Investors who suffered through almost three decades of disappointing returns from the Japanese markets have been rewarded over the past 10 years but there is much more to come, according to M&G’s Carl Vine.

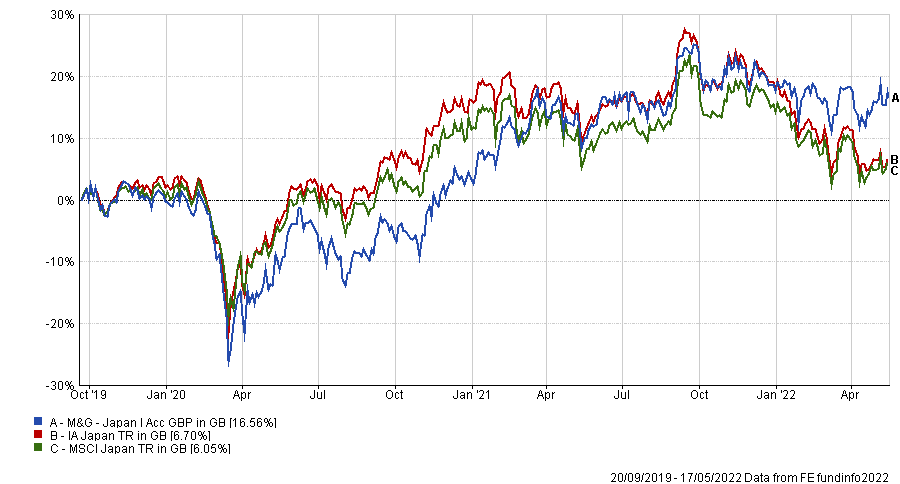

The manager of the £203m M&G Japan fund has done a stellar job at running money in the region since taking charge of the fund in 2019 from Johan du Preez. It has made a top-quartile return (16.6%) in the IA Japan sector since.

However, the fund has been successful for a longer period than that, making the fourth-highest returns in the sector over 10 years.

Total return of fund vs sector and benchmark since manager start

Source: FE Analytics

During this decade, Japan has been a solid option for investors. Indeed, looking at all 58 sectors in the Investment Association Universe, IA Japan funds have made 145.6%, beating other equity peers in the UK and emerging markets, while lagging only US and global funds.

Among smaller companies, Japanese small-caps have beaten their European and UK counterparts, according to FE Analytics.

However, the next decade could see Japan to shoot up the leader board, according to Vine, who said that he expected the market to growth by double digits per year in the coming 10 years.

He highlighted the ongoing corporate governance regulations started by former prime minister Shinzo Abe, but said that while many have spoken about them as a hypothetical good, in the past few years this has turned into actionable benefits.

“It is no longer just a story. Japanese earnings compounded just under 10% per year over the past decade. Not many stock markets consist of companies that can deliver that type of performance – it’s really only the US,” he said.

He said, in fact, that the Japanese corporate sector earnings, which is what much of the valuations in the stock market are based from, have compounded at a better growth rate than the S&P 500 for much of the past decade.

“People are sick and tired of hearing about Japanese reform, and I’m sick of talking about it – especially when people don’t believe me – but it really is happening, it is factual and it is delivering results,” he said.

This should make the market insulated from potential outside shocks and does not rely on global economic growth to deliver.

Instead, he argued, it requires Japanese companies to “do what they should have been doing for the past three decades”.

He noted that even before adding the benefits of dividends, already low starting valuations, mergers and acquisitions (M&A) or buybacks, he expected companies to achieve a double-digit compound return from earnings over the next seven to 10 years.

“There are not a lot of people predicting those types of returns from any developed equity market in the world today,” he said.

“I think Japan is hiding in plain sight. Ten years ago you had to take a leap of faith about these stories about Abenomics and corporate change. Now you can say it has been delivered.”

This structural trend is enhanced by positive macroeconomic factors, which are also set to benefit the once-beleaguered region.

Having suffered through years of low inflation, low economic growth and low interest rates, there are signs of life in Japan.

Indeed, inflation has recently risen above 1%, something that Vine said was “fantastic for Japanese equities” and marked the successful escape of deflation that the country was “flirting with” since before the global financial crisis. Meanwhile, headline inflation rates in the West are in the high single digits or low double digits.

There has also been a change in the consumer, with a recent Bank of Japan survey showing consumers on the street were feeling more positive about price rises – something that has been rejected over a long period of time.

Vine said this should lead to a healthy inflationary environment, rather than a runaway one, particularly when combined with prime minister Fumio Kishida’s most recent comments on wage inflation.

Kishida said he would not be getting in the way of private companies and offered up solutions such as tax incentives, recognising the need to get wages and productivity up through investment, but not at the expense of profits.

“As such he is paying companies to give workers higher wages and invest in labour force to profitably raise wages. It is the most sensible set of policies I have heard in my entire career in Japan,” said Vine.

“It reminded me of when Shinzo Abe spoke in 2012 and the market went up 60% or so in the coming year.”