Investment trusts are a strong option for young investors looking to make the most of their £20,000 tax free ISA allowance before this year’s fast-approaching deadline on 6th April, according to various industry experts.

Several financial advisors and wealth managers have narrowed down their best trust picks for millennials looking to make the best returns on their investments.

The list includes a mixture of cautious trusts for those seeking steady returns as well as higher-risk growth portfolios that young investors have the luxury of investing in for the long term.

Philippa Maffioli, senior adviser at Blyth-Richmond Investment Managers, suggested the Mercantile Investment trust was a good option for younger investors.

It holds shares in UK companies outside the FTSE 100, leading to a more diverse group of names than those that dominate the large-cap index.

Top holdings include consumer discretionary companies such as Watches of Switzerland (4.3% of the total portfolio), media firm Future (3.4%), housebuilder Bellway (2.8%) and retailer Dunelm (2.6%).

Its exposure to small- and mid-cap companies means there is more potential for growth, which Maffioli said is important for millennial investors to look out for.

She said: “I like young people to have significant exposure to pure growth stocks and I often recommend that they invest on a monthly basis in order to benefit from pound cost averaging.”

Although the trust has performed well in the long term, delivering returns of 161.4% over 10 years, its performance dipped in the past year, resulting in a loss of 19.4%.

Total return of trust over 10 years

Source: FE Analytics

However, the short-term poor returns have led to a significant share price discount to the trust’s net asset value (NAV) of 12%, making it relatively cheap and Maffioli said she was confident that performance will bounce back in future.

Another sector with the potential for rapid growth is biotechnology and here she highlighted the Biotech Growth trust.

The portfolio is up 277.3% over the past 10 years, but again the trust has struggled this year, down 34.5%. The current share price discount of 4% could make for an attractive entry point, however.

Maffioli said: “2021 was a challenging year but with strong product launches and more timely drug approvals, it looks appealing to long-term growth investors.”

For young investors with a high risk tolerance and timeframe, Genevra Banszky von Ambroz, fund manager at Tilney Smith and Williamson, suggested two newer trusts that are establishing themselves in their respective sectors.

One is the VH Global Sustainable Energy Opportunities trust, which was set up just over a year ago in February last year.

The portfolio invests in companies supporting the UN Sustainable Goals for clean energy transition and has gone up 9.8% during its short time in operation, already beating the IT Renewable Energy Infrastructure sector by 5.2 percentage points.

Likewise, Bankszy von Ambroz’s other recommendation, the Ashoka India Equity Investment trust has increased 60% since its launch in August 2018.

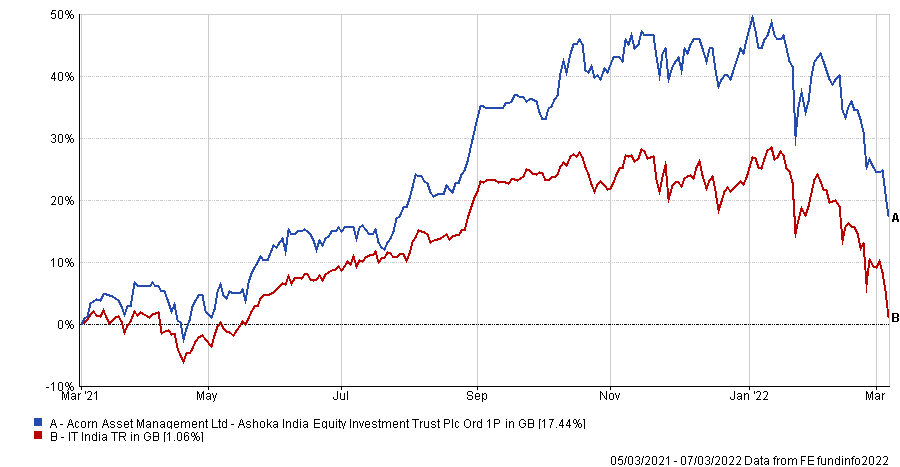

In the past year, the trust – which invests in small- and mid-cap Indian equities – is up 17.4%, powering ahead of the IT India sector’s returns of 1%.

Total return of trust over the past year

Source: FE Analytics

The India/Indian Subcontinent’s 28.3% rise in 2021 made it the best-performing sector of the year, but it became the biggest loser in February when it dropped 9.8% throughout the month.

With sentiment in the sector low, the trust’s shares have slipped to a 6.6% discount, despite its returns since inception being much higher than its peer group.

Paul Chilver, associate and financial planning manager at Bikett Long, suggested the Montanaro European Smaller Companies Investment trust, as another high-risk option.

The portfolio consists mostly of information technology assets, which make up 31% of the trust, and has an unusual overweight in Sweden, where 31% of its assets under management are invested.

The trust has made 283.7% over the past 10 years but sunk 13.9% over the past 12 months, with shares now trading at a 10% discount.

Chilver stated that the trust has future growth potential due to its “excellent long-term track record against its sector”.

His other choice, the Mobius Investment trust, allocates capital across several countries in the emerging and fronter markets, with managers Mark Mobius and Carlos Hardenberg investing in companies not typically found on the benchmark index.

It has made a total return of 11.3% over the past year while the IT Global Emerging Markets benchmark dropped to a loss of 5.9%.

Total return of trust over the past year

Source: FE Analytics

The sector has gone through a difficult period, up just 6.6% in five years with performance largely dragged down by harsh government policy in China but Chilver said that “it’s well diversified over many different emerging market regions”.

Neil Mumford, director at Milestone Wealth Management, suggested Baillie Gifford’s Monks Investment trust as a consistent option for investors that want to make high returns but prefer a broader global view.

He said that manager Spencer Adair’s “patient approach to investment” has led to an excellent track record, delivering returns of 157.3% over the past 10 years.

However, it has been caught up in the inflation and interest rate-led sell-off since the start of 2022, leaving the trust down 28%.

Mumford is still confident that performance will improve in the long term, stating: “For a millennial, taking a long-term view with their savings means they can put up with volatility and, if investing on a regular basis, this volatility will enable them to benefit from pound cost averaging, which should hopefully provide them with well above average returns.