The de-rating of high-multiple growth stocks has been particularly painful over the past few months as markets digest higher inflation figures and the prospect of higher interest rates.

But low-multiple value stocks have proven to be more resilient during this time because their valuations rely less on future earnings than their growth counterparts.

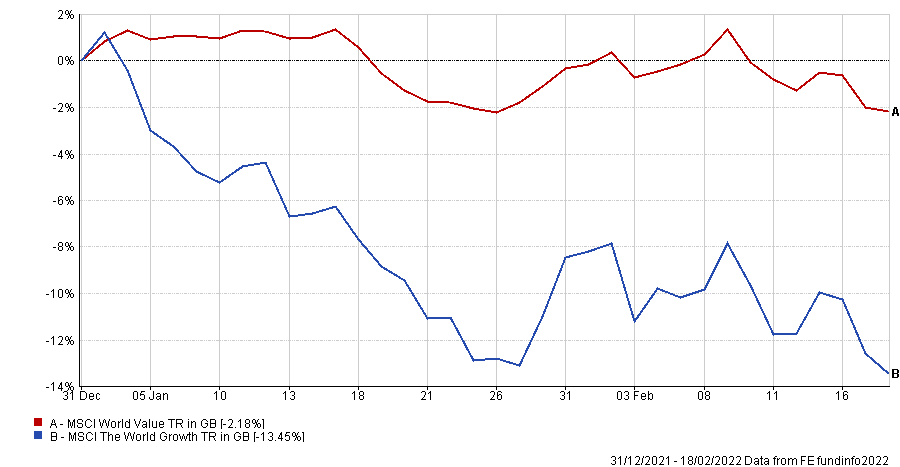

Year-to-date, the MSCI World Growth index is down more than 13% compared to the roughly 2% decline in the MSCI World Value index.

Performance of growth vs value year-to-date

Source: FE Analytics

Despite this apparent resilience, even low-multiple value equities may not be safe from policy error from the Federal Reserve, according to Richard de Lisle of the VT De Lisle America fund.

“If you see that inflation, interest rates and policy error from the Fed (by overdoing it) is going to drive America into recession – then you shouldn't be in any equities at all,” he said. “You really should just hide.”

As central banks gear up to tackle high inflation by aggressively raising interest rates, he suggested there is a risk that it causes economic growth to contract and fall into a recession.

If equity markets correct aggressively on a perceived policy error from central banks, the negative wealth effect of such a move could be major problem for the economy.

It may cause consumers to spend less as their perceived wealth declines in line with asset prices, which would cause lower corporate earnings, lower asset values and even further reduced spending – a negative spiral.

The manager pointed to the mid-70s when inflation rates far exceeded interest rates yet the savings rate still went up despite real interest rates being negative.

He said: “People were so scared because markets were going down, so you put your money in cash even though it was getting eroded by inflation because you lost less money that way. So if that's the outlook you should be in cash and take your knocks.”

Today with the latest US consumer-price-index (CPI) figure of 7.5% and the US 10-year yield at just below 2%, real interest rates are currently negative 5.5%.

“That is the most negative real rate of interest since 1975,” de Lisle said. “The Fed is running at the hottest since inflation was a scare.”

However, he doesn’t think a recession is the most likely outcome for markets and instead said the world could be entering a period more like the late 1940s than the 1970s.

“We look at it rather like in the late 1940s after America decided to spend too much money with the Marshall Plan and accumulated a huge amount of debt,” he said. “What do you do about that? Well, you demonetize it over several decades and that is the sort of market we think we're looking at.”

After dismissing the initial inflation spikes last year as transitory, central banks have swiftly shifted their tone to more hawkish and promised to take action to curb inflation if necessary.

De Lisle said: “Now they [central banks] suddenly have to say: ‘We take all this seriously, we’re going to do something about it’. They won’t. They love to run it hot. The last thing they want is a recession and running at hot demonetizes a huge debt they've created.

“Running hot absolutely suits – but they will pretend they’re doing so much about inflation. But even now, when the Fed is doing all this talking it’s still buying bonds.

“What next? I think that neither policy error nor wealth effects will lead to recession and suspect that the US will therefore be the most difficult market index to beat for the next few years.”

Yet if the economy is set to run hot does that mean growth stocks are best positioned to outperform the negative real rate of interest? Not necessarily, according to de Lisle, who prefers small-cap value stocks.

“Value performs better for the simple reason called cognitive dissonance – the way people overvalue a growth stock’s ability to remain above the mean rate of growth,” he explained. “In other words, we as humans underestimate reversion to the mean.

“If someone says ‘hey I've got great growth stock it's growing at 20%’ – it is priced accordingly. What people get wrong is that the growth rate reverts to the mean – whatever the market mean corporate growth rate is – in less years than the analysts anticipate. That’s the growth stock problem.”

Value stocks also have a bonus of very occasionally being re-rated as a growth stock if it continues to beat market expectations, he added.