Investors need to stop worrying about inflation, as simply remaining invested is usually all that is needed to keep their assets growing ahead of prices over the long term, according to research from Dimensional.

The UK consumer price index hit a 10-year high of 4.2% in the year to October, while the US’s figure of 6.2% was its highest in three decades.

These figures led Vincent Ropers, manager of the TB Wise Multi-Asset Growth fund, to highlight the damage structural inflation could do to a portfolio.

He said: “It seems sensible for investors to look for ways to inflation-proof at least some of their exposures without sacrificing growth.”

However, this was not the conclusion reached by US Inflation and Global Asset Returns, a paper by Wei Dai, head of investment research at Dimensional, and Mamdouh Medhat, an investment researcher at the group.

The study indicated that specifically targeting inflation-proof assets is at best unnecessary for long-term investors and at worst may lead to lower returns than just sitting tight.

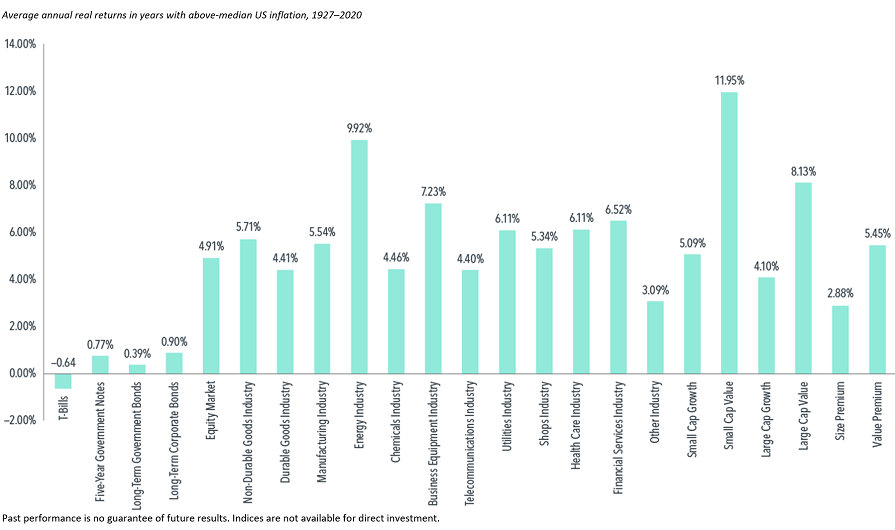

Dai and Medhat studied the relationship between inflation in the US and the performance of 23 asset classes and equity sectors and styles from 1927 to 2020. This included periods of high inflation, such as the 1970s, and considerable deflation, such as the period of the Great Depression.

They found that all assets delivered real returns in low-inflation periods (when CPI averaged 0.5%) over the long term. What may come as a surprise was that, with the exception of 1-month T-Bills, all assets also delivered real returns in high-inflationary environments (when CPI averaged 5.5%).

Source: Dimensional

However, the study found that, on average, most assets delivered lower real returns in high-inflation years.

“For US bonds, all the differences are reliably negative and, in general, more negative for longer-term bonds, although this pattern was mainly driven by the higher average real returns of longer-term bonds in low-inflation years,” said the study.

“For US equities, the differences are reliably negative for the market portfolio, four of the 12 industry portfolios (durable goods, chemicals, shops, and healthcare) and the large-cap growth portfolio. Across all assets, the only positive differences [when returns were higher during high periods of inflation] are for energy stocks and the value factor, although neither is statistically reliable.”

The study was then repeated for the past 30 years, expanding the number of assets and sectors analysed to 30.

During this period, average CPI stood at 1.5% per year in low-inflation periods and 3% per year in high-inflation periods. Again, most assets delivered positive average real returns in both low- and high-inflation years.

Notable exceptions were energy stocks and commodities, which delivered negative real returns in low-inflation years.

However, the study suggested that contrary to conventional wisdom, these assets – along with real estate investment trusts (REITs) and value stocks – should not be regarded as inflation hedges.

“Asset prices already embed the market’s expectation of inflation,” said the study, meaning investors should only be concerned about “unexpected inflation”.

“An asset is therefore most useful as an inflation hedge when its nominal returns [those before inflation and fees] move closely with unexpected inflation,” it said.

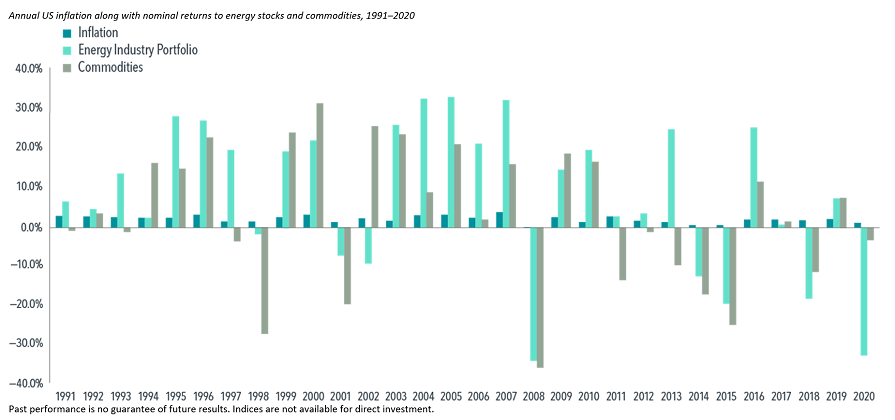

However, the study found few areas in which higher returns correlated with unexpected inflation. For the few exceptions where the correlations were reliable, such as for energy stocks and commodities from 1991 to 2020, the assets’ nominal returns were around 20 times as volatile as inflation and more than half of their returns were unrelated to inflation, it noted.

The chart below shows how the annual nominal returns of energy stocks and commodities differed from inflation.

Source: Dimensional

“If the goal is to reduce the variability of future purchasing power, it is questionable that hedging with something this volatile will effectively achieve that,” the study said.

“In sum, while there is some merit to the intuition that energy stocks and commodities are inflation sensitive, we do not see compelling evidence that either can serve as an effective inflation hedge.

“Hence, inflation-indexed securities still appear to be the most effective instruments for investors who are highly sensitive to inflation and seek to hedge against it.”

The report added that inflation was one of many aspects to consider for asset allocation and that there was no one-size-fits-all approach.

“The right mix of assets for growth and hedging purposes ultimately depends on an investor’s goals and needs. The good news is that most of the global assets we study have been able to outpace US inflation over the long term. Hence, simply staying invested may by itself be an effective long-term solution to inflation concerns,” it concluded.