Bonds are typically seen as a ‘safe haven’ asset that investors can retreat to when markets are rough, but instead of bond prices increasing while the rest of the market falls, valuations have dropped alongside equities over the past few months.

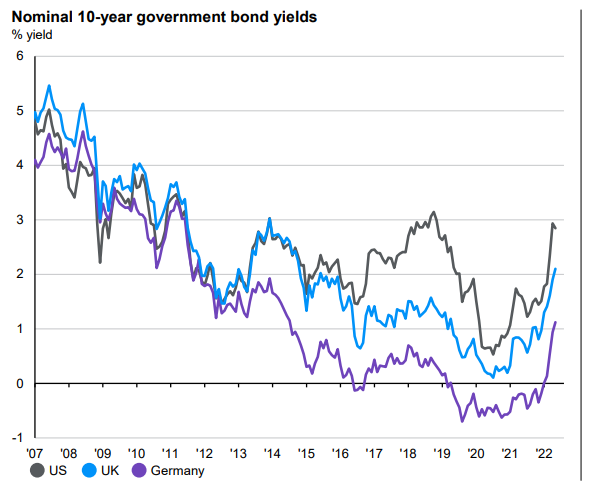

However, lower prices have led to relatively attractive yields, particularly on 10-year government bond, which have got some investors excited about the prospects for fixed income.

Myles Bradshaw, head of global aggregate fixed income strategies at JP Morgan, said: “Now is a good time to start buying bonds for someone without them already in their portfolio – valuations are more attractive so if you’ve got nothing it makes sense to start adding them in for income.”

Source: Bloomberg, J.P. Morgan Asset Management.

Now may indeed be a strategic time to buy, but with such a wide pool to choose from, investors may be left wondering where to start.

Adam Darling, co-manager of the Jupiter Corporate Bond fund, said that he is finding the most opportunities in investment grade bonds at the moment.

The asset class has suffered from a “toxic combination” of rising government bond yields and widening credit spreads, leading to huge sell offs.

However, this lack of interest has brought prices down and boosted yields to their highest rate in a decade, with investment grade bonds denominated in sterling now offering 4.5% yields.

Darling said: “Assuming that the current market panic around inflation and associated interest rate hikes starts to fade, such a yield – secured on the largest, most creditworthy companies in the market – could offer an interesting starting point for future returns.”

Lyndon Man, co-head of global investment grade credit and fund manager at Invesco, agreed that the global investment grade credit market is looking increasingly attractive as yields reach new highs.

He added: “The last time we saw such high levels of yield was during the 2011 European sovereign debt crisis when fragmentation concerns combined with the first ever credit rating downgrade in the US.”

His colleague, Stuart Edwards, fixed interest fund manager at Invesco, said that although they are increasing exposure across their portfolios, it is important for investors to remain flexible.

-

Sterling subordinated financials are another area of the market with a positive outlook, according to from Stuart Chilvers, manager of the Rathbone Strategic Bond fund.

His preference to sterling stems from the UK’s low terminal rate compared to the US, although he has kept durations short for now as he anticipates higher gilt yields in the future.

Likewise, Chilvers said that wider credit spreads have led to “extremely attractive yields” on subordinated bonds, adding: “The fundamentals of these businesses are generally exceptionally strong, so the yields on offer more than compensate you for the credit risk and limited duration risk in our view.

“In the short-term, these bonds are likely to underperform if credit spreads continue to widen given their higher beta, but we think in the medium-term investment horizon they represent an attractive risk-reward."

Furthermore, investors seeking inflation protection in addition to high yields should consider asset-backed securities, according to Philip Matthews, co-manager of the Wise Multi-Asset Income fund.

These types of bonds are backed by income generating assets such as mortgages and loans, so they could offer some protection against the rising cost of living.

Some of the best funds Matthews holds in order to increase exposure to the asset class includes TwentyFour Income fund, Starwood European Real Estate and GCP Infrastructure.

Malcolm Smith, head of international equities at JP Morgan, said that Chinese bonds are starting to look more appealing as the nation recovers from many of the internal issues that dragged its performance over the past year.

This has been shown in the equity market, where the MSCI China index is down 22.8% over the past 12 months following a string of harsh policies by the Communist Party of China (CPC) that limited the performance potential of businesses in the region and sentiment took a hit as a result.

However, Smith said that there are signs of improvement in China as policy becomes more supportive of the private sector and takes a “more realistic” approach to living with Covid, with the equity index up 3.9% over the past three months.

Total return of index over 12 and three months

GRAPH

Source: FE Analytics

He added: “We can start to see signs of inflection in the Chinese market, so that’s an area we’re looking at more closely across all of our portfolios.”

Bradshaw agreed that Chinese government debt is the most exciting area to watch in terms of bonds over the next six months, stating: “The economy is slowing, interest rates have gone up and they haven’t eased monetary policy, so it’s a great diversifier for your European and US fixed income.”

Those seeking income through bond dividends should diversify internationally and consider not only China, but the whole of the emerging markets, according to John Bilton, head of global multi-asset strategy at JP Morgan.

He stressed the importance of spreading risk, stating: “The diversification potential is huge and as a multi-asset investor, that’s what we’re always thinking about – how can I diversify my risk and still achieve those outcomes? That’s really the golden rule we’re trying to adhere to.”

Paul Flood, manager of the BNY Mellon Multi-Asset Diversified Return fund, also has a positive outlook on some government bonds, predominantly in the US.

In fact, Flood increased bond exposure from 0.6% at the end of March to 6.7% by the end of May – around 3.5% of this 6% rise was in US government bonds, and the remainder towards Australia and New Zealand.

He said: “Rate rises in both countries will squeeze disposable incomes almost immediately so it’s difficult to see their central banks raise rates as much as the market expects and both have already priced in a significant increase to base rates.

“This is not the case in the UK where the bond market is not pricing as many rate rises as other markets.”