A near-decade bull market has been stunted in recent years as first Covid and more recently the war in Ukraine have spooked investors and sent shares tumbling.

Making gains consistently in this environment has been tricky, but funds that performed well in both periods are those that have take a quality-growth approach, according to a Trustnet study.

These funds were popular during the good times, when low growth and loose monetary policy meant these lower-growing firms were put on high multiples as bond investors were forced into equities but chose to invest in the sturdiest options.

In the more recent years, these companies have been flocked to by those escaping the sell-off in technology and other high-growth companies, which had been bid up in the good times but have sold off as inflation has risen.

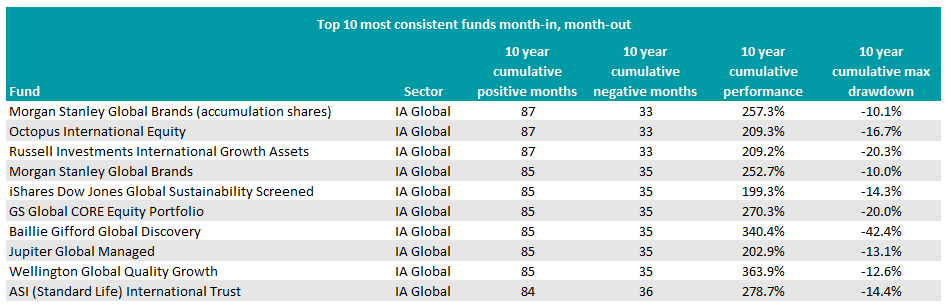

In this study, we looked at the number of months a fund made a positive return over the past decade, as well as its overall performance over 10 years and its maximum drawdown, to discover which had been the most consistent.

IA Global

Previously, Trustnet looked at the monthly performance of all Investment Association sectors overall, which revealed that, on average, funds in IA Global were up in 78 of the past 120 months, making a total return of 178.3%.

Within the sector, the leader was the Morgan Stanley Global Brands fund, which was up in 87 months over the past decade. Not only was it up in the most months, but it also made a total return of 254% with a relatively low maximum drawdown of 10.1%.

The FP Octopus International Equity and Russel Investments International Growth Assets funds were also up in 87 months, each increasing around 204% over the past 10 years, but their maximum drawdowns were higher at 16.7% and 20.3% respectively.

Total return of funds vs sector over the past 10 years

Source: FE Analytics

While all were up in the same number of months, Morgan Stanley Global Brands was statistically the better option with higher returns and lower volatility.

The Wellington Global Quality Growth fund outperformed all three, up 363.9% over the past decade, despite making positive gains in two fewer months than the leaders.

Likewise, the maximum drawdown was relatively low at 12.6%, making the fund one to consider for investors looking for both high returns and consistent monthly performance.

From a return perspective, the Morgan Stanley Global Opportunity fund performed the best overall, increasing 408.9% over the past 10 years.

However, it was only up in 72 of the past 120 months, making it a more volatile option compared to its peer group.

IA Global Equity Income

The JPM Global Equity Income fund was the most consistent portfolio in the Global Equity Income space, up in 82 of the past 120 months while also being the best performer, making a total return of 232%.

Although it made the most positive returns month-in, month-out compared to its peer group, the fund is quite small at £212m in assets under management (AUM).

Had the fund been in the wider IA Global sector, this would have been good enough to place it joint 10th overall.

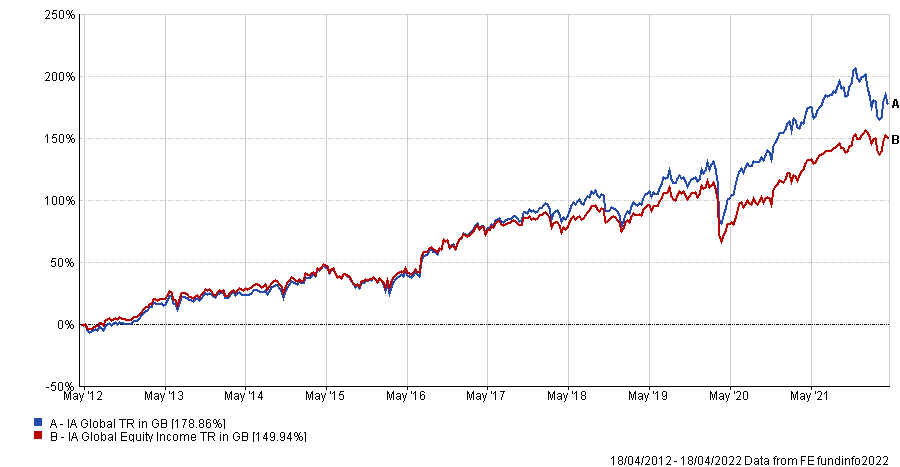

In terms of consistency, this suggests that investors were better off holding IA Global funds rather than IA Global Equity Income portfolios over the past 10 years.

Total return of sectors over the past 10 years

Source: FE Analytics

This is the same when comparing the total return of each sector, with the average fund in the IA Global sector taking a 27.7 percentage point lead over the same period.

Outside of the JPM Global Equity Income fund, BNY Mellon Global Income and Sarasin Global Higher Dividend funds also performed well in the study. Each were up in 82 months over the past decade, increasing 201.5% and 190.2% respectively.