Investors have piled into commodities funds over the past few months as severed oil supplies from Russia drive up the price of gas and energy, contributing to the highest rates of inflation in 30 years.

To demonstrate this, the IT and IA Commodities and Natural Resources sectors have climbed 21.2% and 15.9% since the start of the year as many other sectors struggled.

Along with empirical evidence there are other signs that commodities are booming, such as Blackrock World Mining’s appearance among fund platform interactive investor’s most bought trusts – a place it has held for several months in a row.

Demand in the area could remain high as the West looks to supplement lost oil imports and China’s zero-Covid policy continues to delay production lines, but some are concerned that investors could get carried away by the sector’s short-term success.

Andy Merricks, co-manager of the 8AM Focussed fund, pointed out that there was a spike in commodity prices during the financial crisis in 2008 which “didn’t last anywhere near as long as many investors assumed that it would.”

Total return of sectors over the past 20 years

Source: FE Analytics

He added: “It’s dangerous to get carried away with the rise in commodity prices that we’re seeing at the moment because it can reverse quite quickly.”

Merricks currently has a 7% allocation to energy and 3% to precious metals in his fund to “cover all bases”, but this can drop to zero depending on sentiment.

He also pointed out that the prices of actual commodities and commodity equities perform very differently, stating: “Physical gold has tended to be more stable in price than the mining companies that dig it out of the ground.”

Conversely, Chris Metcalfe, chief investment officer at IBOSS, was more bullish on commodities, keeping allocations at approximately 10% of his portfolios.

Funds in the sector have underperformed against their global peers over the past decade but their low value compared to expensive US tech stocks gives them plenty of room to grow over the coming years.

He said: “Years of misallocation of capital and naïve assumptions around energy and metals requirements cannot be rectified in a couple of quarters.”

Total return of sectors over the past decade

Source: FE Analytics

Lisa Thompson, equity portfolio manager at Capital Ideas, agreed that undervalued commodities companies will continue to rise in future as relations between the East and West appear increasingly strained, but not at the fast rate they have in the short-term.

She said: “The market has overreacted, and we are already seeing prices come back down a bit. But, compared to where we were a year ago, commodity prices are significantly higher – and I do think that’s a durable trend.”

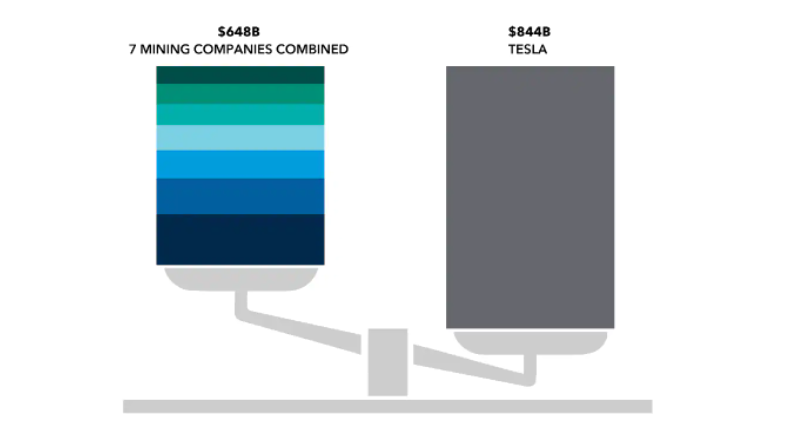

Douglas Upton, equity investment analyst at Capital Ideas suggested that it would take some time still for the undervalued sector to catch up with the US tech market, as the combined value of the seven largest mining companies are worth less than the market capitalisation of electronic carmaker Tesla.

Value of the world’s seven largest mining companies vs Tesla

Source: RIMES

However, Richard de Lisle, manager of the VT De Lisle America fund, has indicated that it is the right move over the long term and was bold in his initial response to the recent commodities surge, increasing allocations to account for a quarter of his total holdings.

He widened exposure to 25% because rising inflation and the war in Ukraine has put an end to years of underinvestment.

De Lisle said: “Recent success is enticing. It’s been a long time since the last commodity shock and, yes, people should pay attention and invest. Commodities are in finite supply and overall their prices do tend to rise over time.”