Inflation risk and duration risk are the two biggest risks that all asset classes face in the coming months, fund managers have warned.

Despite inflation figures coming in well-above expectations for the last several months, financial markets continue to underappreciate the persistence of inflation across the world, according to Fulcrum Asset Management deputy chief investment officer Nabeel Abdoula.

He said: “This is something that will have reverberations for all assets.”

As such, Fulcrum Diversified Absolute Return manager Abdoula is looking across financial markets globally for areas where he can take advantage of inflation being under-priced – for example, by holding inflation swaps which pay out if inflation comes in above market consensus.

He said that around the world, the opportunities are where people have yet to – but will begin – catch on to inflation being a more persistent phenomenon and central banks becoming more willing to react to it.

Japan is one region that Abdoula thinks is “interesting” is due to its central bank’s yield curve control and the potential for “non-linear moves” in some of the region’s asset classes.

The Bank of Japan has been an area of focus for traders in recent weeks given the country’s inflation rates have yet to breach past 2% and it is still running easy monetary policy to support its economy as the rest of the developed world struggles with high inflation.

“In the disinflationary era, financial markets have been used to using the central bank as an anchor for pricing,” Abdoula said. “Nowhere is that most obvious as the Japan yield curve control strategy which has which has been in place now for over a decade.

“So as the dynamics and the differences between Japan’s monetary policy and the rest of the world exacerbate itself, it puts pressure on the Japanese central bank to make the decision on how long to continue with the yield curve control.”

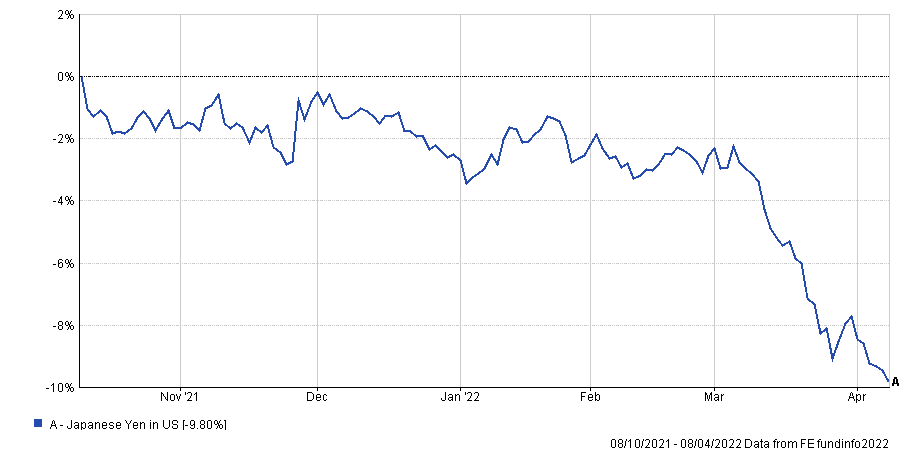

Performance of Japanese yen vs US dollar over 6 months

Source: FE Analytics

He said if Japanese policymakers decide to end yield curve control, it is likely that there would be potential for “explosive” moves in the Japanese yen and bond markets.

“The premise of that type of policy is to be fully committed to it until you're not, but the risk-reward on some of those ideas can be quite asymmetric,” he explained.

“What you would expect to happen is a very significant increase in Japanese bond yields. The Japanese yen would first see an appreciation but beyond that it's not clear whether that appreciation will be sustained.

“Then for the Japanese equity markets, you would expect banks to benefit quite meaningfully and they're quite a big part of the of the Japanese indices.”

Other fund managers, however, are more concerned with duration risk – a risk typically associated with bond prices and their sensitivity to changes in interest rates.

Latitude Investment Management’s Freddie Lait said: “The number one theme that is most critical to investors in all asset classes is the concept of duration risk and where you might find that.

“I think that's the greatest risk and just ensuring that we are correctly evaluating that risk in all of our individual names has been very important for us.”

The reason why duration risk is so important because it is being mispriced in the equity markets, according to Lait.

“Clearly rates are going up and yields are going up, and anything with duration therefore goes down,” he said.

“When we line up these quality businesses – and there are a lot of quality businesses that are commonly held across portfolios these days which we think are brilliant businesses – when we line them up against our relative opportunity set, they're nowhere near the most interesting because they don't have the most phenomenal five-year forward prospects because you're overpaying today.”

Although markets have begun to discount higher interest rates and growth stocks have endured some volatility in the first quarter of 2022, Lait thinks more asset managers will start to think more about rebalancing their portfolios.

Performance of MSCI World Value vs Growth over 1yr

Source: FE Analytics

This could have implications for the pricing of the cheaper, higher-yielding sectors which have been mostly shunned for the past few years.

Lait said: “What I anticipate they [asset managers] will see is what we've been seeing all along: there's so much opportunity elsewhere. There will be a shift towards some of these other forgotten sectors over the next few years and it's really just beginning.”

However, this doesn’t mean that Lait is only bullish on cheaper value stocks. His long-only Latitude Global fund has two companies in its top-10 holdings that are seemingly on opposite sides of the growth and value debate: US tech giant Alphabet and British energy company BP.

“I see value and growth as two sides of the same coin,” he explained. “We're still trying to grow and within our equities, earnings and cash flow per share have grown around 18% a year for the last five years.

“So we're looking for growth. It's just you can achieve that through banks: we own some US banks. You can achieve that through energy companies: we bought some European energy companies last year.”

Although duration risk for equities is broad and significant, Lait still thinks stocks are one of the best asset classes even though he expects returns to be reasonably low compared to history.

“There are still huge opportunities in the equity market and principally they can be found in the lower duration, cheaper end of the market where you can still grow and you can still generate great returns,” he said.

According to Lait, this is growing increasingly important at a time where many investors may find that within their equity allocation, they are overweight expensive growth stocks as these have outperformed for the past several years and indeed decades.