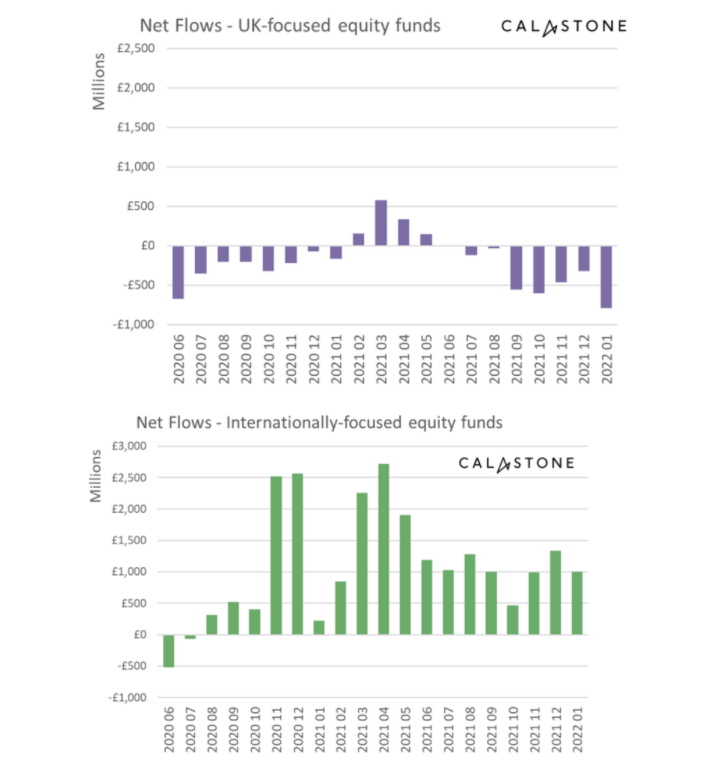

The first month of 2022 was a dismal month for equities as investors lacked confidence in the market, punishing UK funds especially, Calastone data has revealed.

The domestic market suffered again in January and is now on an eight-month trend of outflows, with the start of the year being the worst month on record. Investors pulled £795m out of UK-focused equity funds, beating the previous record set in June 2020.

Calastone analysts said the it was a sustained sell-off, with the UK haemorrhaging money in 30 of the 31 days in the month.

“The poor figures for January were not the result of one or two bad days, but part of a steady trend of cash leaving the segment,” they said.

The UK’s unpopularity is not a new theme for 2022 but a much longer trend. The recent rolling outflows totalled £2.9bn, worse than the nine-rolling months immediately after the Brexit referendum which reached £2.3bn.

Source: Calastone Fund Flow Index (FFI)

Edward Glyn, head of global markets at Calastone said, that the Omicron wave could still be a trigger for the asset class’s unpopularity as well as ‘Partygate’. He said: “Political chaos in the UK may be colouring perceptions, but since this is not reflected in share prices, it is surprising that fund flows are taking a different course.”

Equity funds overall had a steady month of inflows, mainly held up by the popularity of Asia-Pacific and European funds which had elevated inflows.

Emerging market and North American funds had above-average inflows, with the latter holding up reasonably well despite the massive losses from many of its big-name funds in January.

Funds invested in North American tend to have invest in fast-growing stocks and hold overweight positions in technology stocks. This strategy has achieved huge success in recent years when the market environment was more muted, but now that interest rates are rising across global economies in a bid to tackle growing inflation, investors have been spooked by the headwinds and consequential hit on these recent winners.

But even though the US sell off has been more violent, investors have been more willing to sell-out of the domestic market, Glyn said, even though many of its best-performing companies are more vulnerable to the “inescapable maths that crimps their value when long-term interest rates go up”.

“So it seems surprising that investors are so keen to ditch domestic holdings relative to those invested abroad.”

“It is possible that UK share prices have been supported by a rotation out of higher value stock markets by foreign buyers. Meanwhile UK investors in domestic funds may be scarce because this category is already the one they hold the most, so in uncertain times when they are more cautious on equities full stop, UK funds feel the greatest impact.

Ethical funds were another previously strong theme which fell off slightly in January, as Calastone analysts reported that “ESG (environmental, social and governance) inflows fell to their lowest in over a year”. The demand was still strong enough to keep global fund flows in line with the long-term trend, the analysts added.

“Overall however, funds focused on international equities continue to attract interest from investors eschewing domestic stocks,” analysts said.

“In January, these non-UK funds absorbed £998m of new cash, down from £1.3bn in December.”

The researchers reported that this poor month for equities was not because of a panicked sell-off as the sell-order data was in line with the long-term average, but the number of buy orders was below average, suggesting it was more a case of investors lacking the confidence to buy equities.

This is likely down to the shifting macroeconomic picture mentioned above, which has become more focused on interest rate hikes. Markets are already pricing in a three or four rate hikes from the US Federal Reserve this year, despite no concrete plans from its chair, Jerome Powell.

The UK has already begun its tightening programme, raising interest rates to 0.25% late last year and just today boost them to 0.5% today.

This creates a headache for equity investors, many of whom have never had to deal with before, given how long rates were kept on the floor.

Glyn said: “The rising interest rate theme is behind the general caution we are seeing across all asset classes which have all benefitted from the ultra-cheap money that has flooded the financial system in recent years.

“This era seems to be coming to an end leaving investors in a quandary on what to do with record levels of savings needing a home. For now, they are accumulating ever more in cash deposits.”