The £150m Downing Renewables & Infrastructure Trust (DORE) has announced a proposed issue of 250 million ordinary shares to raise £50m for to take advantage of near-term pipeline assets.

Shares will cost 111p each, a slight discount on the 113p price as of Tuesday afternoon with £17.3m of the money raised going towards repaying its revolving credit facility (RCF).

The company will invest the leftover capital in line with its current investment policy in solar, hydro, wind, batteries and other infrastructure assets in the UK, Ireland and Northern Europe.

Chair Hugh Little said the move has the “potential to further grow NAV [net asset value], increase the diversity of DORE's portfolio, and continue to provide stable returns to shareholders”.

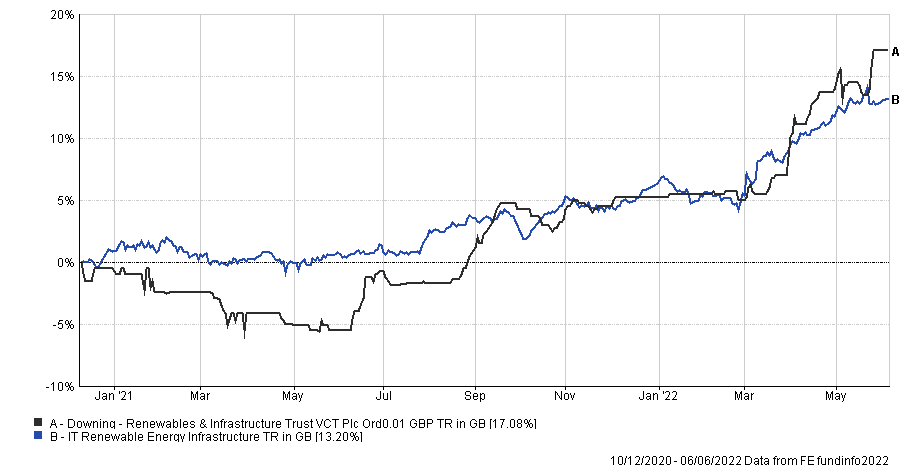

The trust’s performance has indeed been strong, outperforming its IT Renewable Energy Infrastructure sector by 3.8 percentage points since its launch in 2020, as shown in the chart below. It has a yield of 4.2%, which is below average for the sector.

Performance against sector since inception

Source: FE Analytics

Investment managers Tom Moore and Tom Williams diversify the trust through technology, geography, revenue type and project stage.

The trust’s holdings include hydropower plants, ground mount solar projects, rooftop solar portfolios and a wind project.

Income-based infrastructure investments have become increasingly popular in recent months as high inflation and interest rates have caused investors to panic.

This combination of factors has led to a fall in stock markets, while the cost-of-living crisis in the UK has meant people have sought out high-yielding assets to mitigate higher prices.

Indeed, infrastructure funds registered an inflow of £384m since the beginning of 2022, as Trustnet recently reported, and are currently preferred over outperforming but more volatile commodities, according to data from the Investment Association.

Investment trusts are often cited as more appropriate vehicles for alternative investments as they are not forced sellers if investors begin to sell, a point raised by Emily Fletcher, co-manager of the BlackRock Frontiers Investment Trust.