Investors have increasingly had to take on elevated portfolio risk with a higher equity allocation due to the poor offering in bonds or other classic diversifiers, and swallow the volatility.

In the past investors could rely on a 60/40 split between equities and bonds, but with the latter yielding less and less – even negative in some cases – many investors have focused more on equities.

A higher-risk portfolio was typically a tactic suited to younger savers who had a longer investment timeline ideal to ride out the inevitable volatility, but it is becoming increasingly important for all investors to have an allocation to the stock market.

Below fund pickers recommend funds that would sit well in the higher-risk portfolio of any investors’ portfolio.

Schroder Global Energy Transition

James Sullivan, head of partnerships at Tyndall Investment Management, picked several funds for investors with a high-risk mindset. The first was the Schroder Global Energy Transition fund, which is invested in the poplar theme of renewable energy sources.

This is a poignant topic at present, with COP26 currently ongoing, and the fund has been able to “capture the imagination of those within the environmental, social and governance (ESG) community and beyond,” said Sullivan.

Although the energy transition is a hot topic socially and in markets it is a more risky investment theme because the realities and technology required to achieve this are still being developed.

That being said, it is backed by long-term drivers, such as improved economics, supportive policy, and heightened consumer demand, which all continued despite the pandemic, meaning that potential opportunities and therefore returns “remain compelling,” Sullivan said.

The fund was launched at the end of 2020 but its manager, Mark Lacey has more than 20 years of fund management experience and almost a decade in the energy sector having run Schroder ISF Global Energy since 2013.

Since it launched the fund has made 11.7%, beating its benchmark, as the below chart shows, although it has lagged wider IA Global peers.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Jupiter Global Ecology Growth

Staying in the sustainability space, Sullivan also picked the Jupiter Global Ecology Growth, which was previously run by Charlie Thomas before being handed over to his colleague Jon Wallace at the start of the year.

An investment process focusing on positive change towards environmental and sustainable objectives “sounds all too familiar in 2021,” Sullivan said, but the Jupiter Global Ecology Growth was one of the first in this space, the first authorised green unit trust launched in the UK in 2001.

It invests across multiple themes, including clean energy, sustainable agriculture, and the circular economy, providing diversification within the umbrella sustainability theme, helping reduce the overall volatility.

“Recognising this diversified footprint, it is a valuable tool within portfolios where one doesn’t want to be second guessing tomorrow’s themes,” he said.

Over 10 years the fund lagged both the FTSE 100 but beat the average IA Global fund, making 224.2% versus 267.3% and 172.4% respectively.

Stewart Investors Asia Pacific Leaders Sustainability

A third sustainable fund was the £7.6bn Stewart Investors Asia Pacific Leaders Sustainability, a large and mid-cap focused fund.

What makes the fund higher risk is its focus on the Asian region, which has typically been subject to poorer corporate governance and more government interference versus developed markets.

But FE fundinfo Alpha Manager David Gait and Sashi Reddy have a “pedigree” of successfully investing “in one of the more complex regions,” Sullivan said.

Indeed since the fund launched in 2016 it has outperformed the benchmark significantly, as the below chart shows, returning 963.3%.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Two of the three key points in their investment process tackles the corporate governance issues in this region, focusing on the quality of the management of its potential stocks and the quality of the company’s finances and financial performance.

The final point is sustainability, which is central to the fund, with the managers considering the environmental impact, efficiency and responsible business practices, or what Sullivan called “their social usefulness”.

LF Havelock Global Select

Another of Sullivan’s picks was LF Havelock Global Select, a quality value strategy providing some counterbalance an investor’s growth holdings.

Although it has a value label the fund does not invest in the usual tobacco and healthcare stocks, Sullivan said, opting for more “off-piste” companies that may be under the radar of larger funds such as Henkel, a leading German chemical company and Daito Trust, a Japanese construction company.

Square Mile Research and Consulting said the fund was higher risk because of its high allocation to equities and the concentrated nature of the portfolio. This means one stock can have a bigger impact on performance.

But they said that the management team was experienced and was capable of navigating these challenges to deliver returns. Indeed, since it launched in 2018 it has beaten the average IA Flexible Investment fund, making 29.9% against the sector average 24.9%.

Baillie Gifford Global Discovery

Darius McDermott, managing director of FundCalibre, also highlighted several attractive higher risk options starting with the £2bn Baillie Gifford Global Discovery fund.

McDermott said that small and mid-cap investing is the “best way to achieve long-term returns and this fund has proven its ability at unearthing smaller companies that are destined for big things,” taking a different approach to its large-cap focused Baillie Gifford siblings.

Indeed Baillie Gifford as a whole has had major success in recent years with its approach of concentrated investing in growth outliers capable of generating high outperformance, a process applied here as well.

The fund has a significant weighting to technology and healthcare sectors versus its peers, making it more volatile, McDermott said, “so it’s not for the faint-hearted”.

Its bias to growth – typical of Baillie Gifford – means that it also carries a style-bias risk, which has served the fund well during the decade bull run but meant it struggled near term when value led markets.

But overall investors have been well rewarded for the higher risk as the fund made the second-best returns over 10 years in the IA Global sector.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Goldman Sachs India Equity Portfolio

“It’s hard not to like the long-term prospects for Indian equities,” McDermott said.

The region is set to benefit from several tailwinds which could rapidly expand the economy over the next decade, McDermott said, including favourable demographics, a rising middle class, urbanisation and infrastructure demands, the growth of technology adoption and reasonably good corporate governance.

This does not fully take away from the risks of investing in a developing market, though the Goldman Sachs India Equity Portfolio is an “all-weather offering”, worth considering, McDermott said.

Manager Hiren Dasani offers a well-diversified, low turnover portfolio, McDermott said, running a “solid investment process”. Launched in 2011 it has made 326%, ahead of the MSCI India benchmark (177.9%).

Barings Europe Select Trust

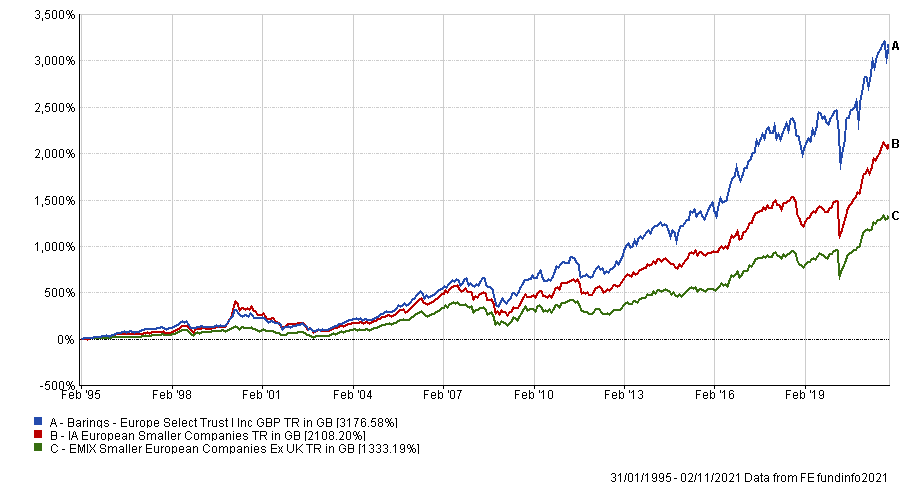

McDermott also highlighted the Barings Europe Select Trust, the second biggest fund in the IA European Smaller Companies sector at £1.4bn.

Small-caps are generally “under-researched and under-appreciated,” McDermott said, but also more risky.

Square Mile said the managers deal with this by investing in companies that can match the index performance during rising markets and perform more in line with large-caps when markets decline, providing some insulation from the asset’s volatility.

McDermott said that the fund’s best performance has actually come in falling markets, validating this process.

The fund launched 26 years ago and has made more than 3,000% in that time, beating the sector and benchmark. Near term the performance has slipped to bottom quartile.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics