Renewables, asset financing and music streaming are three alternative investments that BNY Mellon’s Paul Flood has been looking to as bonds sold off in the first half of 2022.

Fixed income assets have been caught up in the broad-based sell-off that has hampered markets over recent months, as investors worry about the impact of higher interest rates and the conflict in Ukraine.

The outlook for bonds is especially uncertain after Federal Reserve chair Jerome Powell suggested the central bank will bring down inflation – which has surged to multi-decade highs – at any cost.

Meanwhile, Russia’s invasion of Ukraine – and the resulting sanctions and increases in energy costs – threaten the economic recovery that was taking hold after the pandemic’s lockdowns, leaving investors facing the risk of sluggish growth and rising inflation.

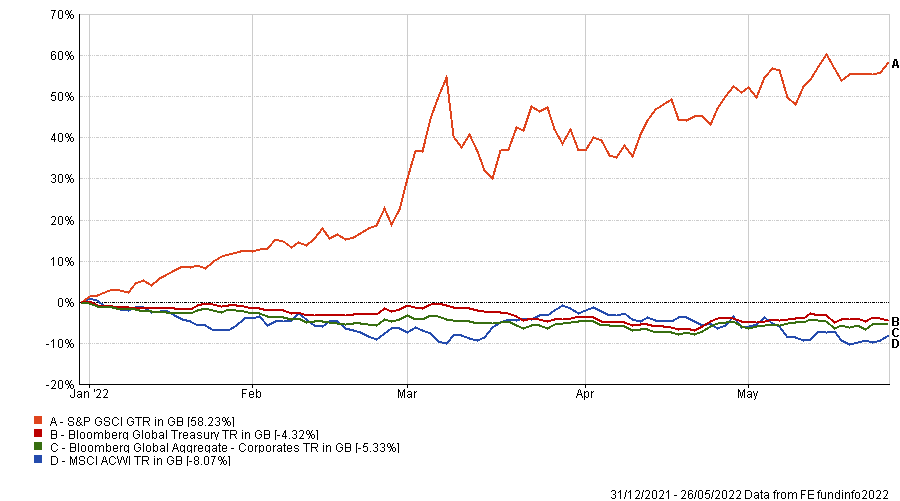

Performance of markets over 2022

Source: FE Analytics

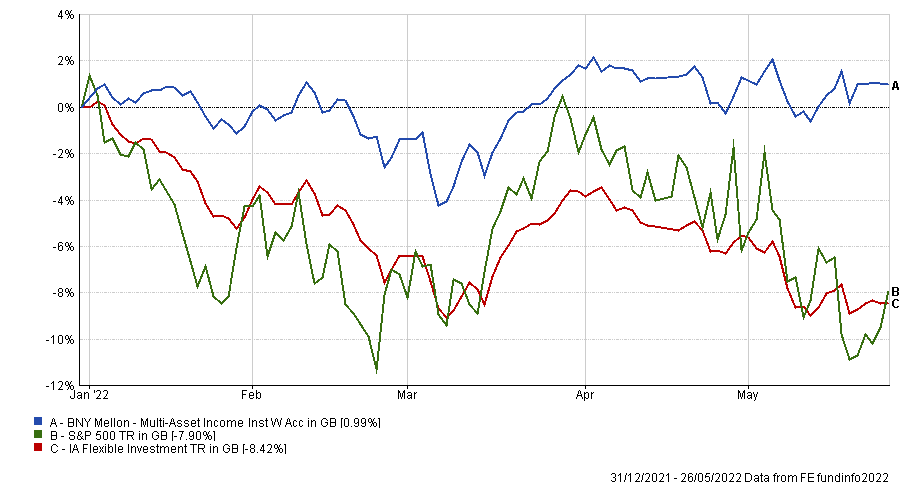

Flood (pictured), whose BNY Mellon Multi-Asset Income fund is in the first decile of the IA Flexible Investment sector over 2022, said: “Against this volatile backdrop and the dwindling appeal of bonds, we would point to alternatives – namely renewables, asset financing and music streaming – as offering potential sources of inflation-protected returns that can also provide diversification in a more stagflationary world.”

Below, the manager explains why these three areas could be attractive to income investors.

Renewables

Renewable energy companies have generally performed strongly over the past few months, after Russia’s invasion of Ukraine and sanctions heaped upon the belligerent by the West prompted countries to consider their future energy security.

“Power prices remain elevated and we expect that long-term power-price assumptions will have to rise as Europe tries to reduce its power dependency away from Russia,” Flood said. “This should benefit many of the renewable companies’ valuations.”

One area that the manager is particularly interested in is battery-storage companies that help with the transition to renewable power. They have reported strong upgrades in revenue generation recently and have the ability to gain additional revenues by providing capacity availability to the grid.

According to its annual report to the end of 2021, BNY Mellon Multi-Asset Income owned renewables assets such as the Gresham House Energy Storage, Bluefield Solar Income and Renewables Infrastructure trusts.

Asset financing

Flood also highlighted ship and aircraft-leasing companies as attractive income opportunities, as they have benefited from escalating transport costs and a recovery in travel after the Covid-19 pandemic.

Shipping hiring costs are climbing due to a lack of available vessels and this has been exacerbated by Russian ships no longer being able to dock in Western countries.

This also comes after a lack of certain types of ships being built over the past decade, which has created a shortage of capacity in the small- and mid-size ships that can dock at smaller ports that cannot handle large vessels.

Flood said: “These assets might not have inflation-linked revenue like renewables or infrastructure, but in many cases their secondary-market values are rising on the back of higher commodity, energy and labour costs.

“In addition, companies are considering the overall costs of running older assets for longer, versus replacing them with new ships or aircraft.”

Some of the holdings that fit into this theme include Tufton Oceanic Assets, Taylor Maritime Investments and Doric Nimrod Air Two, BNY Mellon Multi-Asset Income’s 2021 report shows.

Performance of BNY Mellon Multi-Asset Income vs sector and index over 2022

Source: FE Analytics

Music streaming

Explaining the rationale for taking exposure to music streaming, Flood pointed out that around 83% of the estimated $12bn of recorded music revenues in 2020 came from streaming. This puts it in stark contrast to the live music and entertainment scene, which was damaged significantly by the pandemic’s lockdowns.

There are questions over some ethical considerations when it comes to music streaming. Flood pointed to a UK Intellectual Property Office report that showed the top 1% of artists account for 80% of all streams, while other data suggests some artists receive just 2% of the royalties from their streams.

However, he is optimistic on the long-term prospects for the space, arguing that record companies, streaming platforms and recording artists will eventually reach “a more equitable agreement” on royalties and ownership.

“Overall, the shift towards a subscription-based streaming model has transformed the economics of the music industry, enhancing the visibility of revenues and allowing for significant margin expansion through lower distribution costs and operating leverage, while gaming, social media and emerging-market growth increase addressable markets,” the manager finished.

“Indeed, we believe people paying for music via streaming platforms represent a significant growth opportunity, particularly among audiences in emerging markets such as China, India, Africa and South America. Another strength of investment in music royalties is that the performance of the asset class is relatively uncorrelated with the economic cycle, at least so far.”

BNY Mellon Multi-Asset Income has taken some exposure to this area through Hipgnosis Songs.