Warren Buffet’s age and his bad bet on US airlines were enough to prompt Sebastian Lyon, manager of the Personal Assets Trust, to sell out of his long-time holding in Berkshire Hathaway.

The trust has held Berkshire Hathaway since the aftermath of the Global Financial Crisis of 2009, and, despite its strong performance over the past year, the Trojan fund manager has said investors are not adequately discounting the risks Buffet’s investment house faces.

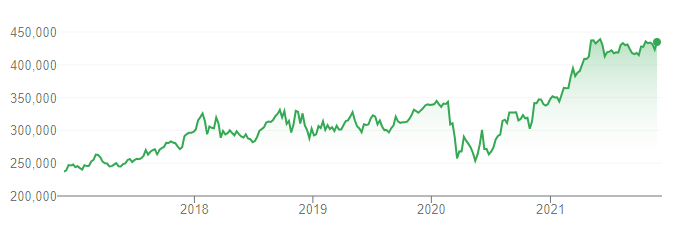

Berkshire Hathaway stock is up over 400% since 2009 and is up 69% from its lows in March of 2020 – now trading at all-time-highs.

Despite this, Lyon said that Warren Buffet’s age poses a key-man risk which is “well known but rises as each year passes”.

Buffett – Berkshire Hathaway’s chairman and chief executive officer – recently celebrated his 91st birthday. Also known as the ‘Sage of Omaha’, he is considered to be one of the most successful investors in the world, however he is still not immune to investing mishaps.

Lyon said this was another reason for the sale. He lamented the “disappointing recent capital allocation” which was “evident particularly in the decision to purchase airlines, something Buffett has long-warned against, followed by their untimely sale”.

Berkshire Hathaway started buying four of the largest US airlines: Delta Air Lines, American Airlines, Southwest Airlines and United Airlines in 2016 after avoiding the industry for decades.

But in April of 2020, Buffett revealed that Berkshire Hathaway sold the entirety of its stakes in the four airlines at a “substantial loss” after they were hit by the collapse in air travel due to the coronavirus pandemic.

There was one other reason Lyon sold out of the company: its failure to hold its businesses to account when it comes to ESG.

He said: “The company's refusal to hold its subsidiary businesses to a higher level of account when it comes to climate disclosures is reflective of a management team that is yet to fully grasp the ESG nettle. This is likely to impact returns in the years to come.”

Share price of Berkshire Hathaway over 5 yrs

Source: Google Finance

Philip Morris International was another stock to recently get the axe from the Trojan manager. The sale of the tobacco manufacturer comes after the trust’s previous sale of British American Tobacco in early 2021 and Altria in 2018.

Lyon said the decision was a result of his views on tobacco holdings evolving over the past few years.

“Like integrated oil companies and newspapers before them, the tobacco business model is changing, making the future returns less predictable and likely to fall as managements attempt to transform their companies for a post-tobacco world,” he explained.

“There is an increasing risk that these companies become wasting assets as they strive for relevance.”

He also questioned the sustainability of the companies paying high dividends when the sector’s indebtedness remains “stubbornly high”.

Lyon compared the tobacco industry to the newspaper industry of the past, pointing to media tycoon Rupert Murdoch’s description of classified advertising revenue as ‘rivers of gold’.

“A few years later, having witnessed a cascade of classified advertising revenue shift from newspapers to the internet, he [Murdoch] admitted: ‘Sometimes rivers dry up’.”

When it comes to equities more broadly, the Trojan fund manager warned that they face risks from rising inflation and future interest rate rises.

“The discount rate, the basis of which is determined by the 10-year US Treasury yield, is key,” he said. “Equities have been supported by four decades of falling interest rates.

“Should this dynamic change, investors may be in for greater volatility as the support from low rates is questioned. This raises uncertainty over the value of the expected growth in earnings from equities, which becomes less precious when eroded by inflation.”

Over the past six months, the Personal Assets Trust has more than doubled its exposure to UK T-Bills from 8% to 17% and reduced its equity exposure from 45% to 40%.

The trust’s second-largest position after equities is a 30% holding in US Treasury inflation-protected securities (TIPS) and he also has a high weighting (7.9%) in gold – both of which should act as a hedge in an inflationary environment.

Lyon said: “Central banks want us to believe that the current inflationary pressures are 'transitory'. Whether this is wishful thinking remains to be seen.

“As economies re-open, demand may well strengthen, which may lead to a further phase of inflation taking investors by surprise in 2022/23.”

However, he said that wage growth will be the most important determinant of whether inflation is transitory or not.

“If wages rise, this is likely to feed the inflationary beast,” he added. “That said, we do not necessarily see a return to the bogeyman of 1970s levels of inflation when unionised labour had a far stronger voice.

“For now, we believe it is crucial to remain open-minded, cognisant that markets are not currently discounting structurally higher rates of inflation.”

Performance of Personal Assets Trust year-to-date

.png)

Source: FE Analytics

So far this year the trust has underperformed the FTSE All Share index and average IT Flexible peer, returning 11.5%. However, Lyon said that the portfolio was designed to “protect and increase” investors’ capital, in that order.

“We believe that, in our conservative asset allocation combined with qualitative equity selection, we are taking considerably less risk than that of an index tracker,” he said.