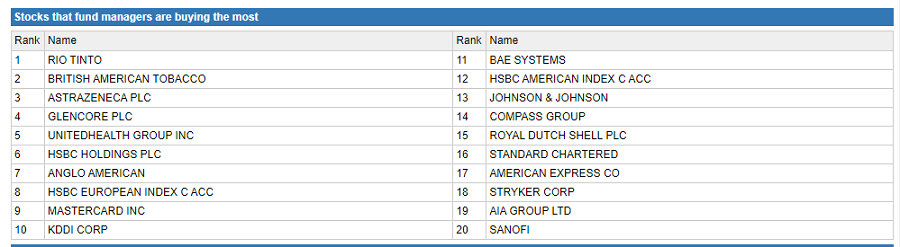

Miners, financials and oil firms were the most-bought companies by IA Global fund managers over the past three months, data from Trustnet has revealed.

Over the past few weeks, headlines have been dominated by the war in Ukraine, which began at the end of February and has since continued to impact the entire world, socially, financially and economically.

Although this data only captures the opening days of Russia’s attack – data accurate to the end of February – it was still a significant driver to the past three month’s market movements.

Source: FE Analytics

As a consequence of the war, oil and energy prices have risen, with Brent crude nearing $110 (£83) per barrel last week. These two assets are inherently linked to Russia, since it is one of the biggest suppliers globally.

Therefore, the appearance of oil giants such as Royal Dutch Shell reflects global managers trying to gain exposure to this rally.

The popularity of BAE Systems, a British arms and security company, can also be explained by the crisis in Ukraine. Earlier this month, Andy Merricks, manager of the 8AM Focussed Fund, commented on the irony that armoury stocks, including BAE System, were among the best performers, given the swell of support for ethical investing.

Prior to the invasion, inflation and central banks subsequently raising interest rates were the big market drivers. The Bank of England announced yesterday that it would be increasing the base rate up to 0.75%, back to pre-pandemic levels, with further hikes to come if inflation hits their forecast of 8% later this year.

This market dynamic has been present for several months and is one which tends to favour more value, cyclical sectors, such as financials, mining and energy.

Stock such as Rio Tinto, British American Tobacco and HSBC Holdings all provide exposure to this area of the market and were popular among global fund managers in recent months.

Hardly any growth stocks were present on the list as the style of investing has given way to value during the heightened periods of inflation and interest rates. These factors can potentially take away from the future earnings of technology and other high-growth stocks, making them less appealing.

Below, Trustnet looks in-depth at a handful of the most popular stocks from the past three months.

Glencore

First is commodity and mining company Glencore, which recently sold its CSA copper mine in Australia to Metals Acquisition Corp for $1.1bn.

The company has benefitted from the increased demand for commodities and the pricing strength of those assets has made it a popular buy, according to Anthony Eaton, manager of the VT Downing Global Investors fund.

The fund has held a position in Glencore for two years, roughly tripling its exposure during that time (now the top holding at 2%).

Eaton said that the stock remained attractive because of its leading role in the global industrial economy and the way it is “such a force for good as an employment-providing, tax-paying and infrastructure-investing wealth-creating machine in many of the world’s more fragile and less developed economies.”

Glencore has come under fire in the past few years, accused of corruption and bribery, antitrust and human rights violations in various countries.

The company has set aside £1.1bn to cover any potential fines over these issues, which it addressed in its annual report, stating that it “expects to resolve the US, UK and Brazilian investigations in 2022”.

FE fundinfo Alpha Manager, Richard Buxton, who also holds the mining stock, recently told Trustnet that he was reassured about his investment after the company’s new chief executive, Gary Nagle, outlined his commitments to resolving these issues.

The company has benefited from the war in Ukraine via the surge on commodity prices, something that has not gone unnoticed by the company. In its annual report Glencore commented that the global commodity market needed to “adapt to some or all of Russian/Ukrainian supply being unavailable, whether due to infrastructure damage, sanctions or ethical concerns”.

Overall, analysts were generally bullish about the company’s upcoming year. Data collected by Tipranks – which aggregates broker recommendations – revealed that, experts expect the company’s share price to grow by an average of 13.9% in the next 12 months, making the stock a ‘strong buy’.

Rio Tinto

Rio Tinto was another popular mining company among global fund managers over the past three months. Recently, the company announced it was in the process of terminating all its commercial relationships with Russian businesses following the country’s attack on the Ukraine.

James Budden, director of marketing & distribution at Baillie Gifford, said that the business had a “diversified portfolio of high-quality, low-cost assets with key strengths in iron ore, copper and aluminium”. The stock is held in the Baillie Gifford UK and Worldwide Equity fund.

On the general criticism about the environmental impact from mining companies, Budden said “we acknowledge the complex and sometimes controversial nature of the mining industry but also recognise that the metals that Rio supplies are required to meet current demand for products and services and for the transition to a low carbon economy”.

Rio Tinto is equally aware of this headwind. In its annual report, the firm said that the global shift to decarbonisation “will shape the future of the mining industry, impacting supply cost structures, and demand for global commodities, and increasing the focus on the non-financial performance measures”.

The company has outlined several plans to try and ensure its business survives this change, including developing products that will enable its customers to decarbonise.

Tipranks’ analysts were slightly less bullish on this holding though, rating it a ‘hold’. They have forecast a 1.6% fall in share price over the next 12 months.

Mastercard

Next up was Mastercard, another company embroiled in the Russian saga. The firm was one of many global payment systems to suspend its operations in Moscow following the global economic and financial regulations placed on Russia post-invasion.

The Baillie Gifford Global Stewardship fund has invested in Mastercard since its inception in 2015 and Budden said it shares the group’s investment philosophy around “social considerations”.

He said that he company “has the potential to shape a cashless society”, which has emerged post-pandemic, focusing on “not only the convenience benefits for consumers but the transparency within payment networks, which should diminish the potential for financial crime”.

Tipranks’ analysts were also positive on the stock, forecasting nearly 20% share price growth in the next year.