and Alphabet, but it also has large stakes in US-listed cryptocurrency exchange Coinbase, and Chinese electric vehicle-maker Li Auto.

Elsewhere in the list were two funds that focused on consumer-facing companies and trends. These were the GS Global Millennials Equity Portfolio and the Invesco Global Consumer Trends fund.

Goldman Sachs Asset Management’s Alexis Deladerrière started the Global Millennials equity portfolio with the aim to capture the companies set to benefit from the changing behaviour of the Millennials generation – people born between 1980 and 1999.

These companies benefited from trends such as the shift to online shopping, and the widespread adoption of social media – which explain its largest holdings: Amazon, Alphabet and Facebook.

Similarly, the Invesco fund managed by Ido Cohen and Juan Hartsfield, focuses on “consumer trends driven by changes in standards of living, demographics and connectivity”.

Its biggest position is in Amazon (9.6%), however it has large overweight positions in big consumer facing brands such as American hotel and casino company Caesars Entertainment (5.6%) and meal-kit delivery brand HelloFresh (2.6%).