The advantages of investing in small caps are well known – their smaller size means it is easier to make many times your money than it is with large caps, while the lack of analyst coverage in this area means there is a greater chance of finding an undiscovered gem and of outperforming the market.

Yet while the advantages of investing in small caps are well known, so too are the disadvantages. These assets tend to be more volatile and are usually among the hardest hit when the market turns south: for example, the IA UK Smaller Companies sector is down 28.1% since it peaked in September last year, more than twice as much as the IA UK All Companies sector.

Performance of sectors since 2021 peak

Source: FE Analytics

Meanwhile, the lack of analyst coverage means poor corporate governance is a greater risk. In a Trustnet article published earlier this year, Montanaro founder Charles Montanaro warned: “Crooks are more likely to run AIM stocks than rob banks.”

One way to lower these risks is to invest in a trust that takes a private equity approach to small caps.

This involves building a significant stake in portfolio holdings, often within a niche area where they have specialist knowledge, then engaging with management teams to improve returns.

Ken Wotton is the manager of Strategic Equity Capital, which is run using this strategy. However, he denied being an activist investor, pointing out he won’t buy into a company with the intention of “shaking things up”.

“We're not trying to find things that are broken and need fixing, or where we're going to change management,” he said. “Those situations are high risk and they're also very resource intensive.

“We aren’t just looking to buy and sell shares. We try to focus on the fundamentals of the business itself, then provide capital, obviously, but also give them advice on strategy, governance and ESG-related issues.”

Wotton and his team will also offer access to their private equity network, including individuals with relevant skills and knowledge of the company’s sector, and organisations such as specialist consultancies and M&A advisers.

Stuart Widdowson, manager of Odyssean, takes a similar approach to Wotton, albeit a more active one – his trust even tried to buy Strategic Equity Capital last year.

He likes to invest in market leaders as these deliver a higher rate of compound returns. The manager has a particular fondness for companies in this category that are going through a period of transformation or are underperforming their potential.

“Quite often that change can take two or three years for the stock market to really understand it and start to value it correctly,” he explained.

“While if an underperforming company can improve its performance, its valuation and its covetability go up significantly, not just for stock market investors, but also potential third-party buyers.”

This last point represents a significant source of opportunity for private equity trusts, on both the upside and downside.

Widdowson said that if he invests and fixes a company with strong potential “but the odd misfiring cylinder”, there is a strong likelihood that a trade buyer will pay a premium for it.

“They never want to find a bargain that might be underperforming, because there's career risk in that,” he added.

“It's another good way we avoid the classic trap of pure value investing, which is finding a cheap company that no one wants and never getting out of it.”

Wotton agreed with him. He said that when he is evaluating potential valuations and returns, he uses transactions in comparable companies as a benchmark.

“At the moment there's a big arbitrage between UK smaller company valuation multiples and similar transactions in private markets.

“That gives us a good margin of safety and it means that if the stock market doesn't re-rate businesses to reflect the value that we can see, there's a decent chance that a trade buyer will come along and do that instead.”

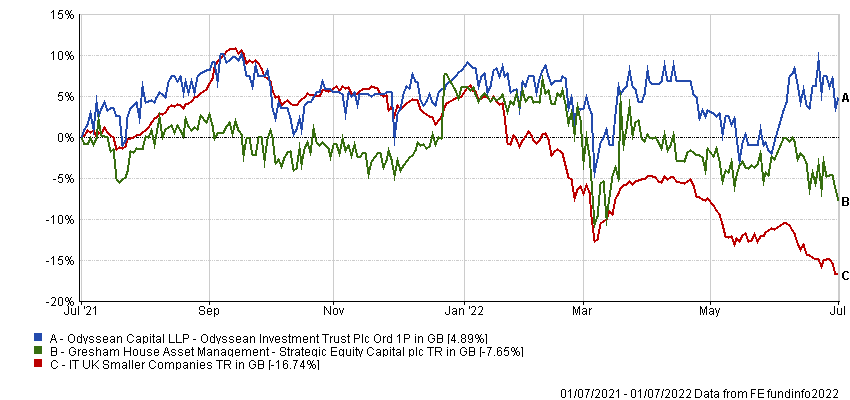

It is difficult to judge the trusts on their long-term performance – Odyssean has only been running since May 2018 and Gresham House only took charge of Strategic Equity Capital in May 2020.

Yet from a risk-control perspective they have both excelled in the sell-off of the past year. While the IT UK Smaller Companies sector is down 16.7%, Strategic Equity Capital has only lost 7.7% and Odyssean has managed to eke out a gain of 4.9%, aided by a movement in its share price from a discount to a premium.

Performance of trusts vs sector over 1yr

Source: FE Analytics

Yet there are downsides to this approach as well. Private equity is associated with higher charges and Odyssean’s OCF of 1.4% looks punchy. Strategic Equity Capital’s figure of 1.07% looks more reasonable, but both also levy a performance fee.

And these aren’t the only “costs” associated with a private equity strategy, according to Montanaro investment analyst Yannis Gidopoulos. He said taking activist positions is time- and resource-intensive and comes with notable opportunity costs.

“With more than 10,000 companies in our universe (95% of all quoted companies are small and mid caps), we want to spend a lot of time truffle-hunting,” he explained.

“We interview and/or travel to visit a few hundred companies each year. Taking activist positions would mean far less time for truffle-hunting, and therefore a smaller chance of finding the very best hidden gems.”

He added: “The other opportunity costs of activism are nimbleness and diversification. Owning small but high-conviction stakes means we have management’s ear but can remain nimble enough to get out when things do not work out as planned, and all within the context of a reasonably diversified portfolio.”