Investors have been seeking out extra sources of income from dividend payments this year as the cost-of-living crisis tightens people’s budgets.

A closer eye has been kept on spending in the past six months as inflation exceeds 9% in the UK, so a good deal is more important than ever to many investors.

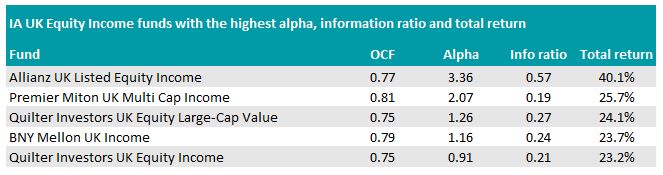

That’s why Trustnet has sieved through the IA UK Equity Income sector and found the funds delivering top alpha, information ratios and total returns over the past five years at below average costs.

Alpha is an important factor in accessing a manager’s talent, as it measures a fund’s returns above that of its benchmark.

Similarly, information ratios takes the performance of the benchmark away from the fund’s own returns and then divides this by its tracking error, giving a score for the additional risk taken by the portfolio. The higher the score the better, although anything above 0.5 is considered good. The maximum score is 1.

These two rates then give a clearer picture of how much the fund manager has added above the benchmark over five years. All the funds below were in the top 10% for each factor.

Source: FE Analytics

The best performer was the Allianz UK Listed Equity Income fund, which had the highest alpha, information ratio and total return of any portfolio on the list.

It made a total return of 40.1% over the past five years, beating the FSTE All Share index by 22.3 percentage points and flying ahead of its peer group by 28.2 percentage points.

The fund had an alpha score of 3.3 over the period, and the fund has managed to go up 6.1% over the past year despite the value cycle putting a strain on many portfolios.

While the £331.7m fund has performed well over the past five years, what may draw in investors is its below average price of 0.77%.

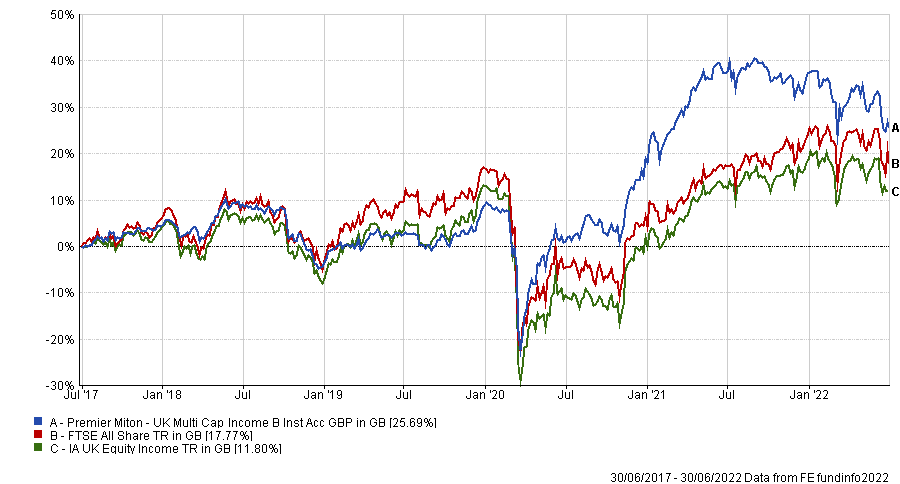

Total return of fund vs index and sector over the past five years

Source: FE Analytics

The two cheapest funds, however, were Quilter’s UK Equity Income and UK Equity Large-Cap Value funds, which each had a charge of 0.75%.

Returns of 24.1% for UK Equity Large-Cap Value and 23.2% for UK Equity Income over the past five years were in the top decile of the sector, although the funds are far smaller – the large-cap fund has £17.7m in assets under management.

Although it was the cheapest, Quilter’s UK Equity Income fund has the lowest alpha on the list at 0.91 as well as the lowest returns over the past five years.

Out of the two, investors would have been better off holding its large-cap sibling over the period, as the below chart shows.

Total return of funds vs index and sector over the past five years

Source: FE Analytics

The largest to appear on the list was the BNY Mellon UK Income fund, which has £1.2bn in assets under management (AUM).

It had an alpha rating of 1.2 and has beaten the FTSE All Share index by 5.9 percentage points over the past five years, making a total return of 23.7%.

Pay-outs to investors who hold the fund are also relatively high and the fund has a 3.8% yield, while its 0.79% charge makes it an affordable option.

Total return of fund vs index and sector over the past five years

Source: FE Analytics

The highest dividend payer on the list was the Premier Miton UK Multi Cap Income fund, which has a yield of 3.9%. However, it has the highest any fund on the list, costing 0.81% per year.

Investors looking for regular pay-out may find this fund appealing, and its 25.7% returns over the past five years make it the second highest performer on the list. This was also reflected in its 2.1 alpha rating.

Total return of fund vs index and sector over the past five years

Source: FE Analytics

Another portfolio worth mentioning is the Schroder Income fund, which just missed out in this study. It was the only other portfolio to sit in the sector’s top 10% for alpha, information ratio and total return, but its charge was higher than many of its peers.

Some investors may think the price of 0.89% is worth for the 22.5% increase in returns net of fees over the past five years.