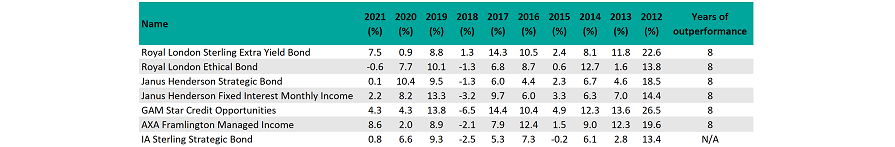

Royal London Sterling Extra Yield Bond is the most consistent IA Sterling Strategic Bond fund of the past decade, beating the sector average in eight of the past 10 calendar years, and making a positive return in every one.

Of the 48 funds with a track record long enough to be included in the study, another five funds also outperformed the sector average – the most common benchmark in this peer group – in eight of the past 10 years, but weren’t as consistent as the Royal London fund when it came to preserving capital.

Royal London Sterling Extra Yield Bond aims to deliver a high yield with a lower risk than most other high yield funds. To achieve this, it prefers to hold bonds secured against specific assets, such as property or cashflows.

Performance of funds vs sector

Source: FE Analytics

Managers Eric Holt and Rachid Semaoune also look to exploit bond market inefficiencies and believe that by considering a wider investment universe than many of their peers, they can uncover value in areas that are often overlooked and cheap.

interactive investor, which includes the fund on its Super 60 list, said: “They do not rely on bonds’ credit ratings. The main question for them is whether there is enough reward for the risk being taken. In practice, this means that the portfolio will hold untypical bonds, such as unrated bonds, sub-investment-grade bonds, smaller issue-size bonds and non-sterling bonds.”

In a recent note to investors, Holt attributed the strong performance in the six months to the end of last year to the fund’s low sensitivity to government bond yields.

“We began 2021 believing that the risk-return prospects for high yield were better than for investment grade and government debt, and subsequent returns confirmed this,” he said. “Our outlook for 2022 is broadly the same.”

Royal London Sterling Extra Yield Bond made 128.9% over the 10-year period in question, compared with 59.5% from its sector.

Holt also runs another fund that made the list, Royal London Ethical Bond.

This fund predominantly holds investment grade corporate bonds, but can invest up to 20% of its assets in lower-quality high yield bonds. Its ethical screening process is outsourced to EIRIS, a socially responsible investment (SRI) research provider.

The FE Investments team said: “Holt and the team are well experienced in credit investing and operate a unique approach to fundamental credit analysis.”

Royal London Ethical Bond made 77% over the 10-year period in question.

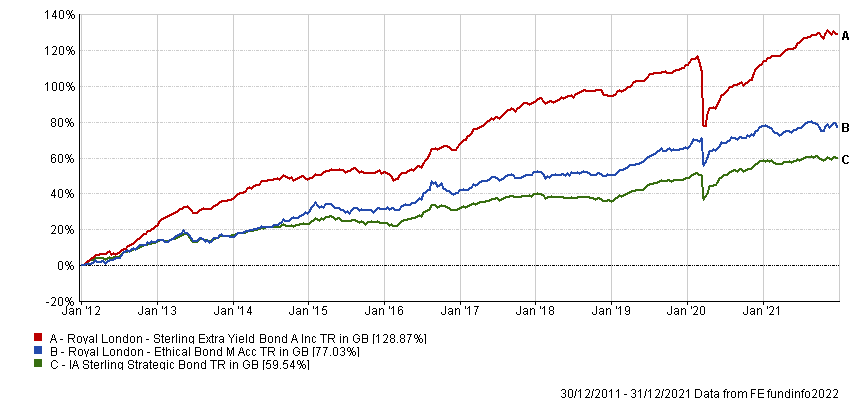

Performance of funds vs sector over 10yrs

Source: FE Analytics

Managers John Pattullo and Jenna Barnard are also responsible for two funds on the list – Janus Henderson Fixed Interest Monthly Income and Janus Henderson Strategic Bond.

The first fund is the riskier of the two, with the team at Square Mile Investment Consulting & Research pointing out its focus on income means that it is likely to be biased towards credit, and will usually hold a relatively large amount in sub-investment-grade assets.

“Given this focus on income and the resultant capital volatility, the fund is likely to perform strongly when markets are rising, but this can be at the expense of capital performance in falling markets, although investors should still receive a good level of income,” it said.

FE Investments said that Janus Henderson Strategic Bond is a better bet for investors in search of total returns as well as income, adding its flexibility and use of derivatives meant it was one of the few strategic bonds funds worthy of the name.

“Despite the fund exhibiting slightly greater volatility than peers, Pattullo and Barnard have proven themselves to be a skilled team at using this flexibility to take advantage of the economic environment, particularly to protect against market downturns,” it said.

“However, the managers have a strict bias to defensive sectors that should be more stable over the course of the economic cycle.”

Janus Henderson Fixed Interest Monthly Income has made 89.5% over the 10-year period in question, while Janus Henderson Strategic Bond is up 78.9%.

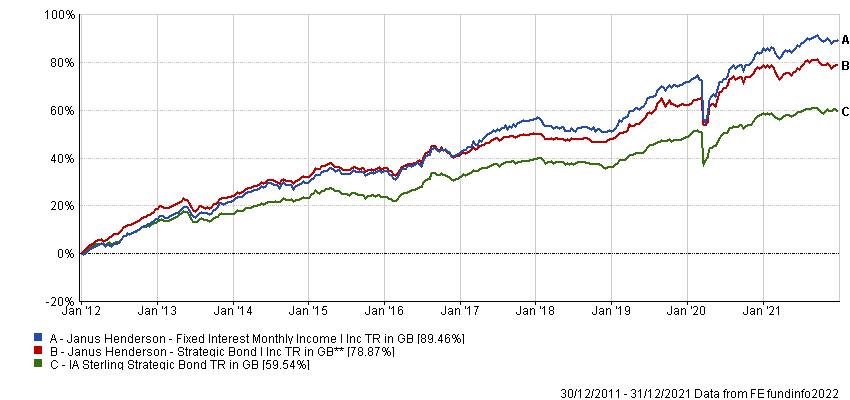

Performance of funds vs sector over 10yrs

Source: FE Analytics

GAM Star Credit Opportunities delivered the highest total return over the 10 years of the six funds on the list, at 147.2%.

The fund seeks to generate a steady and high income from the bonds of quality companies, focusing on subordinated debt (which is paid after every other creditor if the issuer defaults) to capture higher yields.

It is heavily overweight financials, with the team saying: “This is the most regulated market and has been stress tested by regulators, so we know the sector can absorb external shocks.”

Performance of funds vs sector over 10yrs

Source: FE Analytics

AXA Framlington Managed Income is run by George Luckraft, who aims to produce a high income with potential for long-term capital growth. It can invest in equities and had 15.5% in this asset class at the beginning of the year.

It made 113.1% over the 10-year period in question.

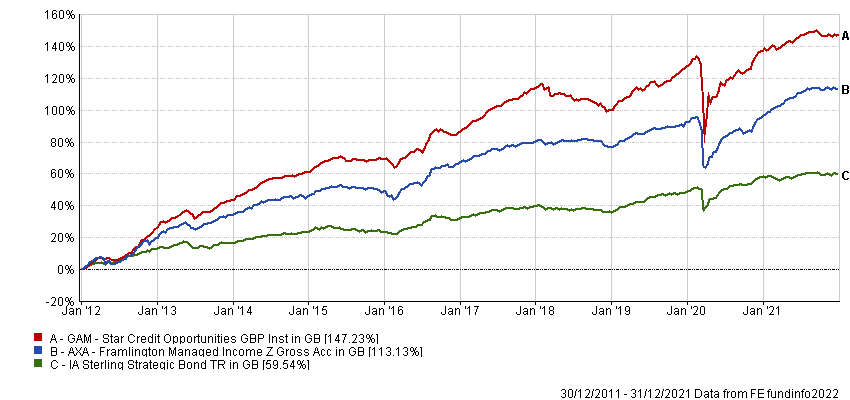

| Name | Fund size (£m) | Yield (%) | OCF (%) |

| Royal London Sterling Extra Yield Bond | 1673.2 | 5.2 | 0.84 |

| Royal London Ethical Bond | 1743.3 | 2.5 | 0.55 |

| Janus Henderson Strategic Bond | 3280 | 3.3 | 0.7 |

| Janus Henderson Fixed Interest Monthly Income | 1746 | 4.4 | 0.7 |

| GAM Star Credit Opportunities | 691.5 | 3.2 | 1.17 |

| AXA Framlington Managed Income | 349.8 | 4.8 | 0.59 |