Following a disappointing end to its financial year, the Monks Investment Trust managers are doubling down on building portfolio resilience to weather ongoing uncertainty.

The £2.5bn portfolio, which is managed by Spencer Adair, Malcolm MacColl and Helen Xiong, has delivered a NAV return of 163.3% over 10 years, slightly behind the FTSE World index’s 182% rise over the same period, according to the latest annual report for the year to 30 April 2025.

However, in the 12 months to April, Monks has underperformed the index by 5.2%, with a flat NAV return of 0.1% compared to FTSE World’s 5.3% gain.

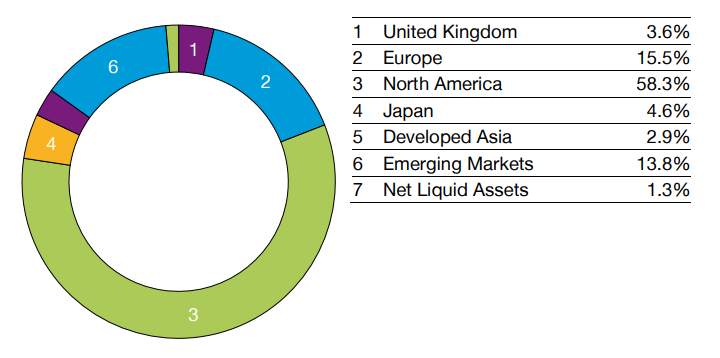

The managers cited global trade tensions ignited by US president Donald Trump’s ‘Liberation Day’ tariffs and strong negative momentum within the US markets – the impact of which was more keenly felt due to the trust’s near 60% weighting to North America.

Regional allocation of Monks Investment Trust

Source: Baillie Gifford

The Monks management team said that ongoing uncertainty caused by the volatile situation in the US cannot be priced, hedged or insured against. Instead, the managers are prioritising building resilience, retaining perspective and remaining reward-seeking.

The Monks’ game plan

The managers’ focus has been on ensuring holdings are “sufficiently adaptable” so that the portfolio is “positioned to win across a wide range of scenarios”.

“Rather than attempting to predict the unpredictable, we focus on building resilience through investing in companies with robust fundamentals and a diversity of growth drivers,” they said.

As such, the trust’s portfolio companies are “conservatively financed”, with 20% net debt/equity compared to the index (50%), and structurally more profitable with 39% gross margins versus 29%, the team said.

Monks also invests more in future growth and its companies have a higher return on equity at 19% versus the index’s 15%.

Holdings are organised into three profiles: stalwart (wealth compounders), rapid (typically technological innovators and disruptors) and cyclical growth (economically sensitive businesses whose growth arrives unevenly).

“This broad and pragmatic approach to growth gives us degrees of freedom to adapt to changing conditions, seize emerging opportunities and shift emphasis as market cycles evolve,” the team said.

The annual report also provided insight into position sizing, with over 40% of the portfolio by weight in the top 15 holdings. The managers said they believe these companies’ have the highest likelihood of at least doubling in return over the next five years.

“However, we recognise the asymmetries that equity investing offers and embrace this by managing a basket of smaller, 'incubator' positions (<0.5%), where the path to growth is less clear but potentially highly rewarding for shareholders,” the team added.

The trust currently invests in 40 such companies – around 15% of the portfolio.

The overall impact of this strategy is that Monks’ shareholders are not “overly exposed to the fortunes of one company, but instead a diverse range of holdings”.

Another method of ensuring resilience is to focus on more enduring and structural trends that will “outlast political cycles”, according to the managers. Examples include artificial intelligence (AI) and the penetration of electric and autonomous vehicles.

Around 25% of Monks is invested in companies that power, build or benefit from AI. The team currently has around 3.5% invested directly in the growth of electric and autonomous vehicles but noted “the direction of travel is clear”.

“By building resilience and maintaining perspective, we create the mental space to remain reward-seeking,” the managers said.

Under the weather

Elsewhere in the report, the managers pointed to the disappointing performance of its healthcare holdings, which were among the largest detractors from relative performance for the portfolio.

“President Trump’s healthcare appointments and their combined pronouncements have impacted short-term sentiment in healthcare,” the managers said.

As demonstrated in the table below, US health insurer Elevance Health suffered a fall in share price, which the managers have put down to tightened Medicaid eligibility criteria post-pandemic.

Top five contributors and detractors to relative performance by stock for the year end 30 April 2025 (%)

|

|

Average weight in portfolio |

Average weight in Index |

Average active weight |

Total Return |

Attribution |

|

Top five |

|

|

|

|

|

|

DoorDash |

2.3 |

0.1 |

2.2 |

40.6 |

0.8 |

|

Prosus |

2.9 |

0.1 |

2.9 |

29.9 |

0.6 |

|

Alnylam Pharmaceuticals |

1.0 |

0.0 |

0.9 |

70.1 |

0.6 |

|

Sea Limited |

0.8 |

0.0 |

0.8 |

98.9 |

0.5 |

|

Shopify |

1.4 |

0.1 |

1.2 |

27.2 |

0.5 |

|

Bottom five |

|

|

|

|

|

|

Elevance Health |

3.1 |

0.1 |

3.0 |

-24.5 |

-1.0 |

|

Novo Nordisk |

1.7 |

0.5 |

1.2 |

-51.1 |

-1.0 |

|

Martin Marietta Materials |

3.0 |

0.0 |

2.9 |

-15.8 |

-0.8 |

|

Moderna |

0.4 |

0.0 |

0.4 |

-70.6 |

-0.5 |

|

Block |

1.2 |

0.1 |

1.1 |

-25.1 |

-0.5 |

Source: Revolution, FTSE. All attribution figures are calculated gross of fees, relative to the index from stock level up, based on closing prices.

Despite this, the managers remain optimistic, arguing that there is “a structural tailwind for growth in the years ahead” as the population ages, treatments become more expensive and need for health insurance coverage grows.

However, in the top five, the managers highlighted Alnylam Pharmaceuticals, which received positive results from its late-stage trial to treat a rare heart condition – an achievement that could give it wider access to the patient population.

“We took some profits on shareholders’ behalf after the share price rose by 80% but we remain excited by the company’s potential to address even larger patient populations,” the managers said.

In contrast, Monks sold its position in Moderna, citing disappointing revenue from the Covid-19 vaccine and slow speed to market with its respiratory syncytial virus vaccine.

“Though we continue to believe that they have a potentially exciting pipeline of drugs, our patience has been exhausted,” the managers said.