Ruffer Investment Company managers Hamish Baillie and Duncan MacInnes have warned we have entered a long-term regime of inflation volatility in which conventional portfolios will suffer – and they have never had a higher conviction in any outlook than they have today.

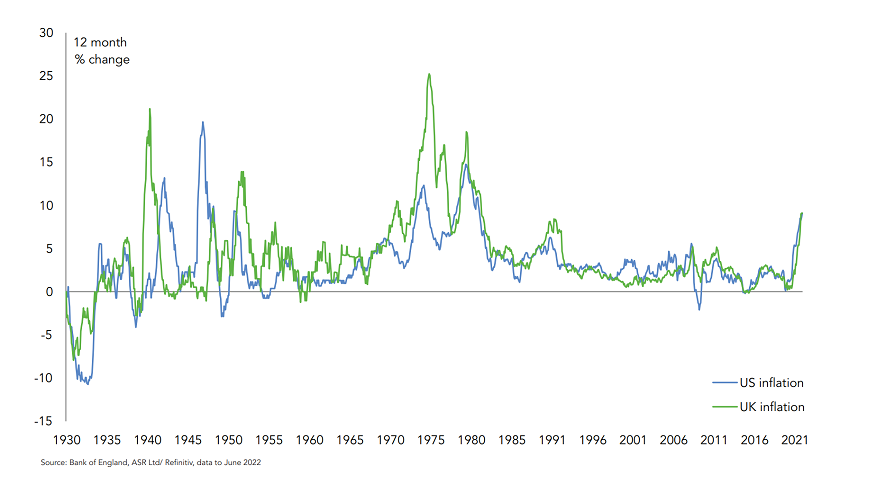

Speaking in the portfolio’s end-of-year message to shareholders, Baillie and MacInnes pointed out that the past 30 to 40 years of steadily falling inflation has been “something of an aberration” when compared with history, adding that we are likely to return to spasmodic bouts of inflation volatility such as those experienced after World War II and in the 1970s.

“We expect an extended period of accelerating financial repression – where interest rates are below the rate of inflation, forcing negative real returns upon savers,” they said. “‘Stealing money from old people, slowly’, as Russell Napier has memorably described it.

Historical inflation in the UK and US

“We believe we are evolving into a staccato, stop-start world of higher inflation and faster economic growth.”

Baillie and MacInnes said that the higher economic and market volatility they are predicting can be partly attributed to the actions of central bankers. The managers likened their approach to “an impatient child slapping on a ketchup bottle”, who after spending a decade trying in vain to create inflation, “have now got too much, all at once, in an uncontrolled splat”.

The question now is how hard central bankers will try to control the trend of rising prices, and here there are no easy choices: if they tighten too much, they risk a surge in unemployment and a recession; if they don’t tighten enough, inflation could become embedded into wages, leading to a similar wage-price spiral to the one seen in the 1970s.

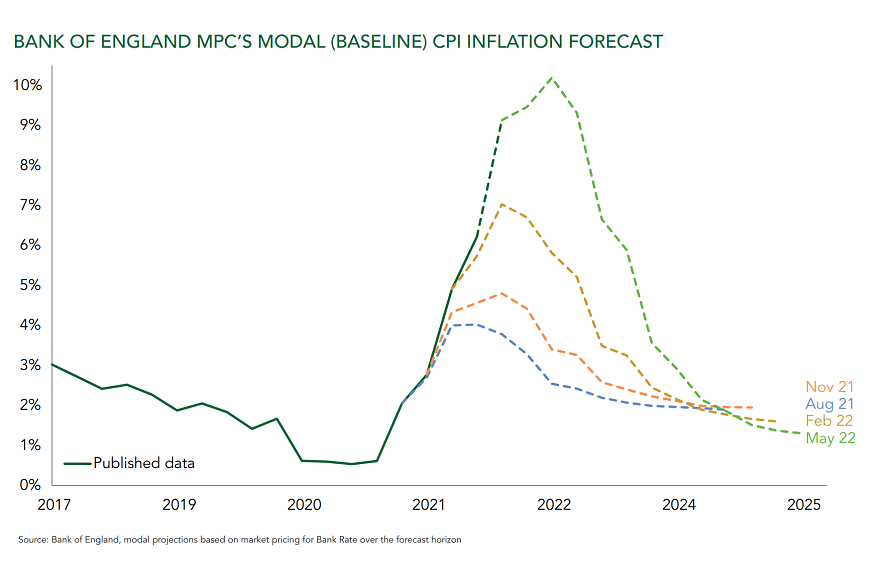

Baillie and MacInnes said that they have little confidence that central banks will get it right, as so far they have been well off the pace.

“In May 2021, the Bank of England thought inflation in summer 2022 would be around 2.5%,” they explained.

“The actual result? 9.2%. So, we must conclude that nobody has a clue – particularly not academic economists. Despite their recent mistakes, they remain highly confident that inflation will drop back to around 2% by 2024 and stay there.”

Whether central bankers take a more dovish or hawkish approach, Baillie and MacInnes are convinced it will have a negative impact on asset prices. The managers said that downside risk has been limited over the past decade or so as investors knew that once equity markets declined by 20% or so, the ‘Fed put’ would kick in and the central bank would ease policy.

Today, however, given the need to dampen demand to tame inflation, the managers said it is market upside that is capped: if it rises too much, it will be met with more hikes and tighter financial conditions.

“The Fed wants higher risk premiums, and that means a lower market,” they added. “If it were to come, another Fed U-turn – similar to 2018’s Powell Pivot or last November’s abandonment of the word ‘transitory’ – would be confirmation central bankers have lost control and America has entered an era of structurally high inflation.”

This has led the managers to the conclusion that the bear market is only just beginning. While most investors under the age of 60 have been conditioned to ‘buy the dip’, most bear markets through history have begun with a steep crash, followed by a prolonged period of slowly falling asset prices.

In these scenarios, they said buying the first downward lurch leaves your capital almost as impaired as buying at the top – and Baillie and MacInnes claimed this is the fate that awaits many bargain-hunting investors today.

“Valuations have come down to something more reasonable, but are based on earnings estimates that remain too optimistic, still forecasting growth when flat would be a good result,” they continued.

“Valuations have fallen because bond yields have risen, not because the equity risk premium has widened. Earnings reflect record high margins at a time of rising debt service, labour and energy costs and supply-chain disruptions.

“Consumer and CEO confidence is at multi-year lows, suggesting demand-reduction and recession.”

Yet despite the warning signs, it appears most investors are relying on market conditions to quickly return to those of the 2010s. The managers pointed out flows into equities have remained strong throughout the sell-off: for example, the ARK Innovation ETF has not suffered net redemptions, even though it has fallen 71% in price since its peak.

“The ‘buy the dip’ mentality is alive and well,” Baillie and MacInnes said. “But the old rules no longer apply. Now that the cost-of-living crisis is front-page news, the political imperative is to bring down inflation, not to support asset prices as in previous market sell-offs.”

They also warned that liquidity, which is the driver of market prices at the margin, is likely to evaporate in the coming months as quantitative tightening takes hold, while rising short-term rates create a legitimate alternative to risky assets.

The managers finished by warning that no risk assets escape repricing when inflation is surprisingly and persistently high. As a result, they said cash isn’t the worst place to keep your money at the moment, despite the prevailing narrative.

“Cash provides the certainty of a slow erosion by inflation, but it also gives you the option value of being able to move quickly,” they explained.

“There are times for a get-rich portfolio and times for a stay-rich portfolio. We believe this is the latter. There will be better moments and better prices in the future.”

They added: “You don’t have to swing your bat at every pitch, only at the ones which look sufficiently attractive.

“That insight applies in spades to investing in risky assets at this juncture. We would rather lose half of our clients, than half of our clients’ money.”