Scottish Mortgage can play an important role in portfolios despite being hit with some of the heaviest losses in its history, analysts have asserted – so long as investors take a long-term view and can stomach near-term volatility.

After a long track record of outperformance, the investment trust is going through a rough patch. While its 546.3% total return makes it the best performing member of the IT Global sector over the past 10 years, it is ranked 16 out of 17 trusts over the past six months after losing 49.9%.

Scottish Mortgage’s strong long-term returns stemmed from its preference for high-growth stocks, particularly ‘disruptors’ in the tech space, which surged in the decade after the global financial crisis thanks to ultra-low interest rates and quantitative easing.

However, soaring inflation and moves by the Federal Reserve, the Bank of England and other central banks to lift interest rates means investors have become less willing to pay lofty valuations for future earnings, thereby hammering the very growth stocks that the trust prefers.

Performance of Scottish Mortgage vs sector and index over 10yrs

Source: FE Analytics

In Scottish Mortgage’s full-year results to 31 March 2022, deputy manager Lawrence Burns urged investors to avoid taking a short-term view of the trust’s performance and highlighted the long-term nature of its investment approach.

“Long-term endurance in turbulent times such as those of the last few months can be challenging. In periods of stress people's time horizons contract and the pressure to sacrifice long-term gains for immediate respite grows by the day. Should our own time horizon ever meaningfully shorten, we would be destroying our greatest advantage,” he said.

“We have no intention of ever doing this but if we did our shareholders should sell. For it is precisely at such difficult times that the distinctiveness, and importance, of taking a long-term perspective is greatest - for us as investors, for the companies in which we invest and for our shareholders.”

Many investment trust analysts continue to back Scottish Mortgage, despite recent challenges.

Tracy Zhao, senior fund analyst at interactive investor, described Scottish Mortgage’s full-year results as “sobering” but pointed out that its performance in the six months since November 2021 have been “the real party stopper”.

Despite this, she argued that the trust remains “an excellent adventurous holding” but one that needs to sit alongside lower risk investments in a portfolio. She also noted Scottish Mortgage’s discount to net asset value (NAV): it is currently trading on a 8.7% discount, having started 2022 on a discount of around 3%.

“The trust remains a strong choice for investors who are prepared to invest for the long term and look through these challenging times, for the most exciting ideas that have been picked by the trust,” Zhao said.

“And for those investors, the trust’s current trading discount, together with market’s rotation away from growth stocks, could well be an attractive entry point. But patience should be key.”

Scottish Mortgage’s discount/premium over 5yrs

Source: FE Analytics

Analysts at Numis also remain optimistic on Scottish Mortgage’s prospects, pointing out that it has “a highly differentiated approach” and focuses on structural growth themes of digitisation of the economy, the intersection of information technology and biology, and energy transition.

This is expected to continue even though longstanding manager James Anderson retired at the end of April, leaving Tom Slater as lead manager with Lawrence Burns as deputy.

“We understand that the current drawdown is in the top 10 since inception in 1909, behind the World Wars, 1920s depression and 1970s. The shares are down circa 50% since their peak in late 2021, making this the second largest drawdown in ‘recent’ history, behind the global financial crisis.”

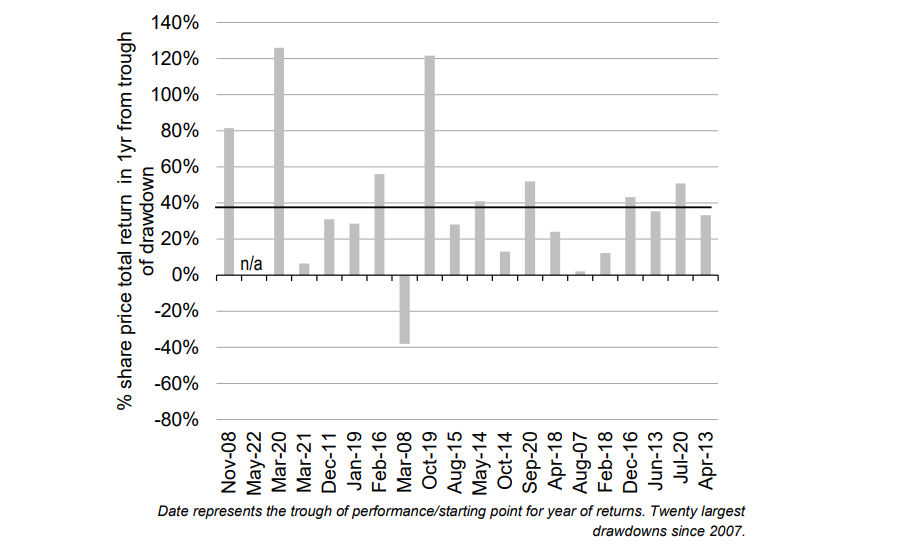

The chart below shows the trust’s largest drawdowns since 2007 and the subsequent one-year returns. Numis said the following performance is “normally pretty strong”. Indeed, there has been an average share price return of around 40% in the year following a trough in Scottish Mortgage’s performance.

Scottish Mortgage’s share price return in year after performance trough

Source: Refinitiv, Numis Securities Research

“The manager and board have always highlighted that the approach could be volatile and returns will differ significantly from market returns. Investors may have been aware of this, but it will not stop the recent period hurting,” Numis’ analysts said.

“Clearly timing the bottom of the current sell-off is extremely difficult, and it likely has further to go, but buying a manager or approach which has a good long-term record at a time when it is out of favour is normally a profitable approach in the investment companies sector.

“We believe Scottish Mortgage continues to warrant a significant place in a portfolio given its unique approach and history of bouncing back from periods of weakness.”

Jefferies continues to put a ‘buy’ rating on the trust, which is assigned to investments the firm thinks will provide a total return of at least 15% over the coming 12 months.