Analysts at interactive investor are backing Scottish Mortgage to bounce back from its recent crash, saying it is well positioned to grow and reward patient investors over the longer term, despite crushing short-term performance.

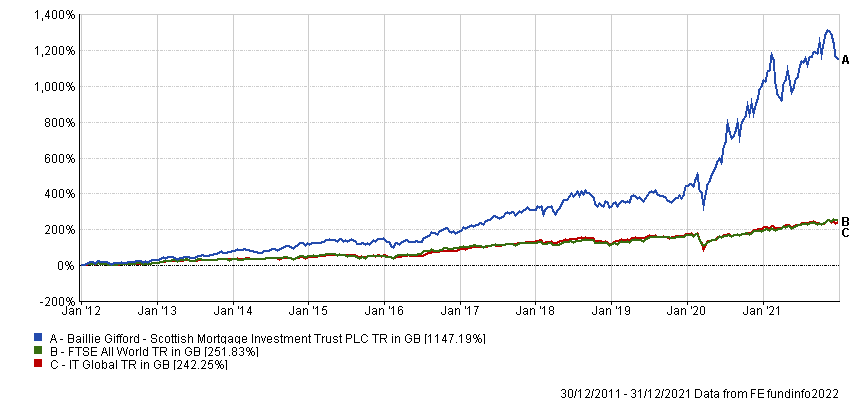

The darling of the closed-ended sector, Scottish Mortgage milked the post-financial crisis bull run in growth stocks for all it was worth. It made 1,147.2% in the 10 years to the start of 2022, more than quadruple the gains of its FTSE All World index benchmark and IT Global sector.

Performance of trust vs sector and index over 10yrs to 2022

Source: FE Analytics

As a result, the money came pouring in and its market cap peaked at more than £20bn on 4 November, making it the UK’s largest investment trust.

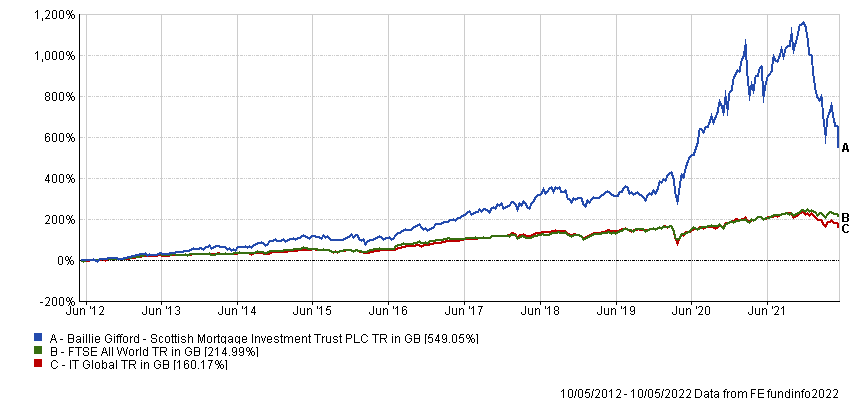

However, nervousness about the prospect of spiralling inflation and interest-rate hikes has hit growth stocks, such as the ones favoured by Scottish Mortgage. The trust is down 41.7% so far this year and 49.4% from its peak, pushing its market cap to £11.2bn, below the £12bn value of private equity trust 3i Group.

Performance of trust vs sector since 04/11/2021

Source: FE Analytics

The yield on 10-year US government debt has risen from 0.55% in 2020 to about 3% today. The more that bonds offer, the lower the valuation of high-growth companies, as these promise profits way out into the future.

Yet the challenging macroeconomic environment hasn’t stopped interactive investor’s head of funds research Dzmitry Lipski from continuing to back the trust.

“Despite the recent sell-off, or as long-term investors would say, ‘short-term volatility’, it is still well positioned to grow and reward patient investors over the longer term,” he said.

“The size of assets should continue to provide easier access to more opportunities in both public and private markets, and the managers’ expertise and their commitment to work with academia should allow them to find modern portfolio ideas and maintain a competitive edge against other players.

“Support and access to wider resources from Baillie Gifford are also important, especially in such challenging times.”

Scottish Mortgage’s investment philosophy is inspired by research from professor Hendrik Bessembinder of Arizona State University, which showed that half of the wealth created by the US market from 1926 to 2016 came from just 0.4% of companies, while the majority of other stocks underperformed bonds.

The trust’s managers focus on finding the companies that they believe have the potential to enter this small group and deliver outsized returns, paying little regard to traditional valuation metrics such as price-to-earnings ratios.

However, one of the downsides to this approach is that the returns are less stable than those generated by value or quality-growth strategies, for example. Former manager James Anderson, who retired from the trust at the end of April, even said aiming to deliver returns in a consistent manner was preventing his peers from harnessing the true power of the stock market.

“Managers and consultants will continue to talk to themselves of tracking errors and Sharpe ratios as risk controls (the reader is fortunate if they are unexposed to such terms) whilst their clients suffer,” he wrote in May 2020.

“Instead of embracing exponential growth, investors and asset allocators have fled. Performance chasing has its own evils, but replacing it with endless rebalancing towards ‘value’ strategies backed by a blind conviction that reversion to the mean is inevitable has been an investment tragedy.”

Despite the recent collapse in Scottish Mortgage’s share price, its 10-year returns of 549.1% are still more than double those of its benchmark and triple those of its sector.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

interactive investor said the departure of Anderson should have little impact on the way the trust is run.

“There will be no changes to the process and philosophy, and the new lead manager Tom Slater will continue seeking exciting opportunities with significant growth potential,” it noted.

Lipski added the trust’s current discount of 6.3% could represent an opportunity, as this figure has been close to zero over one and three years.

“Investors should note, however, that it is a higher-risk investment due to its high portfolio concentration, exposure to unquoted companies and tech stocks,” the analyst continued. “The risks of all this are enhanced further by gearing (borrowing), so it works better as a satellite holding in a well-diversified portfolio.”