Being a value investor has been out of favour for years, but Allianz Global Investor’s Simon Gergel has stuck to his knitting and enabled the £737m Merchants Trust to become one of the top performing trusts over the past year.

Over 12 months the trust is the second highest-performing investment trust in the IT UK Equity Income sector and ranks among the top-five performing investment trusts across both the IT UK All Companies and IT UK Smaller Companies sectors.

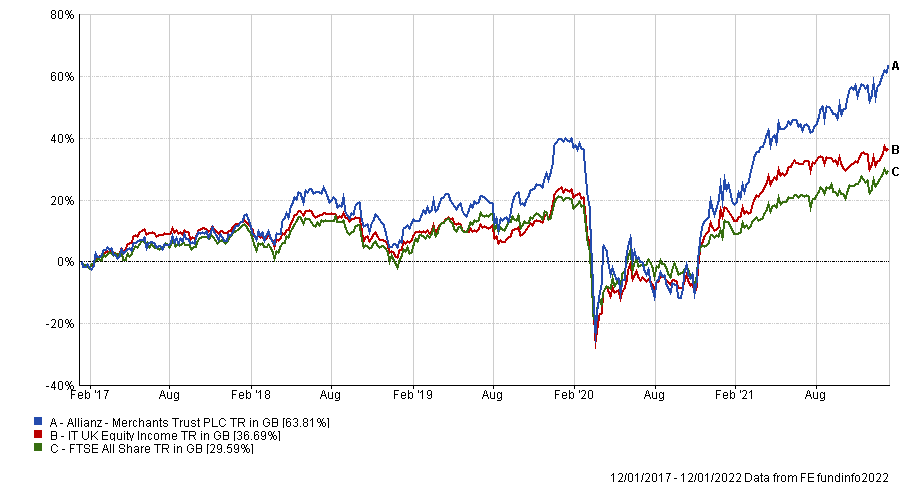

The trust’s longer-term performance also has held up well, with the strategy up 63.8% over the past five years, ranking it top-quartile in its sector.

Below, Gergel tells Trustnet how he avoids value traps, why he has bought into Vodafone and explains why a former coal burner is the most exciting stock in the fund.

Performance of the trust over 5yrs

Source: FE Analytics

What is your investment process?

We start by looking for companies with a with a good yield, but the yield does not drive the investment decision. We're always thinking about the total return we can make.

Within that, we look at the fundamentals of the company, how strong the business model is, balance sheet, ESG (Environmental, Social & Governance) risk, and so on.

We also look at the valuation, and we look at themes. We've spent a lot of time trying to understand how industries are changing over time and the long-term, thematic drivers or potentially cyclical themes as well.

That can really make the difference between what looks like an attractive situation and a value trap.

How do you avoid value traps?

The things that tend to catch you out with a value trap is the slow gradual deterioration in the outlook for the industry or some sort of structural trend: like the way digitalisation is affecting the business or demographics.

We spent a lot of time really understanding those themes and those long-term challenges and we're quite wary of getting involved in a company with basic long-term structural changes.

It doesn't mean we will never invest in a company like that, but we will limit position sizes and will continuously review it. We've had a lot of success avoiding many of the value traps in recent years, but we won't avoid them all unfortunately.

What was the biggest value trap that you think you've avoided in the past couple years?

Probably telecoms for most of the past four or five years. We have a position in Vodafone today, but our sentiment is that the business is potentially turning itself around – but that has that industry has been a bit of a value trap for quite a while.

It's not a great industry, but it does feel like some of the pressures are starting to ease a bit and you're seeing a bit of consolidation as well.

Why should investors pick your fund?

We have delivered a steadily rising dividend stream over 39 years. We have a 5% yield and we've got a strong performance record based on high conviction, active stock selection.

I think we've delivered what investors have wanted from an income fund in the past and we hope we continue to do that in the future.

How risky is the fund?

It depends how you define risk. We are actually stock pickers, so our returns are going to be quite different to the benchmark. So if you define risk in relation to the benchmark, it might look like we're taking a fair amount of risk.

If you look at the absolute positions, we've got companies that are lowly priced with strong business franchises. So we hope this mitigates some of the individual company risks and we try to diversify the portfolio.

One thing to add is that the trust has an element of gearing which amplifies returns in either direction, so in a down market, the negative returns will be magnified by the gearing.

What have been your best and worst stock picks over the past year?

The best single performer has been Meggitt, which is an aerospace and defence company with a very strong market position.

It was a very high-quality business, but clearly it was struggling during the recession because of reduced aircraft demand from airlines.

[Meggitt shares are up 75% over the past 12 months as it was taken over by US Parker-Hannifin in October of last year at a premium]

On the negative side, there have not been too many, but National Grid was probably the worst from a pure statistical point of view. Shares actually went up modestly, but the market has been incredibly strong over the last 12 months, so they’ve lagged that significantly.

I think they've lagged because it is a fairly defensive business, it's not really benefiting from recovering economy.

What is your most exciting stock pick?

I think one of the most interesting companies is probably Drax Group. It’s one of the UK's largest power generators, it used to burn coal, but it now burns biomass.

What they're trying to do is build carbon capture and storage. If they get permission and they get the right contract framework from the government, they could become a carbon-negative generator, pumping carbon dioxide into the ground every year. That would be really helpful for the UK to achieve carbon neutrality 2050.

So this business could be transformed if it can get that working economically. But in the meantime, it's it still looks interesting from a valuation point of view, or at least when we bought it. I suppose it's quite exciting in a way because it's one of those situations that can transform itself.

Do we use ESG in the portfolio?

We do integrate ESG into the into the portfolio, it's very important for us to understand the risk that companies are taking and they're exposed to.

We also engage very actively with companies to try and influence what they're doing with ESG, and we spend a lot of time in that area engaging with businesses.

Are there any sectors that you don't invest in at the moment?

We tend not to exclude whole sectors. There are exceptions like cluster munitions, we don't have any investments in companies generating a large part of their profits from coal mining, but we're not generally excluding sectors.

We're much more interested in individual companies and understanding the risks of what businesses are doing than excluding. We will not only understand the risk, but we'll also engage with companies to try and improve the situation.