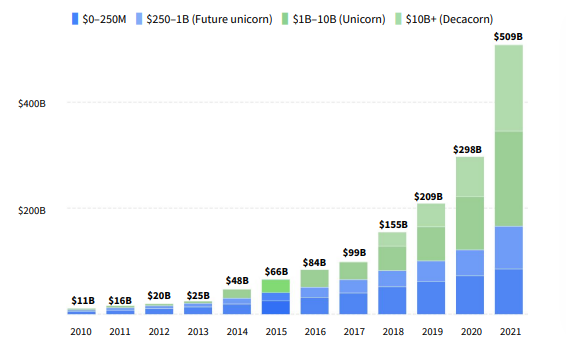

The UK technology sector doubled in value over 2021 and exceeded the half-a-trillion dollar mark, according to research by Dealroom.

Although the UK might not be the leading region when it comes to technology, the $211bn (£161.4bn) increase in companies established since 2000 to $509bn is a clear sign that performance is strong.

In terms of the global tech industry, which is valued at £5.2trn, Europe (including the UK) accounts for 22% while the US leads with 35%, according to data from Zippia.

Enterprise value of UK tech companies founded since 2000

Source: Dealroom

However, with the UK’s tech sector swelling so rapidly last year, Trustnet asks stock pickers for their favourite small UK tech companies that can compete with the large-cap leaders.

James Barton, co-founder and CEO of Featherstone Investment Management, suggested that the UK offers plenty of lucrative tech opportunities at a much more affordable price than the US.

He said: "If you buy a global tracker fund, 55% of their money goes to America and it's self-fulfilling in that it's the biggest market in the world and therefore attracts the most money. Whereas if you're surgical, you can find better value elsewhere. That's really what we've been trying to do."

Barton recommended investors keep an eye on Superdielectrics, a company that produces energy-absorbent semi capacitors at a cheap price compared to its peer group.

Although production only began two years ago, the product has the potential to enhance performance across many sectors, including wind farms where it could reduce energy wastage.

Barton advised investors to keep an eye out for it when it lists publicly later this year.

He added: "The UK has got some great technology businesses and if they were American they'd be listing for billions of dollars whereas Superdielectrics is listing at £500m. It’s ridiculous - if it was a US stock it'd be four times that."

Laurence Hulse, co-manager of the LF Gresham House UK Smaller Companies fund, said that Medica, a company that provides technology for radiology departments, has “plenty of opportunity to give bigger tech names a run for their money”.

He added that the company’s circa 50% discount to private equity transactions “gives it a chance to outperform big tech on valuation grounds going forward”.

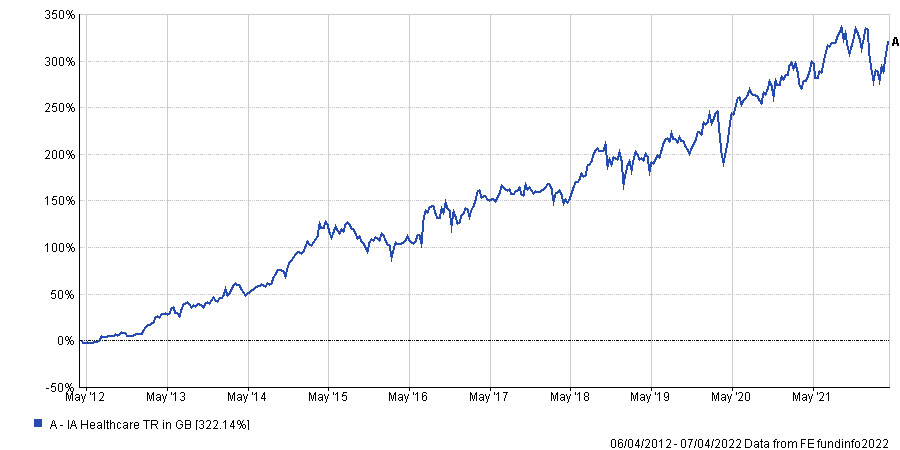

Total return of sector over the past 10 years

Source: FE Analytics

Technology is also helping to enhance performance in the financial sector, with Alex Game, co-manager of the Unicorn UK Growth fund, recommending FD Technologies.

The UK-based company, a group of data-driven businesses that provides products and consulting services to the capital markets industry, recently signed a deal with Microsoft, signifying its global appeal.

The share price is down 13.6% over the past year but Game said that the new partnership will give it “significant strategic benefits supporting its growth ambitions”.

Another tech sub-sector with room to grow is gaming, with Leigh Himsworth, portfolio manager at Fidelity International, citing game developers Team17 as one of his top small UK tech holdings.

The business grew rapidly throughout the pandemic as consumers turned to gaming while in lockdown and the far-reaching popularity of games like Overcooked and Moving Out increased revenue.

Himsworth said that Team17 experienced some growing pains as it expanded so quickly but the new corporate support has allowed it to work on a vast array of new projects.

Other large companies around the world are backing the gaming sector, with Microsoft acquiring Activision for $75bn, reflecting a growing sentiment for the industry that Team17 could benefit from.