Technology shares have had a tough time since early 2022, when the market started to migrate from high-value growth stocks towards cheaper, value-oriented investments.

As a result of this rotation to value, US-based technology equities have suffered significantly, with the tech-heavy Nasdaq index down 25% since the beginning of the year.

Many industry players have also been impacted by a lack of earnings, rising interest rates and broader concerns about the economy. As households’ spending is being constrained by a raging cost-of-living crisis, analysts agree that subscription-type services, which abound in the sector, are likely to be the first ones consumers will budget on.

In our round up we start with Netflix, which has been agonising over this problem for a while.

Netflix

In April, the streaming giant had said it expected a drop of 2 million subscribers in the following quarter. According to the latest quarter results, published on Tuesday, this alarming prediction turned out to be exaggerated.

In fact, paid memberships went down by only 970,000 units compared to the previous quarter, and many investors were able to catch their breath. But for Sophie Lund-Yates, equity analyst at Hargreaves Lansdown (HL), there is little to celebrate.

“With 1 million customers signing out for good, things are hardly perfect. In fact, it’s hard to overstate how tough things are. Shareholders will still feel as though Netflix’s foundations are showing some fundamental cracks. Ones that are going to take a lot of time and heavy lifting to fill,” she said.

Netflix is starting to address some of the problems it identified, including the practice of sharing a single streaming account between more people. This is being combated with the introduction of cheaper, ad-supported plans, run in partnership with Microsoft.

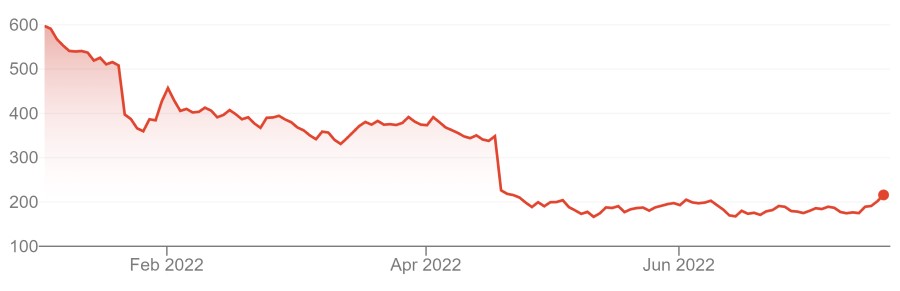

Share price of Netflix in 2022

Source: Google Finance

The main concerns for the company revolve around costs and content. Total costs and expenses have increased significantly since the previous quarter, with technology and development costs up more than 33%, while operating income fell to $1.6bn from $1.8bn. Around $4.7bn was spent on additions to content.

“In today’s hyper-competitive landscape, having average content on offer simply won’t cut it. Playing catch up here becomes more difficult when you consider the breadth of M&A happening in the sector, the likes of Amazon snapping up Metro-Goldwyn-Mayer gives it access to pre-made, and crucially, rewatchable content,” said Lund-Yates.

“There’s a sense too that spending, and plans for the future, make sense on paper. But what’s crucial now is evidence showing these billions of dollars are being thrown at growing, rather than protecting, market share,” she added.

Tesla

There had already been a peek of what would come out from Tesla’s results out this Wednesday as earlier in the month the automotive company had released a disappointing update on production and delivery volumes, as noted by HL equity analyst Matt Britzman.

“Despite June being the highest production month in the company’s history, volumes missed expectations and marked the first time in 10 quarters that quarter-to-quarter deliveries fell,” he said.

Ongoing supply chain issues and factory shutdowns hindered the group’s ability to ramp up scale, with China operations slowed down by Covid restrictions and new factories in Texas and Berlin battling with soaring costs.

According to HL equity analyst Laura Hoy, this data helped investors adjust their expectations ahead of the publication of the half-year results.

“The more cars that rattle through Tesla’s enormous gigafactories, the lower the per-unit costs, so the disappointing delivery numbers released earlier this month meant investors had already braced themselves for a step down in profitability,” she said.

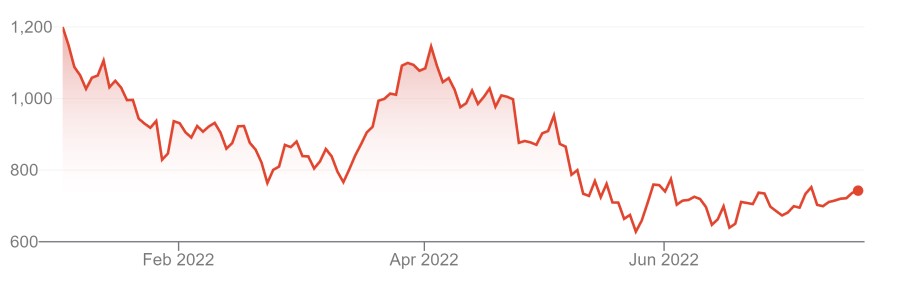

Share price of Tesla in 2022

Source: Google Finance

With a 42% revenue growth offsetting a 13% increase in operating expenses and a 0.5 percentage point fall in automotive margins, Tesla’s second quarter results were “sturdy”, but received tepidly.

According to Hoy, weighing down the sentiment was CEO Elon Musk himself.

“His affinity for cryptocurrency chipped away at profits, with the group calling out Bitcoin impairments as a thorn in its side. It’s unclear exactly how much the group lost to the sell-off in crypto, but with 75% of its holding now converted into more stable currency, most of the damage has been recognised,” she said.

“However, the bitcoin losses point out an important part of the Tesla investment case—its eccentric owner. While Musk’s impressive innovation has served the company well, his personal flair is starting to raise governance questions.”

Ocado

In the UK, online delivery company Ocado – a pandemic winner and often cited as the domestic equivalent to a tech stock – was another player the market was nervous about.

Britzman said: “Having tapped investors for just shy of £600m last month, there’s pressure to deliver some positive news on new partner sign-ups for Ocado Solutions. It’s all well and good having the most advanced robots flying around fulfilment centres, but further progress is needed on sign-ups sooner rather than later”.

Particularly vexed was the retail branch of the brand, jointly owned with M&S, which was anticipating an impact on sales as lockdown benefits faded and consumers tightened their belts.

“Last we heard, new customers were coming onboard but average basket size was declining as shoppers ordered one or two less items. That, coupled with growing cost pressures put the retail arm under pressure,” he continued.

As a result, today’s low earnings before interest, tax, depreciation and amortisation (EBITDA) didn’t come as a surprise.

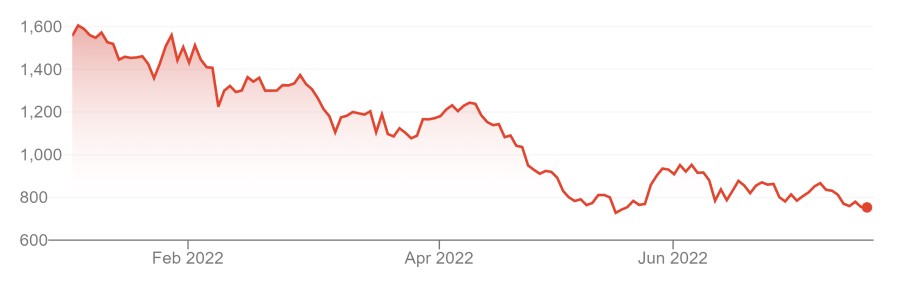

Share price of Ocado in 2022

Source: Google Finance

Driven by Ocado Retail, the group’s EBITDA fell to a loss of £14m. Sales in the past six months dropped by 8%, which led to a 70% drop in cash earnings at the division and pushed the group to an overall loss for the period of £211m, compared to a £28m loss the year before.

But despite a declining UK retail division, according to Steve Clayton, fund manager at HL Select, “Ocado has released interim results that show a business with robust finances, following recent equity and bond issuance and a fast-growing international technology licencing arm”.

The company left its full year guidance unchanged, which reassured investors, so much so that today Peel Hunt analysts released a ‘buy’ rating for the stock.

“It is now very second-half weighted, but growth in active customers gives Ocado confidence in that guidance. With current liquidity at £2bn, the group believes no more financing is required into the mid-term. It has also restated its ‘clear path to £6.3bn+ revenue and £750m+ EBITDA in the mid-term’, which should excite the long-term investor,” they said.

Bonus: Twitter

Twitter has yet to release its half-year results, but with Musk seeking to withdraw from his $44bn deal to purchase the platform, this is surely one to keep an eye on.

Mirabaud’s head of global thematic and strategy, Toby Clothier, said that “most of the twists and turns have been rather unpredictable, and this pattern will probably continue.”

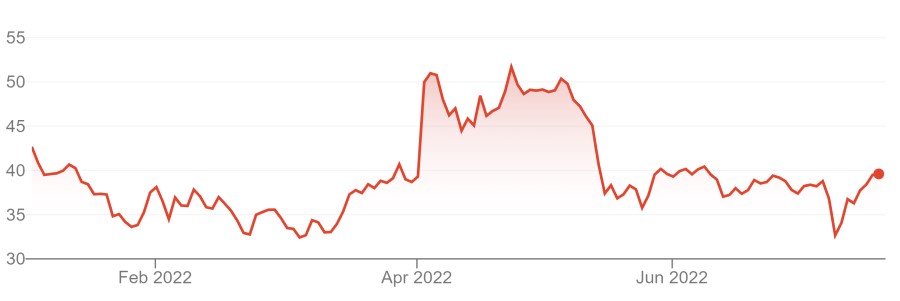

Share price of Twitter in 2022

Source: Google Finance

While the stock is now at $34, he thought it possible for it to move either up or down to two extremes.

On the one hand, the tumult and employee turnover this situation has created, deteriorating ad-spend and user flight from Twitter could push the price down to $25-$30 if the deal is truly off.

On the other hand, “if Twitter’s lawyers prevail in the argument that Musk must deliver on his promise – having signed the merger agreement and offered $54.20 per share and been supplied with all the relevant information – then there is potentially a situation where Twitter could double from the high $20s in due course.”