The coming year could usher in a new market regime, according to BlackRock strategists, as the world continues to move into the post-pandemic ‘new normal’.

Offering its outlook for 2022, the BlackRock Investment Institute highlighted higher inflation, the confusing economic backdrop and the transition to net-zero as three issues that could move markets in the months ahead.

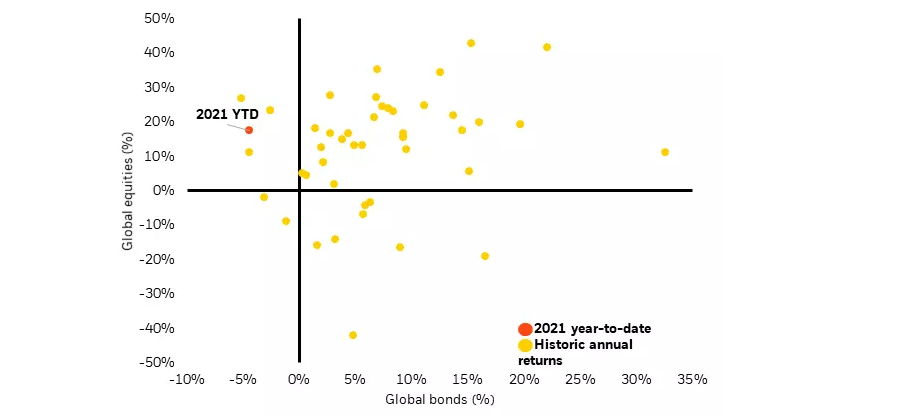

“We see 2022 heralding a new regime by delivering global stock gains and bond losses for a second year – what would be a first since data started in 1977,” the group’s strategists said.

“This unusual outcome is the next phase of our new nominal theme that is still playing out: central banks and bond yields are slower to respond to higher inflation than in the past. That should keep real, or inflation-adjusted, bond yields historically low and underpin equities valuations.”

Annual returns for global equities and fixed income, 1977-2021

Source: BlackRock Investment Institute, Refinitiv Datastream Bloomberg, Dec 2021

As the chart above shows, it is relatively rare for global stock returns to be positive and bonds negative in any given calendar year. In 2021, this occurred because inflationary pressures rose and bond yields edged up – which BlackRock expects to happen again in 2022.

Below, the firm offers more details on how its three themes could affect markets in 2022.

Living with inflation

The first theme identified by the asset management house’s strategists revolves around the idea that inflation will end up settling at levels higher than pre-Covid even after supply bottlenecks are resolved.

This year has been marked by a persistent tick-up in inflation across the globe – for example, the US consumer prices index rose by 6.8% in November, taking inflation to its fastest annual pace since 1982. Central banks spent much of the year arguing inflationary pressures were ‘transitory’ but have recently started stepping back from this narrative.

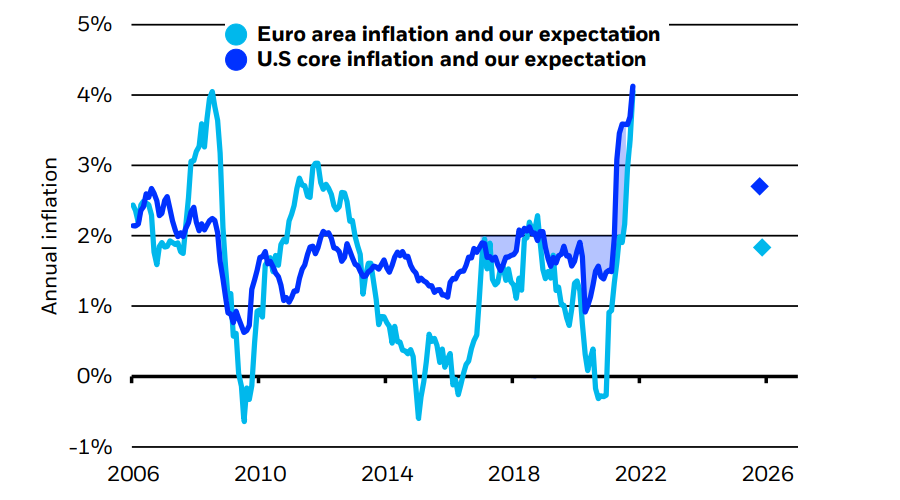

US and European inflation and BlackRock’s forecast

Source: BlackRock Investment Institute, US Bureau of Economic Analysis, Eurostat, Haver Analytics, Dec 2021

BlackRock’s ‘living with inflation’ theme heralds a “big change” in 2022, as central banks will start to withdraw some of the monetary policy support they launched in the pandemic. The group expects the US Federal Reserve to be the first to start hiking rates, with more of a focus on employment rather than inflation.

“The Fed has belatedly acknowledged meeting its inflation objective to make up for past misses – something we had long argued had already happened. We expect the Fed to kick off rate hikes in 2022 but don’t see it reacting aggressively to inflation,” it added.

“We are watching how the Fed interprets its ‘broad and inclusive’ employment objective to guide when and how quickly policy rates rise. The Fed’s mandate means it will want to see further progress on the return of people to the workforce – and we expect rate hikes to be gradual.”

On an investment level, this leads BlackRock to prefer equities over fixed income and remain overweight inflation-linked bonds.

Cutting through confusion

BlackRock’s second theme – ‘cutting through confusion’ – reminds investors to keep the big picture in mind amid the disorienting backdrop caused by the 2020 pandemic and the 2021 economic re-opening, as well as the outsized positive and negative data surprises that come with it.

The strategists added that “confusion is natural” for policymakers and investors attempting to react to this confusing new reality. Extra confusion comes from the fact that, at the same time, central banks are introducing new frameworks on how they react to inflation.

“We expect new virus strains to delay, but not derail, the restart thanks to effective vaccine campaigns. We could see a short-term macro and sectoral impact, but the big picture is unchanged: less growth now is more later,” they said.

“We are, however, dealing with a confluence of events that have no historical parallels: the unique restart, new virus strains and untested central bank frameworks. This means our new market regime view could be wrong about the policy response or the growth outlook – and increases the range of potential outcomes.”

Because this situation leads to “an unusually wide range of outcomes”, BlackRock’s investment response is to trim risk until there is more certainty.

Navigating net zero

The asset manager’s third and final theme for 2022 centres on the investment opportunities being created as the world attempts to achieve net-zero emissions by 2050.

It regards an orderly transition as having the potential to “brighten the economic outlook”, causing higher growth and lower inflation than the alternatives of a disorderly transition or no climate action at all.

“We believe the transition will be an ongoing driver of asset returns over coming years thanks to the tectonic shift of capital to retool economies,” its strategists said.

“Sudden divestment from carbon-heavy companies and sectors could be disruptive, adding to inflation pressures. Carbon-heavy companies changing business models to reduce emissions will also require capital.”