It has been a decade since the launch of the junior ISA (JISA) allowed parents and grandparents a tax-free way to put money aside for the future generations, but not enough people are making the most of their savings.

The tax wrapper, which works in the same way as a traditional ISA except the money can only be withdrawn by the child once they have turned 18, has proven popular.

More than a million accounts were subscribed to in the 2019-2020 tax year, according to statistics from Her Majesty’s Revenue & Customs (HMRC). Some £971m was added during the year.

Over the past decade, more than 5.7 million accounts have been set up, and a total of £6.3bn invested on behalf of children.

Initially, family members could put a maximum of £3,600 per year into a JISA, but this steadily increased to £4,368 by 2019/20, before almost doubling to £9,000 in the financial year between 2020/21.

However, just 39% of the money added last year was in the stocks and shares option, with the remaining 61% in cash ISAs.

Juliet Schooling Latter, research director at fund shop Chelsea Financial Services, said: “With interest rates so low for so long, this makes no sense whatsoever, especially as children have such a long investment time horizon.”

Those that were brave enough to invest have been rewarded. Around half (23) of the Investment Association’s 57 fund sectors have doubled investors’ money over the past decade, on average, according to the firm’s research.

The worst performing sector over the past decade has been IA Latin America, with the average fund returning just 1.1%, growing an initial £3,600 pot by £40.33.

Conversely, the average fund in the IA Technology & Telecommunications sector, made 470.1%, turning the a fully invested initial ISA pot in 2011 into £20,523.63.

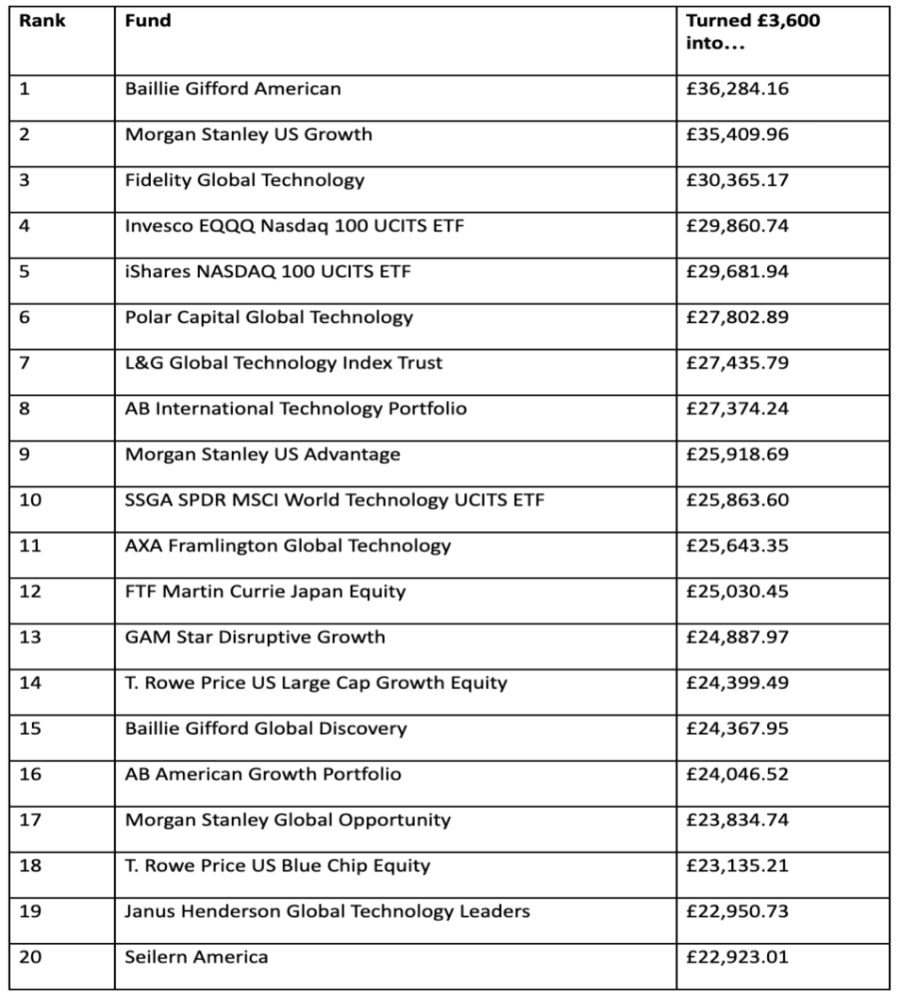

The best-performing individual fund was Baillie Gifford American, which has turned the same figure into £36,284.16, as the below chart shows.

The top 20 funds over the past decade

Source: Chelsea Financial, FE Analytics, based on an initial £3,600 investment

Schooling Latter said: “As the figures show, equities – although they can be far more volatile – have the potential to return 10 times the amount of a cash ISA and set a child up very well for the future.”

DIY investment platform interactive investor said there were 110 junior ISA accounts with the group that were worth more than £100,000, although some of these may have started out as child trust funds – the precursor to JISAs.

Of these, Fundsmith Equity – the UK’s largest fund – was the most popular, Scottish Mortgage Investment Trust – the world’s largest investment trust – was second while the F&C Investment Trust – the world’s oldest investment company – was third.

Total return of the funds over 10yrs

Source: FE Analytics, based on an initial £3,600 investment

Among all of its customers, the average JISA holds £13,285, with the average accountholder aged around 9 years old. Across all JISA accounts, the Vanguard LifeStrategy 80% Equity fund, which holds 20% in bonds and the remainder in stocks, was the third-most popular – displacing the F&C trust, which was in 10th spot.

Myron Jobson, personal finance campaigner at interactive investor, said: “It is difficult enough investing for yourself, so the prospect of investing for your children and the possibility it may go wrong is a challenge for even the most experienced investor – which may explain why so many parents choose to save their Junior ISA in cash.

“However, history shows that even a ‘middle of the pack’ fund is likely to compare favourably with cash over 18 years. So, you don’t need to be an expert stock picker to benefit.”

Parents should invest early and regularly if possible. According to data from Boring Money, the consumer advice website, parents are most likely to save when their children are babies.

In a survey of more than 4,100 adults, two thirds of parents with a child aged 0-3 said they were saving or investing for them, but the figure gradually falls to 54% of parents of secondary school age children.

Zoe Dagless, senior financial planner at Vanguard, said ideally parents should start early and keep saving. Setting aside £100 a month from birth – rising 2% a year to account for inflation – at a 4% return would yield around £37,000 by the time a child turns 18.

“Depending on your timeline, £150 a month from age 5, or £280 a month from age 10 will get you to nearly the same place,” she said.

However, she added that parents with teenagers should also save as it is “not too late to start” and can save a “substantial total” by saving a little more each month.