Commodities managers who make outlandish predictions about the price of natural resources “aren’t helping anyone”, according to Georges Lequime, co-manager of the TB Amati Strategic Metals fund.

Oil, gold and other commodities analysts often feel the need to put claims on the future price of their asset, but Lequime said the sector is no different from any other: finding value in companies that others have missed is still the best way to invest.

TB Amati Strategic Metals was launched in March this year, partly to take advantage of numerous tailwinds behind a sector “that has been in the doldrums for 20 years”.

For example, an International Energy Agency (IEA) report estimated that to achieve net zero carbon emissions by 2050, the market of minerals such as copper, cobalt and manganese will have to grow almost sevenfold by 2030.

At the same time, supply has been constrained. Lequime’s co-manager Mark Smith pointed out that investment in mining peaked in 2012 with $130bn of capital development, such as building mines, and $21bn of exploration. These figures now stand at $60bn and $8bn respectively.

“We've got a sector that's been under capitalised,” said Smith. “They're not building new mines, not exploring for deposits, yet the demand for metal is stronger than we've ever seen, with the decarbonisation and the infrastructure rollout on the core base metals; on the precious metals side, there is obviously the inflation argument coming through.”

Yet the problem with relying on these tailwinds alone is that you are opening yourself up to the boom-and-bust nature of commodities and the fact that valuations tend to get ahead of themselves.

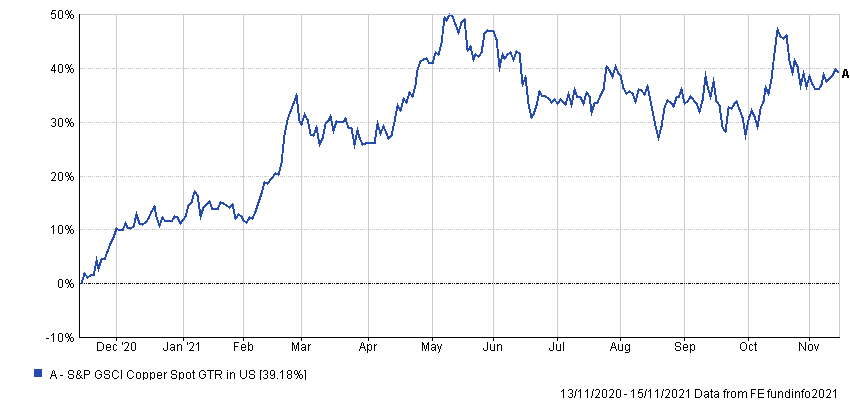

For example, when the managers ran a dummy version of the fund for the FCA ahead of the official launch in March, it was filled with copper stocks. But by the time it received the green light, the metal had rallied so much, the managers decided it looked overvalued and sold all their holdings.

Performance of index over 1yr ($)

Source: FE Analytics

Instead the managers take a bottom-up approach, aiming to eke out gains with a traditional value mindset.

“Something that has always stuck in my head since I started in 1994 at Old Mutual was meeting the late Julian Baring from Mercury Gold and General,” said Lequime. “The returns on that fund in the 1980s were about 1,000%, even though the gold price actually come down from $800 an ounce in 1981 to $400 an ounce and stayed flat for many years.

“We don’t rely on higher commodity prices: we're trying to find undervalued or mispriced stocks when there’s a flight of risk, where we are confident short-term disappointments on the mine will solve themselves over time.”

However, Smith warned “a big dose of cynicism” is required when investing in miners, saying because it is such a multi-faceted industry with so many moving parts, there are numerous “tricks of the trade” company management teams fall back on as an excuse for why they haven't delivered. As a result, he said technical knowledge and discipline is vital.

The managers begin by building financial models of a mine, and if this throws up an anomaly – for example if the valuation they have arrived at is twice as much as its current price – they will arrange a site visit to test their hypothesis.

This is where their different backgrounds come in handy. Before moving into fund management, Lequime studied as a mining engineer, while Smith began his career as a geologist.

They start their first-hand analysis using Lequime’s area of expertise, looking for operational inefficiencies in the running of the mine.

“When you're mining such a large amount of Earth, it's operational efficiencies that save you cents on the dollar,” said Smith.

“You’re asking, are they using their equipment 90% of the time, are there any trucks standing still and are the excavators filling the trucks efficiently?

“Then we will look at the crushers and ask, are they filled efficiently? How many times are they turning? Do they need another crusher? What's the crush size of the rock that they produce and what's the recovery of metal that they get from it?

“Basically, is there any deadweight in that pipeline of production?”

Once the managers are satisfied that the mine is running efficiently, they will turn to Smith’s area of expertise, working out if they can find value from a geological point of view.

An initial academic study will give them an idea of the grade of the metals deposit in the mined area – for example, if the study suggests it should yield 2g of gold per ton of rock, yet it has so far only yielded 1g, they will investigate further.

Smith said: “We start asking, have they mismanaged the original geological interpretation of their asset base? Or is it just a function of geology at the time they're mining the ore body?

“The ore body and the grade do this over 10 years. We might be in a dip, but the market will assume they’re not delivering on plan.

“But we may look at the geology and realise that the grade is going to come up in the next six months or the next year. We will buy the dip on the grade because we know it is going to produce more gold in the next six months and will continue to do so over the next 10 years.”

An example of where the managers’ strategy paid off is in Golden Star Resources, a Canadian company that owns and operates the Wassa gold mine in Ghana.

Smith said operational problems caused its value to fall from $1bn to $250m; however, a call to the chief executive revealed this was a temporary issue that would take six months to resolve.

“It had to change the design of the mine to improve stability underground so it could mine more ore. But the market in its impatience just said, ‘this is a broken model’.

“This company had 10m ounces of resources in the ground and it cost $50 an ounce to drill it out. So the cost to drill out the deposit was larger than the market cap of the company. And this mining company already spent billions building the mine.

“We looked at this and thought, OK, what's wrong here? These opportunities do present themselves, but you’ve got to understand where this company is in its cycle.”

Performance of fund vs sector and index since launch

Source: FE Analytics

Data from FE Analytics shows TB Amati Strategic Metals has made 18% since launch in March, compared with 18.2% from the IA Commodity and Natural Resources sector and 21.8% from the MSCI World index.

The £39m fund has ongoing charges of 1%.