Just two funds out of the thousands in the Investment Association universe have been awarded a top score in every single FE fundinfo Crown Rating rebalance on record, Trustnet analysis shows.

The FE fundinfo Crown Ratings are designed to help investors identify the funds that are strong when it comes to stock picking and consistency of outperformance against a credible benchmar, all while doing this with relatively low risk.

The top 10% of funds are awarded a coveted FE fundinfo Crown Rating of five and, with the next rebalance due in July, Trustnet looked for the funds that have consistently been awarded a five-crown rating.

Our records on the ratings goes back to the start of 2012 and only two funds were given five crowns at every one of the 21 rebalances since then.

The first is LF Lindsell Train UK Equity, which will be a familiar name to many investors. Headed up by FE fundinfo Alpha Manager Nick Train, the £5bn fund is run with a quality-growth approach. Train looks for what he considers to be exceptional companies and his strict criteria for this leads to a concentrated portfolio of between 20 and 30 stocks.

The fund has proven to be very successful over the long run: LF Lindsell Train UK Equity’s total return of 208.4% over 10 years is the 10th highest of its 199 peers in the IA UK All Companies sector. The fund is also in the top-quartile of its peer group for numerous risk and return metrics over the past decade, including alpha generation, maximum drawdown, maximum gain, Sharpe ratio and volatility.

Performance of LF Lindsell Train UK Equity vs sector and index over 10yrs

Source: FE Analytics. Total return in sterling to the end of May 2022

What’s more, it has outperformed its FTSE All Share benchmark in eight of the past 10 full calendar years. However, it’s important to note that this long-term picture is being soured by its short-term numbers.

As the rising inflation and interest rates have caused investors to rotate into value stocks, the growth businesses favoured by LF Lindsell Train UK Equity have started to struggle.

The fund underperformed the index in 2021 and fell into the IA UK All Companies sector’s bottom quartile. It has also lost 13.2% over 2022 so far, compared with a fall of 6.7% from the peer group and flat result for the FTSE All Share; correspondingly, it’s now in the third quartile for many of those risk metrics mentioned above on a 12-month view.

Analysts at Square Mile Investment Consulting & Research said: “The fund has successfully and consistently met its long-term performance objective and we have conviction in the manager and his ability to continue to meet this over the long term.

“Though, we would stress that this strategy is probably best suited to investors that have little interest in the month-to-month and year-to-year performance of their investments but instead seek attractive returns over very long time periods.”

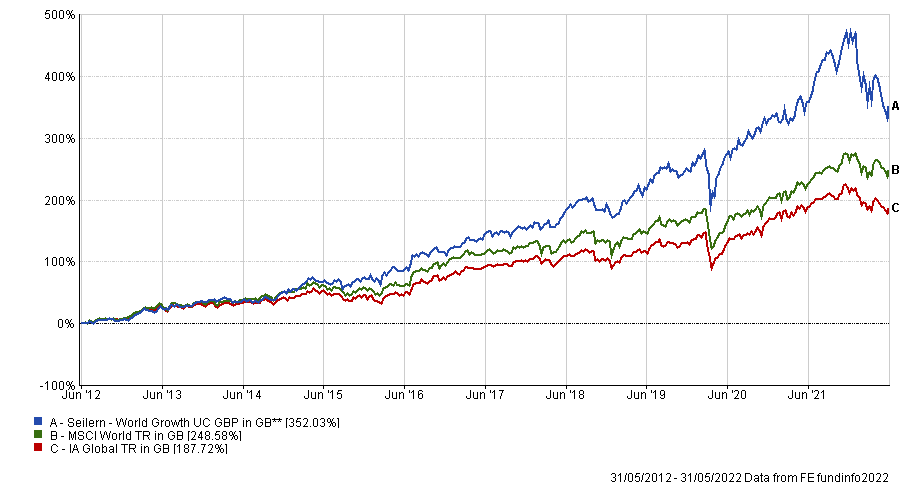

Performance of Seilern World Growth vs sector and index over 10yrs

Source: FE Analytics. Total return in sterling to the end of May 2022

It’s a similar story for the only other fund to win an FE fundinfo Crown Rating of five in every rebalance we looked at: Seilern World Growth.

In 2020, lead manager Michael Faherty told Trustnet how the fund’s strict quality-growth investment process starts with an universe of around 58,000 stocks before a series of screens and the application of ‘10 Golden Rules’ (characteristics that each company must hold if it is to be considered for Seilern’s funds) casts 99.9% aside.

The remaining handful of stocks are then debated by the fund’s managers to see if they will be included in Seilern World Growth’s concentrated portfolio of between 17 and 25 names.

As the chart above shows, this quality-growth approach has seen the £1.8bn fund strongly outperform both its average IA Global peer and its MSCI World benchmark over the past 10 years.

Like LF Lindsell Train UK Equity, however, the rotation away from growth stocks has hit it hard and over 2022 so far it has made a bottom-quartile loss of 19.4% (versus a 9.6% loss from the sector and a 6.3% fall from the MSCI World).

The fund’s process means it avoids entire sectors for reasons such as the lack of a compelling growth case (utilities, telecoms, banks), holding limited pricing power (commodities, oil & gas, airlines) or needing high capital intensity (heavy industrials, insurers, auto makers).

This means any recent underperformance should not surprise investors. Faherty told Trustnet: “There are lots of sectors which we will not invest in. This means the fund has a very understandable and stable way in which we expect it to perform and how it has largely performed in the past.

“We’re very clear at articulating to clients when the funds will not perform. In a situation where you have what you might call a rally in cyclical assets or value assets, or what we would call a ‘dash to trash’, this is a fund that should underperform and has underperformed in the past.”

With the FE fundinfo Crown Ratings due to be rebalanced next month, Trustnet will report back whether LF Lindsell Train UK Equity and Seilern World Growth continue their unbroken five-crown streak.

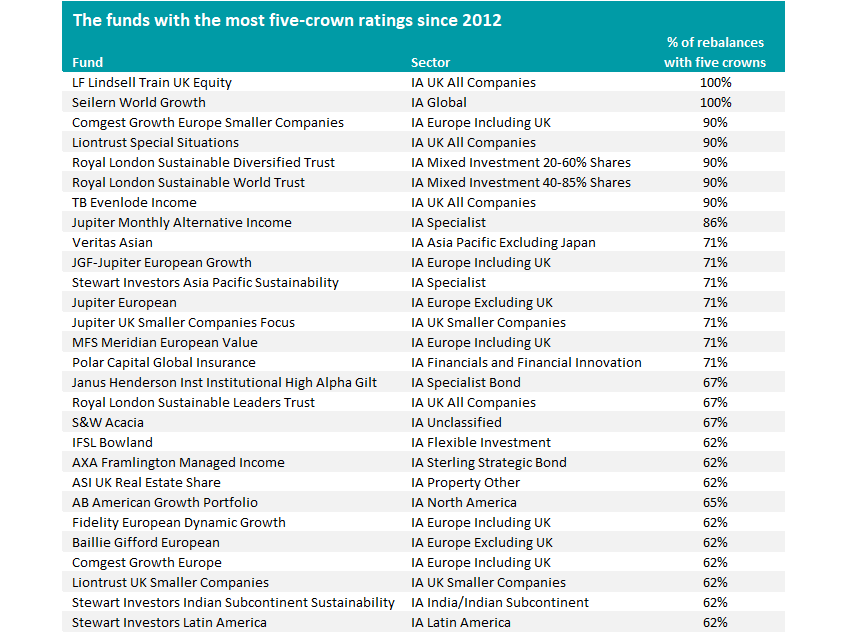

In total, there are 28 funds in the Investment Association universe that have held five crowns for more than 60% of the rebalances since 2012 and they can be seen in the below table.

Source: FinXL