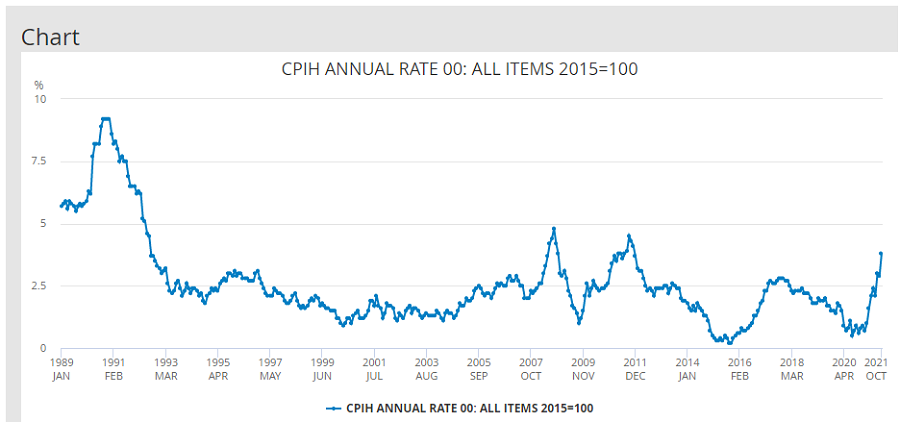

UK inflation rose to a 10-year high of 4.2% in October, according to the Office for National Statistics (ONS), but some believe it has much further to run.

Although the Office for Budget Responsibility (OBR) had previously forecast inflation to hit 4% by the end of the year, some expect it to head even higher.

Colin Dyer, client director at abrdn, said that the Bank of England is expecting inflation to reach 5% early next year, meaning the coming months are likely to be uncertain and uncomfortable.

This also ties in with others, such as Yannis Gidopoulos, investment analyst at Montanaro Asset Management, who previously told Trustnet that inflation should be double its current level.

He cited the global supply-shock combined with disproportionately high short-term demand, noting that “in any other circumstances, this is a perfect storm for the most record-breaking inflation on record?”

Source: Office for National Statistics (ONS)

These inflation figures are the latest in a series of statistics that imply the Bank of England is to increase interest rates to tackle inflation at its next meeting.

Earlier this week ONS data showed unemployment was at 4.3% in October – the first full month since the close of the UK furlough scheme. Commentators said this was a ‘green light’ to the central bank to start hiking rates.

Ben Laidler, global markets strategist at multi-asset investment platform eToro, said that inflation was a “runaway train” that would put more pressure on the Bank to act in order to cap economically debilitating price rises.

The central bank held off increasing interest rates at the Monetary Policy Committee (MPC) last month, maintaining the 0.1% level that has been in place since the start of the pandemic.

This was despite the Bank of England governor, Andrew Bailey, breaking away from the central bank’s ‘inflation as transitory’ messaging and hinting at a rate hike sooner rather than later.

Melanie Baker, senior economist at Royal London Asset Management, said that an increase could come as early as December now.

The latest inflation figures are more than double the Bank of England’s 2% inflation target and higher than economists’ initial forecasts (3.9%).

The rising costs of transport, gas and electricity bills and second-hand cars all contributed to the consumer price index (CPI) spike in October.

Stocks were muted on the news, with the FTSE 100 down 0.3% in early trading to 7,304.74, while in the currency market the pound rose as investors started to price in rate rises.

In this new environment Laidler said investors would face some “tough choices” about what to do with their capital, but many seemed unsure about what to do.

Indeed, inflation will take a toll on savers, as there are currently no savings accounts on the market that offer a return above 4.2%, according to data from Rachel Springall, finance expert at Moneyfacts. This means any money held in these accounts will have reduced spending power – or a negative real return.

This could push more people into investing, but this is also not straightforward. According to eToro’s own research most investors said that rising inflation was one of the biggest threats to their money but two-thirds of investors have not adjusted their portfolios to counter it.

A decade of record-low interest rates and minimal inflation have meant many investors lack the first-hand experience on how to deal with the problem.

“This inflation data will no doubt change that, and we believe investors will be repositioning their portfolios in the coming days to counter the ravaging effects of price rises,” Laidler said