Small-cap, private equity and technology strategies were the most common investment trusts to have tripled investors’ money over the past five years, according to data from FE Analytics.

For many investors, the ‘minimum’ time horizon for a long-term investment is five years, while most funds and investment trusts often recommend that they are given five years to prove themselves.

The longer an investors’ time horizon, the more time there is to recover from any unexpected market downturn. It also allows investors to benefit more from the power of compounding, or to potentially take more high-risk, high-reward investments.

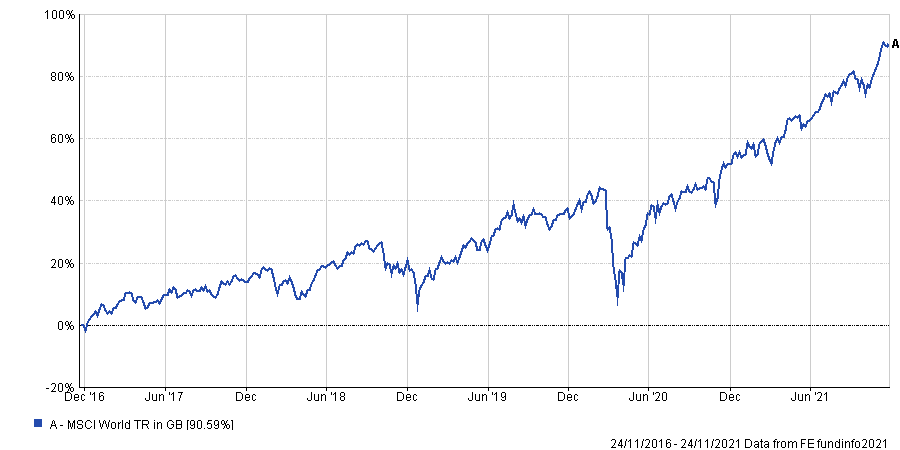

Over the past five years, passive investors tracking the MSCI World index would have made a 90.6% total return, almost double their original investment.

MSCI World index over 5yrs

Source: FE Analytics

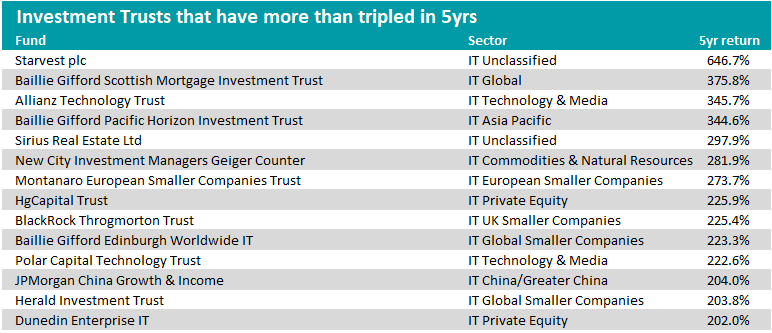

However, certain investment trusts have managed to triple investors’ money (making more than 200%) over that same time frame, as the below chart shows.

Source: FE Analytics

One third of the investment trusts that featured on the list invested in smaller companies, while another third focused on technology and private equity.

The most notable trust was Baillie Gifford’s Scottish Mortgage Investment Trust. Its total return of 375.8% over five years means investors would have almost quintupled an original investment made half a decade ago.

Managed by James Anderson and Tom Slater, their early bets on Amazon, Tesla and Moderna have propelled the trust’s performance over the past few years.

The strategy has also benefited from its private equity exposure, whereby more than a third of its total portfolio started out as unlisted companies – the most notable its early stake in Alibaba.

The most common type of investment trust that featured were small-cap portfolios. Academic research has suggested that smaller companies have tended to outperform their larger counterparts over time – a phenomenon widely cited by small-cap managers as a reason for their strong returns.

Some of the reasons attributed to this include smaller companies’ nimbleness and adaptability to rapid change, or the fact that they are often relatively under researched by analysts and investors when compared to large-caps.

Perhaps another reason for the presence of many top-performing small-cap investment trusts is because of the highly volatile nature of the asset class. Small-caps are often subject to large downturns which could be exacerbated by large withdrawals from open-ended funds, a problem which investment trusts don’t have to struggle with.

The highest-performing small-cap investment trust that featured was the Montanaro European Smaller Companies Trust, which returned 273.7% over the period.

Managed by George Cooke, the trust invests in what it deems to be quality growth small-caps across Europe, some of which have rocketed in value in recent years.

Some of the fund’s largest positions are stocks such as Thule – a Swedish outdoor brands owner, which has quadrupled in value over the past five years, and Sartorius Stedim Biotech, a French laboratory equipment provider that has risen more than 8-fold over the same period.

Another small-cap trust that featured was the BlackRock Throgmorton Trust, which returned 225.2% over the period.

Managed by Dan Whitestone, the UK smaller companies trust takes high conviction bets and has the ability to take short positions in various stocks. It recently benefitted from a short position in a UK CFD trading businesses whose shares plunged after a profit warning.

Elsewhere in the list were two private equity-focused investment trusts: HgCapital Trust and Dunedin Enterprise investment trust.

Private equity funds invest exclusively in businesses that are privately owned with the aim of trying to grow the value of the businesses either through restructuring or other various methods, to eventually sell them for a profit.

Hg Capital, which delivered a total return of 225.9% over the period, invests in software and technology enabled businesses mostly in Europe, with a 35 portfolio companies across a range of industries ranging from wealth management to engineering to healthcare.

It most recently sold Achilles, a supply chain risk and performance management firm, to another private equity investor for a 20% profit.

The Dunedin Enterprise investment trust, which delivered a total return of 201.9% over the period, focuses on UK lower mid-market companies, typically worth between £20m and £100m.

It recently sold its investment in U-Pol, a manufacturer of automotive refinish products, for 4.4 times cost and is expected to be complete its sale of CitySprint, courier and logistics firm at 2.1 times cost if the deal gets regulatory clearance.

The Allianz Technology Trust and the Polar Capital Technology Trust were two other notable investment trusts that tripled investors’ money over the period.

Both investment trusts have benefited from the rise of the technology stocks over the past few years, whose earnings were turbocharged by the coronavirus pandemic.

Their overweight positions in the US technology giants Microsoft, Alphabet, and many other technology businesses boosted both trusts’ performance in recent years.