Fundsmith Equity’s manager Terry Smith has accused Unilever’s management team of running out of ideas, following its failed bid for GlaxoSmithKline’s Consumer Healthcare division.

In his annual letter to shareholders, published earlier this month, the manager of the £26bn fund said Unilever’s management team were “obsessed with publicly displaying sustainability credentials at the expense of focusing on the fundamentals of the business”.

“A company which feels it has to define the purpose of Hellmann’s mayonnaise has in our view clearly lost the plot,” he said.

Since then it has been revealed that Unilever embarked on a failed bid to buy Glaxo Consumer Healthcare for £50bn. Yet rather than applauding the proactive approach of Unilever’s management team, Smith suggested it was playing what Warren Buffett called ‘gin rummy’ management: “Like a player in the eponymous card game, throwing away their least promising card(s) each round in the hope they will turn over better ones. They should maybe consider whether the problem may not be with the hand/business, but with the player/management.

“The irony is that food and refreshment, the business they planned to sell if they were to buy GSK Consumer, outperformed the rest of the business, the one they wanted to materially expand, two to one.”

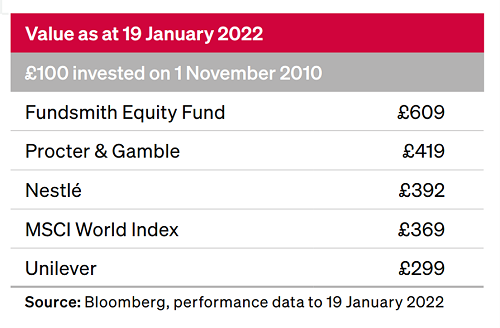

Unilever has been a holding in Fundsmith Equity since the fund opened in 2010. While Smith continues to hold the company, he noted it has been the worst-performing fast-moving consumer goods (FMCG) company in his portfolio “by a considerable margin” over this time.

Smith said he became concerned about Unilever’s management team following a previous takeover bid involving the company – although on that occasion the company was the target, rather than the bidder.

“Kraft Heinz bid $50 (£36.50) per share for Unilever five years ago,” he said. “Whilst we have never been Kraft Heinz shareholders and are not fans of their business model, Unilever surely needs to address the fact that five years later the share price is only at the level of that bid.”

The MSCI World index has made 67.7% over the same period, and even the FTSE All Share has made 28.6%.

Performance of stock vs indices since Feb 2017

Source: FE Analytics

“Why then should we trust this management and board with preserving value for shareholders? This seems to have been largely forgotten and when it is raised, we are told that we would have fared worse with Kraft Heinz,” Smith added. “We will never know, but what is a fact is that we did not get the chance to choose.”

The manager said this bid raised questions about Unilever’s operational capability, but these were never addressed publicly because former chief executive Paul Polman turned it down without any discussion of the fundamentals.

“There was much talk of 20% operating margins and other targets in response,” Smith continued.

“We are not fans of such targets, which are produced like a rabbit out of a hat in response to a bid – if you think you can achieve 20% operating margins, why aren’t you doing so anyway or at least disclosing that as an aim?

“Unilever’s current operating margins? 16%. We did not ask for 20% operating margins, nor do we require them, but we dislike it when spurious targets are produced like a magician to thwart a bid and then conveniently forgotten.”

Turning to the bid for GSK Consumer Healthcare, Smith noted it made £2.2bn of earnings before interest and tax (EBIT) in 2020. While 2021’s results have yet to be released, he has assumed a figure of about £2.5bn.

This meant Unilever’s offer of £50bn implied a return on capital employed (ROCE) of just 5%, and it would need to significantly improve the performance of the business to make a return anywhere near its own cost of capital, “without which this acquisition would have destroyed value”.

The only way to improve the performance of the business to a level that justified the proposed bid price would have been to raise profit margins and/or increase revenue growth. However, profit margins at GSK Consumer Healthcare were already above those of competitors, leaving little scope for improvement.

Meanwhile, Barclays estimated that the global over-the-counter (OTC) healthcare market is growing at just 2% to 3% annually, which was in line with figures produced by Reckitt Benckiser and Johnson & Johnson.

“Surely Unilever should have explicitly addressed those points before asking to be allowed to proceed with a bid?” Smith said.

“Instead we were faced with a statement that the bid worked based on financial metrics including the all-important return on capital. However, getting management to discuss what that number was was like a dentist pulling a back tooth. This was all the more puzzling given that GSK is a listed company and the profits and cashflow of the consumer division can be established from its segmental reporting.”

Worse still, Smith said management has responded to poor performance in the past by uttering “meaningless platitudes”, and accused it of having a penchant for “corporate gobbledegook as a substitute for effective action”.

He finished by saying: “They have already sold the spreads and tea businesses. They have been pursuing a £50bn acquisition and we could have expected further disposals and further major acquisitions if they had acquired GSK Consumer Healthcare, taking them out of familiar businesses and into a new area where they have very limited expertise (beauty, oral care and OTC health).

“We believe the Unilever management – or someone else if they don’t want the job – should surely focus on getting the operating performance of the existing business to the level it should be before taking on any more challenges.”

Unilever was approached for comment.