Taking over from a legendary manager can be a stressful, daunting and, most of all, difficult task, just ask the string of Manchester United managers that have followed in the wake of Sir Alex Ferguson’s retirement.

Thankfully for investors that have stayed with the £3bn Fidelity Special Situations fund, FE fundinfo Alpha Manager Alex Wright has forged his own success since taking charge of the portfolio that was formerly run veteran stockpicker Anthony Bolton.

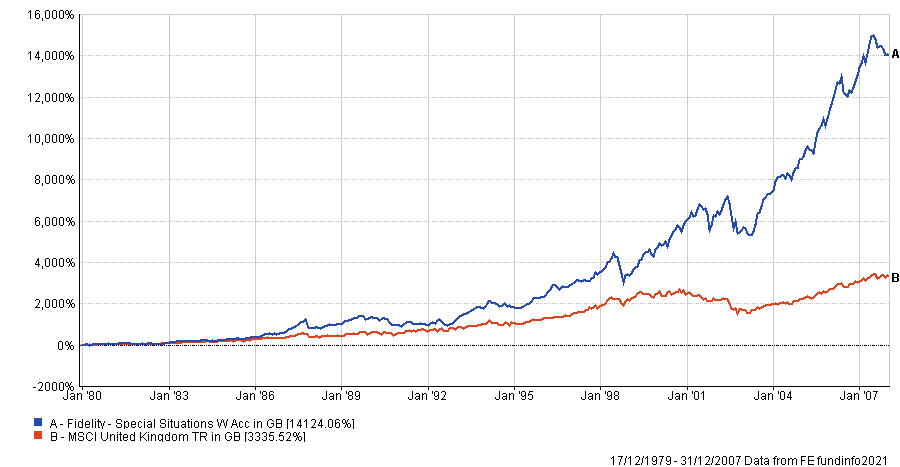

Between 1979 to 2007, the fund under Bolton had an exceptional track record, returning 14,124.1% over this 28-year tenure.

Performance of the fund under Anthony Bolton (17/12/1979 – 30/12/2007)

Source: FE Analytics

Sanjeev Shah then ran the fund after Bolton stepped back in 2008, with Wright taking over in 2014. Despite the gap between the two Wright said Bolton’s legacy performance still had a big factor on the fund.

He said: “It is like taking over Man United after Alex Ferguson, because you can never really hope to emulate what he did over such a long career when he ran the fund.”

Under Wright the portfolio has also outperformed both the average IA UK All Companies fund and FTSE All Share index with returns of 66.4%.

Performance of the fund under Alex Wright (1/1/201 – to date)

Source: FE Analytics

Before his own retirement in 20 years Wright said he hoped to achieve a performance as close to Bolton’s as possible. He co-manages the fund with Jonathan Winton, who joined in 2020.

Below, the Alpha Manager tells Trustnet what frustrates him most about the investment industry and how a value fund navigates a growth-biased market.

What is your stock picking process?

We call it a value, contrarian process, where we try and work out what we think the market is wrong about. We look for stocks that are undervalued compared to their future earnings prospects and where the market has been too pessimistic, which is depressing the share price and incorrectly making the stock cheap.

Why should investors pick your fund?

It’s a really differentiated approach when you consider that over the past decade, or certainly when I’ve been running the fund, investors have generally been allocating money to growth companies, which is the opposite of what I look for.

People are unwittingly very overexposed to growth today, even if they're invested across different markets, be it Asia and the US or even the UK. People have really herded into growth funds and therefore investors’ diversification is quite low.

Going forward the regime of the past 10 years in markets is potentially going to change because the pandemic has really highlighted a lot of supply chain issues and economies are now running hot. So there is a potential for inflation, which hasn’t been an issue for the past 10 years but could become a bigger one.

If that happens then there’s good reason that the good performance of the fund and the value style seen over the past year could continue.

What have been your best and worst calls over the past year?

Life insurance did really well in the past 12 months with Legal & General and Aviva very big contributors to performance. The sector proved more resilient than markets expected, which forecast it would act like banks.

Those have been long-standing positions in the fund and we added to both last year after they traded off in the Covid rally.

Legal & General’s share price increased 56.3% during those 12 months and Aviva’s 53.3%, making 66.6% and 64.9% on a total return basis.

The worst performer was Serco, which received a lot of attention when it was awarded the contract for running the NHS’ Test and Trace. In the past 12 months is share price dipped 2.4% and lost 0.8%

It’s not that the stock has gone down massively, it’s flat on a 12-month basis but the market had a strong Covid rebound, so that is very significant underperformance in a rising market.

I think that is really surprising because Serco actually had one of the best earnings deliveries through Covid and actually grew its bottom-line earnings by 50% in 2020, winning new government contracts and growing the non-UK side of the business more. That’s been frustrating in the past year, but fundamentally we're very happy with the company.

How risky is the fund?

It depends how you think about risk. I think about risk as the absolute, permanent loss of capital so we don’t invest in companies unless they have a dependable earnings base because we're always looking for stocks with some form of downside protection in case we get the upside optionality wrong. From that perspective I’d say it’s around a three or four out of 10 versus other equity funds.

But in terms of volatility, which is how a lot of investors consider risk, it will be higher because we’re buying smaller companies going through a turnaround, meaning there is the potential on an annual basis to have significant volatility.

Investors definitely don't want to buy the fund if they're going to need the money within the next 12 months, or they don't have a sort of a contrarian view on holdings. Don’t expect this to be a steady-Eddie fund.

Is there a cap on the fund?

Under Bolton the fund got to £6bn and Fidelity decided to split it, creating the Fidelity Global Special Situations fund and took this one down to £3bn where it’s remained since.

I think we’re a long off the capacity being too big, but if it did double in size we would probably close the fund: we wouldn’t split it again.

What is the most frustrating thing about the investment industry?

Unfortunately a huge amount of the industry chases near-term historic performance, on both a stock basis and in terms of managers buying stocks with high momentum. But also retail investors and professional fund allocators tend to chase what's done well recently. That often means that people buy at the top and they sell at the bottom.

What do you like to do outside of fund management?

I’ve played in the Fidelity five-aside football team since 2002, although I'm getting towards very much the end of my football career. I’m also an avid gardener.