The Consumer Prices Index (CPI) published this morning has registered an increase in prices year-on-year of 9.1%, up from 9% in April. Despite a smaller rise than the markets had expected, the index has now hit a new 40-year high.

Fuel and raw material prices were up by more than 22% year-on-year, and, driven by the supply crisis from Ukraine, food and non-alcoholic beverages were also among the biggest contributors to the upwards rally.

Analysts are at a loss trying to predict how long this situation will go on for. Les Cameron, technical expert at M&G Wealth: “We now see the inflation peak is going to be higher than earlier predictions. What we don't know is where it will stop and how long these high rates will be around.”

The rate is expected to grow even further later in the autumn, when the energy price cap will expire and energy prices could soar. For the next few months, the Bank of England (BoE) predicts inflation to hover at around 9% before spiking to around 11% in October.

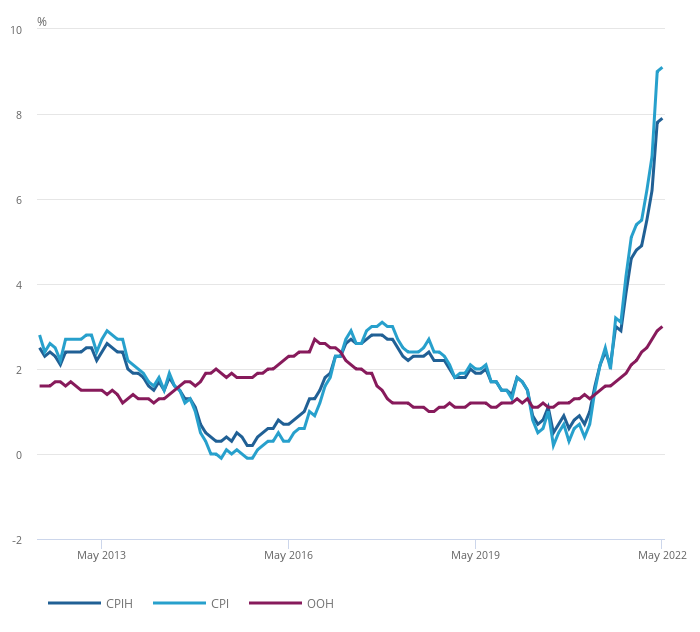

CPI, CPI including housing costs (CPIH), and owner occupiers' housing costs (OOH) component 12-month inflation rates for the last 10 years

Source: Office for National Statistics

Commenting on May's figures, Daniel Mahoney, UK economist at Handelsbanken, suggested that “we are, indeed, on course for this trajectory, unless an unexpected event occurs at some point this year”.

With such fortuity not yet on the horizon, many analysts see the UK one step closer to a recession.

While the valuation of sterling against the dollar is down to $1.22 compared to $1.23 yesterday, the burden to prevent a recession is on the shoulders for the BoE, according to Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

“With the economy taking on more of a sweat, the pressure is now on the Bank of England to apply much cooler compresses in the form of successive interest rate rises over the next few months to try and reduce demand and bring down prices”, she said.

Neil Wilson, chief market analyst for Markets.com, feared the BoE is not doing enough to protect the currency: “Better a short, sharp dose of monetary policy medicine now than prolonged stagnation/stagflation”, he said.

But further spikes in interest rates are also dangerous, as Mike Bell, global market strategist at J.P. Morgan Asset Management, warned: “There is the risk that without further rate rises a wage price spiral could develop. The Bank of England are therefore stuck between a rock and a hard place.”

Despite the uncertainty, not everyone was as pessimistic, with some commentators suggesting shy optimism. Some hope for headline inflation to be helped by falling freight costs and ingredient costs in the coming months could improve the picture, for example.

Others drew attention to the better piece of news that came out with this morning’s report, which is that the core inflation has slipped down 0.3 percentage points to 5.9% in May, slightly lower than the 6% predictions.

James Lynch, Fixed Income Manager at Aegon Asset Management, was among them.

“Yes, headline has moved from 9% to 9.1%, but core inflation fell from 6.2% to 5.9% which is a better gauge of underlying domestic inflation. So that is two months in a row that if you squint hard enough, we can see what almost seemed an exponential rise in prices starting to tail off”, he said.

Chris Beauchamp, chief market analyst at IG Group, agreed: “The rise to 9.1% for headline CPI will heap fresh opprobrium on the BoE for its slow hiking moves, but with core CPI a touch softer compared to last month’s figure perhaps there are still signs that the rise in prices is abating.”

But how does the everyday situation in the UK look? Emma Mogford, fund manager at Premier Miton Investors, said that today’s CPI figure is a reminder of the pressure that consumers and businesses are currently facing. Or, as Wilson put it, “consumers don’t pay core, they pay headline”.

While the inflation measure is a ‘one size fits all’, realities may seem wholly different depending on demographics as the increase in prices disproportionately affects some parts of society.

“People spending a lot of time at home, for example pensioners or the new army of people working from home, may well feel they are experiencing much higher inflation with increased energy and food prices and, for many, the dramatic rise in the cost of fuel”, said Cameron.

In an inflationary environment and without any increase in savings rates, more people with cash savings or near cash savings will see the continued erosion of their wealth in real terms.

“Strict budgeting, dipping into capital savings and perhaps even looking to invest cash to try and generate a real return should be on most people’s agendas at present”, he stressed.