Making positive returns month-in and month-out is no easy feat, but investors that want to make the best returns may wish to seek out funds that can achieve exactly this.

Recently, Trustnet looked at the sectors that made positive returns month-in, month-out, with the IA UK Smaller Companies sector scoring well. Funds in the sector were up in 82 of the past 120 months and have performed strongly over the past 10 years with an average total return of 189.6%.

Those in the IA UK All Companies and Equity Income sectors were less impressive, but these figures may not show the full potential of certain portfolios. As such, below Trustnet looks at the funds within these sectors that have delivered the most consistent monthly returns over the past decade.

IA UK Smaller Companies

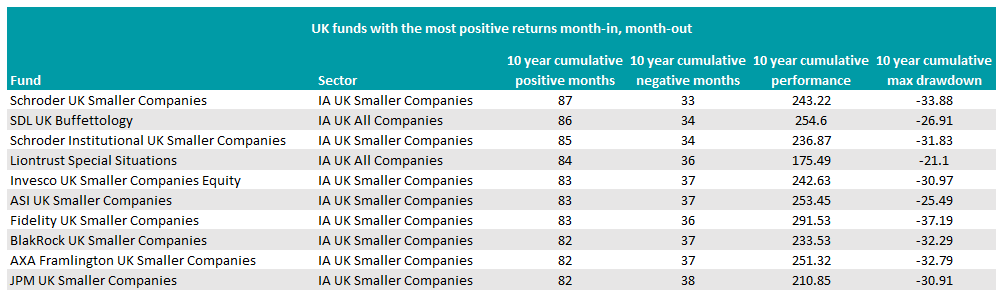

Funds within the IA UK Smaller Companies sector accounted for eight of the top 10 most consistent portfolios across all three sectors, with the Schroder UK Smaller Companies fund taking the lead.

The fund was up in 87 of the past 120 months and made 243.2% in that time. Although performance was strong, the fund is still relatively small with £480m in assets under management (AUM).

Schroder also runs the second most consistent in the sector, with the slightly larger Institutional UK Smaller Companies portfolio which has an AUM of £648m.

It was up in two months fewer than its sibling fund and returns were 6.4 percentage points lower over the past 10 years.

Total return of funds over the past 10 years

Source: FE Analytics

This similarity in performance may be due to similar stock positions, with the funds having six of their top 10 holdings in common.

For example, Tremor International and Xaar are the top two holdings in each fund, although Schroder UK Smaller Companies has higher weightings to both.

Fidelity’s UK Smaller Companies fund outperformed both of them with a total return of 291.5% over the past decade despite the third largest drawdown of 37.2%.

Performance was fairly positive, with increases in 83 of the past 120 months but returns could drop further than most in difficult periods.

Overall, the ES R&M UK Equity Smaller Companies fund had the highest returns out of any of the sectors combined, up 361%. Returns were down in 42 months over the past decade, suggesting that the fund shot up in the good months, but had fewer of them.

That being said, it had the second smallest maximum drawdown out of any other in its sector, dropping 22.2% at worst, meaning it held up well during tougher times.

A slightly less volatile option that still maintained high returns was the Liontrust UK Smaller Companies fund, which was up in 82 of the past 120 months and increased 341.5%.

The maximum drawdown for the fund was 1.6 percentage points higher than the ES R&M UK Equity Smaller Companies portfolio at 23.7%, but still below average.

IA UK All Companies

Across the largest UK sector, the CFP SDL UK Buffettology fund was up in the most months over the past decade, increasing in 86 of the past 120.

Not only does that make it the second most consistent across all three sectors, but it also had the second highest returns within its peer group, up 254.6% over the past 10 years.

The Slater Growth fund made the highest returns in the IA UK All Companies sector overall with a 254.6% increase but was up in six months fewer than Buffettology.

Total return of funds over the past 10 years

Source: FE Analytics

Though performance was strong for both portfolios, they were ranked 8th and 9th when compared with funds in the IA UK Smaller Companies sector, which generally made higher returns.

However, maximum drawdowns in the All Companies sector were smaller, with the lowest 15.7% compared to 21% in the Smaller Companies group.

The Liontrust Special Situations fund was also up a lot in the past decade, increasing in 84 months. However, returns were less impressive at 175.5%, trailing 79 percentage points behind Buffettology and Slater Growth.

A fund that has been better at keeping up with their performance is the Marlborough Special Situations fund, which increased 234.4% over the past 10 years and was also up in 82 months overall.

IA UK Equity Income

In the income space, funds were not as consistent on a monthly basis than other UK fund groups as the strategy came under fire towards the latter end of the period.

The pandemic forced companies to suspend or cancel their dividends, which had a big impact on this sector, while few high-growth stocks, which have dominated the market for most of the decade, pay dividends and are therefore unlikely to appear in these portfolios.

Total return of sectors over the past 10 years

Source: FE Analytics

The Quilter Investors UK Equity Income fund was up in more months than the rest of its peer group, increasing in 80 out of 120 – this is at least six months fewer than the other sector leaders and returns in the period were almost half at 131.5%.

The Premier Miton UK Multi Cap Income fund, the top returning portfolio in the sector with a 201.6% increase over 10 years, was only up in 77 of the past 120 months.