Personal Assets Trust and Alliance Trust are some of experts’ preferred ‘one-stop-shop’ options for investors seeking a core portfolio allocation.

One-stop-shop portfolios are an easy way to access broad market exposure, providing a diversity of assets and geographies. Although they may not shoot the lights out in terms of performance, they are usually more defensive when markets go through volatile periods, like the ones investors have experienced recently. Because of their diversification it can make them a useful, core stabiliser within a portfolio.

They also provide the added bonus of taking away a lot of the decision making from investors hands, according to Rob Morgan, chief analyst at Charles Stanley Direct, and remove the need for constant portfolio readjustments.

He said: “These multi-asset funds can be convenient and provide instant diversification. However, the level of risk taken by funds varies according to their objectives, so investors need to be careful they select an appropriate one for their needs.”

“They can either be a ‘one-stop-shop’ for a small portfolio or used as a core holding around which more specialist investments can be added.”

Below, experts give their preferred all-in one portfolios worth considering for a core portfolio.

Personal Assets Trust

First up is arguably one of the most well-known options for this type of portfolio, the Personal Assets Trust. It is run by FE fundinfo Alpha Manager Sebastian Lyon and co-manager Charlotte Yonge, who follow the fundamental goal of all Troy Asset Management portfolios, putting capital preservation at its core as a way of keeping volatility low.

Its holdings are split between blue-chip equities, gold, US index-linked bonds and UK short-term money market instruments with the remainder in cash. The fund’s equity portion in particular, which is focuses on high-quality, blue-chip companies, has the ability to generate strong cashflows consistently over time.

Within this split the assets are deliberately chosen to provide some insulation from top-down events that the managers cannot control.

Indeed, in the latest monthly factsheet, the managers acknowledged the huge movements in markets recently, specifically the “shock waves from the war in Ukraine” as well as lingering Covid and inflation concerns.

They said that Troy’s style was “rooted in the selection of companies well placed to determine their own fortunes”, meaning that they tend to avoid businesses with too many “external factors” such as, “excessive” single country exposures or those dependent on the changing commodity and energy prices.

AJ Bell’s head of investment analysis Laith Khalaf, who highlighted the fund, said that this combination and style of investing fitted a more “conservative mindset” but still offered investors “a diversified portfolio run by a manager with pedigree”.

The five FE fundinfo Crown-rated trust has made 68.5% total returns in the past decade, in line with the average IT Flexible Investment fund (68.8%) but have both lagged the FTSE All Share during that time (96.7%).

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Alliance Trust

Staying in the closed-ended space, James Carthew, head of investment companies at QuotedData, highlighted the Alliance Trust as a core, diversified portfolio pick.

The £2.8bn trust is an ‘dividend hero’, having raised its dividend every year for the past 54 years and is one of the oldest and largest investment trusts.

It is an active multi-manager portfolio, with investment managers, Willis Towers Watson, sub-contracting the management of the trust to 10 stock-pickers with different styles, each of which runs a 20-stock portfolio, totalling 188 individual holdings at present. As such, although the portfolio is broadly diversified, the individual stock picking process is very concentrated.

By using this method Carthew said they each “select their best ideas to make up a geographically diverse portfolio”.

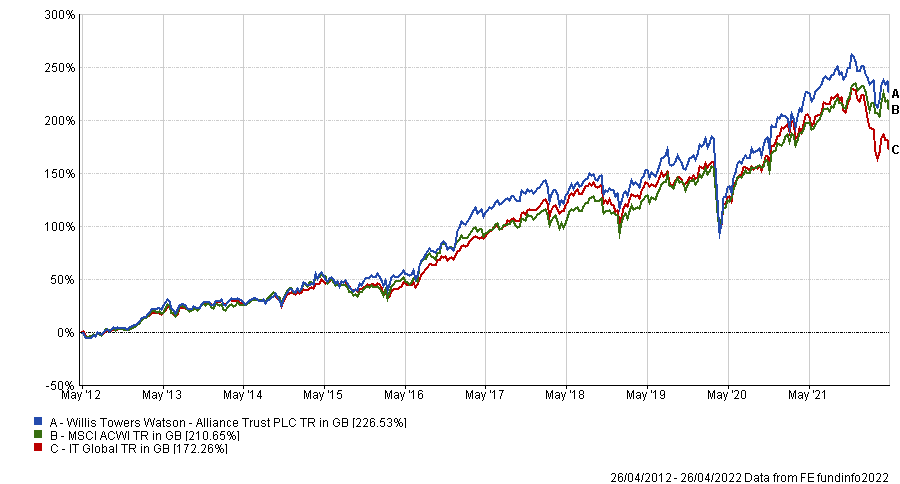

Over the past decade this process has delivered investors 225.5% total returns, better than the MSCI ACWI benchmark and the average IT Global trust (210.7% and 172.3%, respectively).

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

RIT Capital Partners

Another option was Morgan’s pick, a fund he said “covers a lot of bases for investors”: the RIT Capital Partners fund.

The five crown-rated fund invests in a broad range of assets, including equities, bonds and alternatives, all via a “flexible and unconstrained approach”, he said.

This enables it to “capture the long-term performance of markets while reducing the ups and downs along the way”, fulfilling the trust’s core priority of protecting shareholder capital, regardless of the bigger picture.

Morgan said that it “maintains an edge” in its process “through access to specialist managers and private equity deals, as well as the ability to bolster risk management through hedging”.

As a result, the trust has made 162.5% in the past decade, beating the IT Flexible investment sector average (68.8%).

VT Momentum Diversified Income

For investors after some open-ended options, Chris Salih, multi-asset fund researcher at FundCalibre, recommended the VT Momentum Diversified Income fund, noting that the fund has proven its ability to deliver through a range of different market environments.

Indeed, over the past 10 years the fund’s performance has consistently ranked in the top quartile across all time frames, including year-to-date. In total it has made 95.6% total returns over the past decade, ahead of the IA Mixed Investment 20-60% sector average (60.2%).

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Salih said it had achieved this “through the clever use of a variety or asset classes and vehicles, and I believe its value-focused style is well set to benefit from the prevailing global conditions today”.

The fund mainly invests in UK equities, with some exposure to international assets, with a bias towards mid-cap stocks.

| Name | Sector | Fund Size(m) | Fund Manager | Yield | OCF | IT Net Gearing | IT Pub. NAV Discount | Launch Date |

| Personal Assets Trust | IT Flexible Investment | £1,838.40 | Sebastian Lyon, Charlotte Yonge | 1.12% | 0.73% | 0.00% | 1.62% | 01/01/1981 |

| RIT Capital Partners | IT Flexible Investment | £3,822.80 | 1.48% | 0.66% | 0.14% | -8.72% | 01/01/1987 | |

| VT Momentum Diversified Income | IA Mixed Investment 20-60% Shares | £173.80 | Richard Parfect, Mark Wright, Tom Delic, Gary Moglione | 4.85% | 1.07% | 26/03/2012 | ||

| Willis Towers Watson Alliance Trust | IT Global | £2,877.20 | Willis Towers Watson | 1.99% | 0.64% | 8.68% | -5.57% |